Silver spot prices have outperformed gold since early 2024, rising over 120% in 2025, and surpassing $66 for the first time after opening the year at $28.92. These highs not seen in more than 40 years are driven by a supply deficit, expanding industrial use, as well as growing recognition of silver as both an inflation hedge and a strategic industrial metal.

Shifting from “the forgotten asset” to one of the most powerful commodities and asset classes in 2026, the Silver price is forecasted to continue its uptrend.

What will 2026 hold for silver? As we enter a new year, investors are closely watching how changes in monetary policy and global uncertainty could impact the precious metal, along with supply and demand trends in the space.

Silver Forecast & Price Prediction – Summary

- Silver price forecast Q1 2026: While supply tightness continues to define the short-term price outlook, silver could find resistance around the $70 level, the next Fibonacci expansion of the current wave up, and a psychological level that could attract some profit-taking.

- Silver price prediction 2026: Tightening supply, rising industrial demand, and a technical breakout setup aligned for the first time in more than a decade, making silver one of the most appealing opportunities for 2026. While a correction is very likely, $70 is forecasted as the new normal for Silver, a future floor, not a target.

- Silver price prediction for the next 5 years and beyond: Silver rate has been heavily influenced by industrial production cycles and a shifting level of investor interest globally. However, if the continued focus on the energy transition is accompanied by stronger global growth and a sustained breakout above the $38–$41 band, silver prices could push toward and above the $70 mark, a level many see as more plausible in early 2026 if momentum persists.

With NAGA.com, you can trade Silver through CFDs (XAG/USD) if you want to speculate on price movements or invest in silver mining stocks and ETFs.

Fundamental Silver Forecast 2026 – Significant supply deficit

Silver, as an asset, is emerging from gold's shadow as its market dynamics shift, reaching record highs on structural drivers like:

- Persistent supply deficit — mine production has stagnated while demand continues to grow, particularly from industrial sectors.

- Strong industrial demand — especially from sectors tied to renewable energy (solar), electronics, and emerging technologies that rely on silver’s conductive and other properties.

- Investor demand and macro trends — with economic uncertainty, inflationary pressures, and potential interest‑rate shifts, silver is once again being viewed as a hedge and store of value.

- Structural constraints on supply growth — silver is often a by‑product in mines for other metals; as such, higher prices do not always lead to proportionally greater new supply.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

Industry forecasters predict a continued silver deficit through 2026, supporting the bullish outlook for XAG/USD.

Silver’s new emerging role in the economy

Silver is carving out a pivotal role in the AI economy, with artificial intelligence infrastructure emerging as its fastest-growing demand source. Hyperscale data centers powering advanced AI models from tech giants are driving a surge in silver use within high-performance hardware, thanks to its superior electrical and thermal conductivity. Essential in printed circuit boards, connectors, busbars, and thermal interfaces, silver thrives in the dense, power-intensive environments of AI servers and accelerators.

AI-focused servers consume two to three times more silver than traditional data center gear, with global power demand set to double by 2026—absorbing millions of extra silver ounces into rarely recycled hardware. This demand remains price-insensitive, as silver accounts for just a fraction of multi-billion-dollar data center costs, dwarfed by risks like slower processing or energy inefficiency. Consequently, even sharp silver price spikes fail to affect consumption, intensifying pressure on an already tight market.

Some key statistics highlighting the bullish forecast for silver’s industrial demand:

- By 2050, solar energy could account for approximately 85–98% of the current global silver reserves.

