The pound posted poor performance against the euro and Swiss franc amid weak UK economic momentum, despite a quick US trade deal and the BoE's relatively hawkish stance among the G10. It outperformed only the dismal US dollar, holding above 1.32, and the yen, which has had abysmally poor years, trading above 200.

Fiscal issues and politics could further weigh on the Pound in 2026. The recently announced tax-heavy budget, along with the heightened possibility of further measures in the Spring 2026 budget, may continue to choke growth, potentially resulting in further gilt borrowing, which investors absolutely disapprove.

However, there could be a buy-the-dip opportunity in sterling given resilient domestic growth, an anticipated global growth upswing and a carry-friendly environment. JP Morgan forecasts that sterling strength is more likely to come in the first half of the year, with the second half seeing fiscal fears coming back into focus ahead of the next budget, meaning underperformance becomes more of a central risk.”

Key British Pound (GBP) Forecast & Price Prediction Summary

- Pound to Dollar (GBP/USD) Forecast 2026: Major banks and analysts project GBP/USD in a 1.35-1.47 range for the current year, with most eyeing 1.36-1.40 by year-end amid Fed easing versus UK fiscal drags.

- Euro to Pound Forecast 2026: The pair is expected to experience a gradual upward movement towards 0.90 due to ECB-BoE divergence, continuing its multi-year sideways market.

- Pound to Yen Forecast 2026: The pair is expected to hold near the 200-208 area, buoyed by yield spreads.

With NAGA.com, you can trade CFDs on GBP/USD, GBP/EUR, GBP/JPY, GBP/CHF, GBP/AUD, GBP/NZD, and GBP/CAD with tight spreads using our award-winning trading platform and mobile apps.

Fundamental British Pound (GBP) Forecast 2026

The trajectory of UK interest rates will largely influence the trajectory of the pound and the FTSE index. In 2025, yields on 10-year gilts traded sideways close to peaks not seen since 2008 amid stagflationary pressures, even as the Bank of England delivered six rate cuts starting in August 2024.

Markets now anticipate one or perhaps two more cuts in 2026, signaling the easing cycle could soon wrap up.

The pound offers attractive carry, but this is unlikely to fully offset a softer growth outlook and the potential re-emergence of fiscal concerns.

Bank of England to ease interest rate cuts in 2026

Several members of the Bank of England's Monetary Policy Committee have expressed caution about reducing interest rates too rapidly. However, the possibility remains for more rate cuts, but the rate-cutting cycle may be nearing its end.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

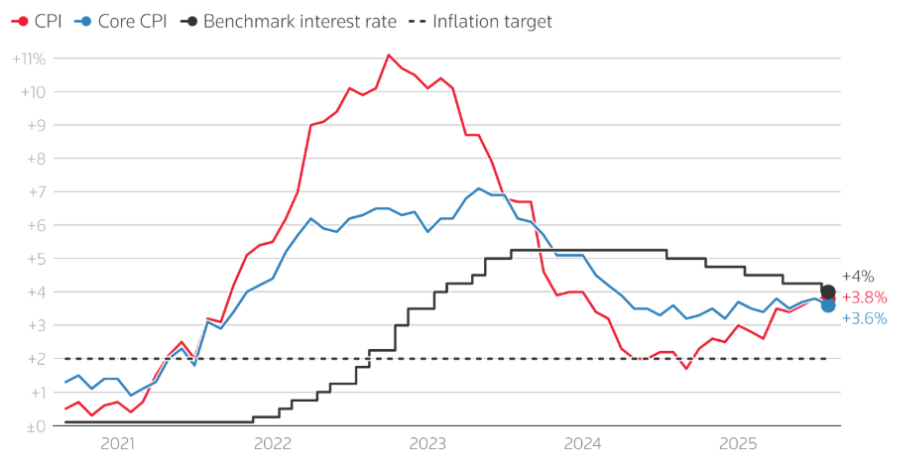

Heading into 2026, fewer cuts are anticipated as the Bank approaches a more neutral rate level. The expectation is for two additional reductions during 2026, eventually bringing rates to approximately 3.25% over the medium term. This reflects a careful balancing act between controlling inflation and supporting economic growth.

A mixed short-term outlook for GDP growth

Following an unexpectedly robust start, the UK economy is anticipated to experience slower growth into early 2026, with GDP projected to rise by 1.1% in 2026. This subdued pace reflects a combination of internal and external challenges, although some support is expected from lower interest rates and increased defense and infrastructure spending in both the UK and Europe.

Despite falling borrowing costs, business investment growth is forecast to remain limited mainly due to heightened global uncertainty and the effects of tax increases. These factors weigh on business confidence and spending plans, tempering economic momentum overall.