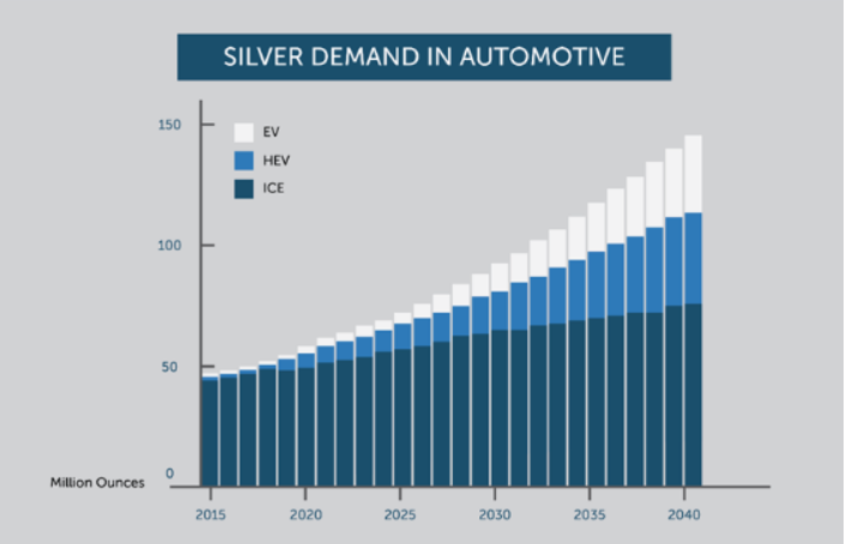

- The automotive sector is expected to contribute significantly to silver demand growth, benefiting from greater vehicle sophistication, rising electrification of powertrains, and ongoing investments in infrastructure such as charging stations.

Fifth straight year of supply deficits

Silver's price rally rests on more than sentiment, as it enters its fifth straight year of global supply deficit—a rare structural imbalance with cumulative shortfalls since 2021 nearing 820 million ounces, equivalent to a full year's mine output. Although the 2025 gap is smaller than the 2022-2024 peaks, it continues eroding above-ground inventories amid inelastic supply.

Some 70-80% of silver comes as a copper, lead, zinc, or gold mining by-product, preventing quick scaling even at higher prices—new primary mines take a decade. Exchange inventories hit multi-year lows, spiking lease rates and delivery stress, where modest demand upticks spark sharp rallies.

Gold-Silver ratio signals silver strength

The gold-silver ratio, a key relative value gauge, now hovers near 65:1 with gold at approximately $4,340/oz and silver at around $66/oz as of the end of 2025—sharply compressed from earlier decade highs above 100:1 and below the modern average range of 80–90:1.

Past performance is not indicative of future results

In precious metals bull markets, silver historically outperforms gold, driving the ratio lower as investors chase higher-beta plays; this pattern resurfaced in 2025 with silver's outsized gains. Holding gold steady into 2026, a drop to 60:1 implies silver above $70/oz, with potential overshoots in tight-supply momentum phases.

Technical Silver Price Forecast 2026

Looking at the historical price action, silver spent much of 2022 and early 2023 consolidating in a broad range below $27.50 before gradually shifting into an uptrend through 2023. The price broke above the moving averages decisively in late 2023 and has been making higher highs and higher lows since then. The long-term bullish structure was confirmed when the market broke through the $30 psychological level and held above it, leading to an accelerated move higher in 2024.

In the first part of H2 2025, silver has tested and briefly pierced the $39.50 region before consolidating just below it. After a pause in momentum, Silver’s rally tested the all-time highs from 2011. The $50 region was a ceiling for more than 13 years. Breaking above it, and more importantly, holding above it, signals that silver is entering price-discovery territory. The clear breakout above $50 opened the door to subsequent technical extensions around $70-72 and $88.

These levels aren’t fantasies; they come straight from measured moves of the multi-year consolidation. And we’ve seen what a real breakout can do; in 2011, silver almost doubled in a few months once price discovery kicked in.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

The sign of strength is a correction (secondary reaction or intermediate trend counter trend) above the previous swing high $54.50. That will signal buying pressure and a more likely leg up towards new records. Otherwise, the trend will enter a struggling phase that can be resolved with an exhaustion rally to complete the bull market or trend reversal.

From an indicator perspective, the RSI on the weekly chart is above 80, reflecting bullish momentum in overbought territory. Moving averages remain bullishly aligned, with the 50-week (green), 100-week (blue), and 200-week (yellow) MAs all trending upward and showing supportive structure.

The main scenario favors continuation of the broader bullish trend, provided price holds above the $54.50.00 level.

How much can the silver price rise in 2026 and beyond?

Silver’s story is far from over. Despite its recent moves, the metal remains 𝑑𝑒𝑒𝑝𝑙𝑦 𝑢𝑛𝑑𝑒𝑟𝑣𝑎𝑙𝑢𝑒𝑑, but the conditions for its next major rally may already be taking shape. Ted Butler, an expert in reading the CoT report in silver, breaks down the forces driving this setup and why 𝐬𝐦𝐚𝐫𝐭 𝐦𝐨𝐧𝐞𝐲 𝐜𝐨𝐧𝐭𝐢𝐧𝐮𝐞𝐬 𝐭𝐨 𝐚𝐜𝐜𝐮𝐦𝐮𝐥𝐚𝐭𝐞 𝐬𝐢𝐥𝐯𝐞𝐫 while most investors look elsewhere.

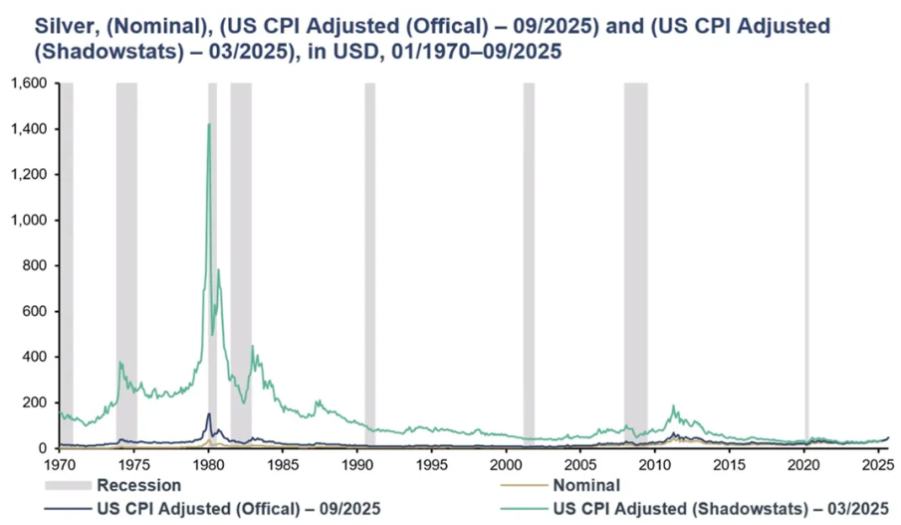

Silver’s all-time high in 1980, when adjusted for real inflation numbers from Shadowstats, comes in at ~$1400. Shadowstats inflation diverges from official U.S. CPI data because it reconstructs inflation using pre-1990s government methodologies, before ‘revisions’ diluted how price growth is measured.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

In essence, it shows what inflation would look like if measured the same way it was in 1980, revealing that today’s asset prices aren’t nearly as overvalued as they appear under official CPI.

Notably, Ted’s analysis of this data does not predict that silver will rise to $1400 tomorrow or during 2026. Instead, shows how cheap silver remains in an era of chronic monetary debasement.

Still, even if he adjusts for the more conservative, albeit inaccurate, official CPI figures, silver’s 1980 all-time high comes in at approximately $150, which is roughly 2.5 times the price of the end of 2025.

Ultimately, whether silver price reaches $150, let alone the lofty heights of 1400, the reality is that $66 silver is still a whole lot better than the $20-25 price we were stuck with for the past decade.

Why could the silver price decrease in the following months?

Despite the strong rally, the silver market is not without risks. Industrial demand, particularly for sectors like solar, may slow if companies find cheaper substitutes or reduce silver intensity due to higher prices. Indeed, some analysts forecast silver demand to decline this year compared with prior years.