Exports feel the force of US Tariffs

The recently announced US tariffs are anticipated to slow down trade between the UK and the US, causing subdued export activity extending into 2026. While there was a noticeable surge in UK exports to the US early in 2025, this was mainly due to frontloading—the advancement of shipments to avoid higher tariffs. However, by mid-2025, exports had declined sharply, falling to 21% below the 2024 average. The tariffs have disrupted supply chains and raised costs, leading to cautious trade behavior and weaker performance in the coming periods.

Inflation to peak at 4% this year

On the brighter side, inflation pressures are easing nicely. Wage increases in the private sector have cooled to a 2.4% annualized pace over the past three months.

The Autumn Budget turned out less brutal for short-term growth than the screaming headlines suggested. Sure, tax rises totaling 0.7% of GDP are slated by 2029, but hardly any hit next year. Still, fiscal drag lingers from the persistent freeze on income tax bands. Expect the budget deficit to narrow from 4.5% this year down to 3.5% in 2026.

Pound to Dollar (GBP/USD) Fundamental Analysis and Forecast

Jerome Powell kept his guard up during the post-December FOMC presser, leaving aggressive hawk bets out in the cold. Even with the Fed's tentative trim heading into the new year, traders aren't budging—still baking in a couple more cuts for 2026. LSEG FedWatch data pegs expectations at about 63 basis points of easing ahead.

Part of that optimism? Folks figure a softer Fed could emerge soon, especially with Powell's chairmanship wrapping up in May. Trump's eyeing Fed Governor Chris Waller or his economic advisor Kevin Hassett for the top spot, and both have voiced support for dialing rates lower.

Over in the UK, the Bank of England followed through with another quarter-point slash to its key Bank Rate, dropping it from 4% to 3.75% at the December policy huddle—this marks the lowest borrowing costs since early 2023. All told, they've trimmed rates by a full percentage point this year since kicking off the easing spree back in August 2024.

Governor Bailey finally jumped on the cutting bandwagon, though the 5-4 split vote was pretty much expected. He cautioned that with rates edging toward that tricky neutral zone (somewhere around 2-4%), any more moves will be a tougher judgment call—money markets are now betting on roughly one and a half cuts through 2026. Bailey added that he still sees rates heading slowly lower.

Goldman Sachs tweaked its forecast for BoE to cut rates by 25 bps in March, June, and September 2026—instead of their earlier picks for February, April, and July.

Deutsche Bank, meanwhile, holds firm on two cuts next year: one in March and another in June, which could bring the Bank Rate at a steady 3.25%, which lines up with their take on neutral territory.

When will interest rates go down?

Euro to Pound (EUR/GBP) Fundamental Analysis and Forecast 2026

The eurozone economy posted solid GDP gains across all four quarters of 2025, clocking in at a stronger-than-forecast 1.4% for the full year. Sure, manufacturing's still dragging its feet, but cheaper energy bills are easing the pain. A potential truce in Ukraine might spark some optimism, and Germany's postponed fiscal push—think infrastructure upgrades plus a bit of defence outlay—could give late 2026 growth a real boost. That said, shaky government budgets, particularly in France, keep things dicey.

More working days on the calendar will nudge 2026 GDP higher; analysts are forecasting around 1.2% expansion. Inflation is projected to slip below 2% in 2026, keeping the door partially open to further easing, if needed. With growth staying tame and prices stubborn, though, the ECB figures its 2% deposit rate hits the sweet spot right now.

The ECB is forecasted to cut rates by 25 bps in 2026, which appears to favour euro upside against the pound, primarily due to the expected continued divergence in their respective monetary policy stances. However, a plethora of unknowns could turn the tide against the euro, particularly in the second half of 2026.

Pound to Yen (GBP/JPY) Fundamental Analysis and Forecast

Inflation, spring wage negotiations, and the Japanese yen are the most closely watched indicators for the BoJ.

- Thanks to government subsidies on energy and falling rice prices, headline inflation is likely to drop below 2% in the first half of 2026.

- On wage growth, several labor unions have set wage goals, such as last year’s above 5%, signalling that wage momentum should continue at a steady pace.

- Moderate JPY appreciation is mainly forecasted because the US dollar is expected to pull back next year.

If the JPY stays below 155 and heads toward 152, ING analysts do not expect the BoJ to rush into another rate hike. Currently, they expect the BoJ’s next rate hike to emerge in October 2026.

GBP/JPY has recently been fluctuating above the ¥200 psychological level in 2025.