Investor demand could also wane if macroeconomic conditions change — for example, if interest rates rise, or inflation subsides, making non‑yielding metals like silver less attractive. Market sentiment and speculative flows remain a major variable.

Finally, while the structural supply deficit is real, supply responses (such as mine expansion, recycling, and substitution) could eventually ease tightness. However, such adjustments tend to lag price moves because mining and processing silver takes time.

Silver Forecast and Price Predictions 2026

Leading financial institutions dedicate extensive resources to precious metals research.

Their silver price forecasts, built on macroeconomic analysis, technical indicators, and supply-demand data, guide investment decisions for institutional investors and central banks worldwide.

While these silver price projections draw from deep market expertise, investors should note that actual prices can deviate from even the most well-researched predictions. Here’s how major institutions view silver’s potential in 2026:

Analyst/Firm Silver Price Target Time Frame World Bank +8% 2026 Citigroup +6,06% 2026 Bank of America -1,5% 2026 Silver Stock Investor +6,06% 2026 aNewFN.com +21% 2026 Trading Economics +6,06% 2026 GovCapital +9% 2026 Table with Silver Price Forecasts 2026 and Beyond from Analysts and Firms

According to BarChart, silver is currently likely seeing that final, explosive price gain phase. The climaxing phase of a major bull move in a raw commodity market can show explosive price action to the upside before the bull run finally ends.

Their silver price forecast for 2026 are:

- Early February: $56.68

- Early May: $69.00

- Early August: $79.50

- Late: December: $97.85

The Silver Institute’s World Silver Survey confirms silver remains in a seventh consecutive year of structural deficit, with prices supported by strong industrial demand and renewed safe-haven buying amid ongoing tariffs and geopolitical tensions. They report that global silver demand is tracking near 1.15 billion ounces in 2025—down about 1% year over year to a four-year low—with industrial uses now accounting for nearly 60% of total demand.

Citigroup forecasts that silver will continue to outperform gold and reach upwards of US$70 for 2026, especially if its industrial side fundamentals remain in place.

Clem Chambers, CEO of aNewFN.com, doesn't think US$80 is a stretch at all. US$100 gets a little spicy in his opinion. He forecast silver could rise as high as US$150 to US$160 per ounce in 2026.

Chambers referred to silver as the “fast horse” of the precious metals. While industrial demand is essential, he believes retail investment demand is the real “juggernaut” for the silver price in the coming year.

Peter Krauth of Silver Stock Investor expects that key thread to continue running through the silver story into 2026. He said that silver prices are not enough of a motivation for miners to increase production, because about 75 percent of silver is mined as a by-product of other metals such as gold, copper, lead, and zinc.

Krauth also cautioned investors to remember that silver is “famously volatile” and while “it's been fun because the volatility has been to the upside ... don't be surprised if you get some kind of rapid drawdowns.” He forecasts US$50 as the new floor for silver and gave what he deems a “conservative” silver price prediction in the US$70 range for 2026.

How to Invest in Emerging Markets

The World Bank’s forecasts precious metal prices to remain elevated through 2026 before a mild correction in 2027. Silver has benefited both as a safe-haven asset and as a key material in the renewable energy and semiconductor industries. The Bank forecasts silver prices to climb another 8% in 2026, before dropping 10% in 2027.

Bank of America has a bullish silver forecast for 2026, projecting prices to reach $65 per ounce, with an average of around $56.25/oz, driven by strong industrial demand (especially solar), persistent supply deficits, and potential policy shifts. Analysts highlight structural issues, like tightening physical markets and declining stockpiles, suggesting this rally is more fundamental than speculative, though volatility remains a key risk.

InvestingHaven.com has been bullish on silver, predicting significant price increases, with a 2030 forecast of $80, driven by strong industrial demand (EVs, solar) and supply deficits. However, some past forecasts missed targets, highlighting volatility, with recent support from technology demand and macro uncertainty.

While analysts are typically cautious in issuing long-term forecasts for commodities, algorithm-based forecasting services regularly provide price outlooks for more extended periods.

Trading Economics forecasts continued strength driven by a persistent supply deficit, strong industrial/investment demand, and a weaker dollar, with predictions anticipating elevated prices through 2026, potentially testing new highs above $70, though short-term volatility exists due to Fed policy and economic data. Trading Economics specifically suggests upside potential, citing low inventories, ETF inflows, and dovish monetary policy as key drivers.

Gov Capital’s 2026 algorithmic forecast has projected silver hitting $72 by December, with machine learning models previously identifying $32.64 as critical resistance—a level surpassed earlier in 2025. The platform forecasts silver rising to $80 by the end of December 2027, $90 by the end of 2028, and $100 during 2029. This is one of the most bullish Silver price predictions for the next 5 years.

Wallet Investor’s silver price forecast for 2026 is moderate, pointing to a consolidation within the $60-70 range. Based on their forecasts, a long-term increase in silver prices is expected, up to 89.151 USD per ounce by 2030.

In his book, “The Great Silver Bull,” Peter Krauth derived a valuation of $300 silver through technical analysis, a view that sits well outside today’s consensus. Krauth has a model that forecasts that gold’s price will rise to $5,000 by 2030, which would drag silver’s price up to $300, whereas major houses now look for gold nearer $4,000 by late 2025 or early 2026 and keep long-run silver targets far below $300. This is due to gold’s use as an inflation hedge.

Ted Butler is an expert in reading the CoT report in silver.

*It is worth keeping in mind that both analysts and online forecasting sites can and do get their predictions wrong. Keep in mind that past performance and forecasts are not reliable indicators of future returns.

When considering Silver price predictions for 2026 and beyond, it’s important to keep in mind that high market volatility and the macroeconomic environment make it difficult to produce accurate long-term Silver analyses and estimates. As such, analysts and forecasters can get their Silver forecast wrong.

It is essential to do your research and always remember that your decision to trade depends on your attitude to risk, your expertise in the market, the spread of your investment portfolio, and how comfortable you feel about losing money. You should never invest money that you cannot afford to lose.

Silver Price History

The silver markets have climbed from the $12 per ounce lows reached at the start of the Covid-19 pandemic, as investors have bought physical precious metals and financial instruments as safe-haven assets during ongoing economic uncertainty.

The silver price reached a $28 high in August 2020 and ended the year around the $26 mark.

The price then jumped to an eight-year high in February 2021, briefly touching the $30 per ounce psychological level, as the market attracted the attention of retail investors.

In addition to investor sentiment, the silver price trend has found support from its growing use in industrial settings, which account for roughly half the metal’s annual demand.

Physical silver demand climbed to a record high in 2021, led by an all-time high in industrial applications – silver is the best conductor of electricity, so it is often used in high-end applications. That strength carried through subsequent years, with robust industrial offtake and repeated supply shortfalls underpinning the market into 2025.

The silver spot price had climbed from about $28.90 to roughly $37–$38 per ounce since the start of the year, as persistent supply deficits and strong demand from solar and electronics tightened the market. Higher interest rates tend to be bearish for precious metals, as investors opt for interest-bearing savings accounts and other assets that generate guaranteed returns, but the 2024–2025 rally unfolded despite elevated real yields as investors diversified alongside gold.

Silver traded up from around $29 per ounce in early January to an intraday high near $39.91 in late July, a peak so far this year, as the market responded to ongoing supply deficits and surging green-technology demand. But while the market held between $35-$38 into early August, it cooled modestly as the dollar firmed, and some profit-taking emerged.

The price briefly eased toward the mid-$36s in early August but then stabilized around the $37–$38 area, closely following the trajectory of the gold price.

The metal attempted to break above the $40 mark in late July, trading above the $35 mark for several weeks, before shedding close to $2 from its value in a matter of days on the back of dollar strength and profit-taking – in the current climate, tight supply and resilient industrial demand are leading investors to favor exposure to silver even as it remains a non-interest-bearing bullion asset.

November 2022 saw the Fed make its fourth consecutive 75bps rate hike, taking its short-term borrowing rate to a target range of 3.75%-4% – then the highest level since January 2008 – as it sought to return the US economy to 2% inflation by 2025, after rates peaked in 2023, policy has shifted toward gradual easing as inflation pressures have moderated.

The precious metal saw an outstanding few weeks towards the end of 2022, with a weekly gain of about 4.7% and a monthly gain of about 14.4%. This was in part due to speculation about China loosening its zero-Covid policy at the time, even though official statements denied it; since then, the key drivers have shifted to persistent supply deficits, robust industrial demand (notably from solar and electronics), and renewed investor interest.

The continuous futures contract for silver ended 2022 at $23.97 per ounce, up 3.7%, and as of August 20, 2025, it is trading around $37–$38 per ounce. The price advanced up to $26 in the first half of 2023 amid geopolitical risks, briefly pulled back toward the $23s, then trended sharply higher through 2024–2025, breaking above $35 in June and touching intraday highs near $39.9 in July before consolidating in the high‑$30s.

Silver prices and precious metals in general were weighed in 2022–2023 by elevated real yields amid the view that interest rates would remain higher for longer, given stubborn inflation. As inflation has eased and central banks, including the Fed, have shifted toward accommodation, real rates have tempered, reducing the opportunity cost of holding non‑yielding precious metals such as silver and allowing supply/demand fundamentals and industrial demand to take the lead.

History of Silver

Evidence of the first silver mines dates to the 4th millennium B.C. (around 3000–2500 B.C.) in Anatolia, a site in modern-day Turkey. Most of the silver mining in that part of the world shifted to the Laurion district of Greece by about 1000 B.C., as that civilization expanded. By the first millennium B.C., Spanish silver mines—first exploited by Phoenicians and later by Rome—fed the classical world's economy.

Silver's popularity increased in the years 1000 to 1500, thanks to improved technology, more mines, and better production techniques. After 1492, the quest for silver and other precious metals gave rise to Spanish fleets that sailed all over the world, seeking wealth and new lands to conquer. It was a vital part of the mercantile system.

Silver production in the United States surged with the Comstock Lode in Nevada, discovered in 1859, and peaked in the late 19th century; by the end of that century, humans produced more than 120 million troy ounces every year. One of the most iconic ways humans used silver was as a form of currency.

In the early 1960s, supplies of silver in the United States dwindled to all-time lows. Therefore, the U.S. government decided to stop using silver in its coins after 1964. Any American dimes, quarters, half dollars, or dollar coins with a date of 1964 or earlier contain 90% silver. If the price of silver is about $29 per ounce as of August 2025, these silver coins are worth approximately 21 times their face value in the precious metal content alone. A silver dime is worth roughly $2.10, whereas a silver dollar is worth about $22.40 at a $29-per-ounce price.

Free resources

Before you start investing and trading in Silver, you should consider using the educational resources we offer, like NAGA Academy or a demo trading account. NAGA Academy has lots of free trading courses for you to choose from, and they all tackle a different financial concept or process – like the basics of analysis – to help you become a better trader or make more-informed investment decisions.

Our demo account is a suitable place for you to learn more about leveraged trading, and you’ll be able to get an intimate understanding of how trading and investing work – as well as what it’s like to trade with leverage – before risking real capital. For this reason, a demo account with us is a great tool for stock investors who are looking to make a transition to leveraged trading.

Sources:

- https://silverinstitute.org/wp-content/uploads/2025/04/World_Silver_Survey-2025.pdf

- https://www.jpmorgan.com/insights/global-research/outlook/market-outlook

- https://investingnews.com/daily/resource-investing/precious-metals-investing/silver-investing/silver-forecast

- https://cot-reports.com

- https://www.federalreserve.gov/monetarypolicy/monetary20250730a.htm

- https://www.jmbullion.com/charts/gold-silver-ratio

- https://www.jpmorgan.com/insights/global-research/economy/fed-rate-cuts