Moving forward, forecasts suggest Pound to Yen (GBP/JPY) will experience moderate volatility but with a gradual downtrend into 2026, influenced by divergent monetary policies, safe-haven flows, and economic developments in both the UK and Japan.

Technical British Pound (GBP) Forecast - Technical Outlook 2026

The British Pound enters 2026 with a mixed sentiment. Technical price patterns combined with fundamental factors imply a cautiously optimistic outlook for GBP in 2026, but key resistance levels and volatility may create trading challenges.

Pound to Dollar (GBPUSD) Technical Analysis and Forecast 2026

As we can see on the larger time frame, GBP/USD’s price action in 2025 has carved out a bullish flag pattern, within a long term bullish channel. A flag pattern in technical analysis signals a brief pause (the "flag") in a strong price trend (the "flagpole") before the trend continues, characterized by a sharp move, a small counter-trend consolidation with declining volume, and a breakout in the original direction, suggesting strong momentum continuation. Bullish flags show an upward trend and a slight downward/sideways flag, as seen in the below GBP/USD chart.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

As flags are continuation patterns, the preceding trend is expected to resume. The 1.35 is the resistance level, and a breakout is needed to confirm the pattern. The target in this case is the upper band of the long-term channel, around 1.40-1.42.

If the pattern is not confirmed, the downside potential is more limited, towards the 1.29-1.30 area, the key support level of the multi-year price movement.

Once a flag pattern is identified, traders may locate the best entry point. This process is the same across bear and bull flag candlestick patterns. While bull and bear flags are relatively simple to identify, using different strategies can help enhance the effectiveness of these chart patterns.

Euro to Pound (EURGBP) Technical Analysis and Forecast 2026

In the bigger picture, the multi-year sideways pattern continues after the rebound from the key support area at 0.8250. The 2025 pattern shows an uptrend. The EUR/GBP pair is forecasted to target the 0.90 area during 2026 as the most likely scenario.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

On the downside, a failed rally should bring another leg down towards the 0.82 area, the key support level of the multi-year sideways pattern.

Pound to Yen (GBPJPY) Technical Forecast

GBP/JPY reached new highs not seen since 2008, after a 9-month rally.

Most likely, this is an exhaustion rally that could extend as high as 220 levels before reversing and consolidating the 200-208 levels.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

The reversal of this leg up is indicated by the technical indicators also, showing bearish divergences and overbought conditions.

British Pound (GBP) Price Predictions 2026

Here we look at the latest Pound forecasts for 2026, including comments from highly rated institutional FX strategists.

JPMorgan sees a balanced path to 1.39 early 2026, then 1.36 year-end, driven primarily by cyclical US slowdowns and deficit worries, but cautions against Sterling-specific hurdles like BoE easing to 3.25% or below, favoring short-term longs over bold bets.

Morgan Stanley offers the bull case at 1.47 end-2026, betting on three Fed cuts in H1 pushing rates to 3.00% and eroding USD yields sharply, though they've tempered calls as dollar resilience lingers if US growth falters less than expected

Goldman Sachs forecasts GBP/USD at 1.36 by end-2026, viewing Sterling as tethered to EUR/USD trends without an independent spark, amid UK growth slowdowns and fiscal tightening that cap gains despite dollar softness.

MUFG targets around 1.40 by mid-2026, aligning with a steady USD unwind rather than chaos, after upward revisions to dollar strength forecasts reflecting 2025 resilience.

EUR/GBP price predictions 2026

MUFG projects GBP/EUR sliding to ~€1.11 by Q3-Q4 2026, as ECB eases sooner than BoE amid eurozone inflation nearing 2% and UK growth softening with sticky prices, eroding GBP's yield edge.

HSBC eyes GBP/EUR at 1.1365 end-2025, translating to EUR/GBP around £0.88 into 2026, supported by eurozone stabilization and safe-haven flows during global risks like trade tensions.

ING and Danske Bank anticipate EUR/GBP climbing to £0.89-0.90, reflecting BoE rate cuts outpacing ECB while UK consumer demand cools against eurozone resilience.

Barclays calls for a rebound lifting GBP/EUR toward 1.17 (EUR/GBP ~£0.85-0.86), betting on relative UK outperformance if fiscal signals improve, though consensus leans toward range-bound drift in €1.10-1.14.

GBP/JPY price predictions 2026

Reuters poll pegs GBP/JPY near ¥210 average for 2026, balancing BoJ hikes to 0.75% that narrow yield gaps with persistent UK-BoJ policy divergence keeping the pair afloat amid moderate volatility.

Pound (GBP) price predictions from AI-based websites

Panda Forecast predicts GBP/USD to trade roughly in the mid‑1.3s for much of 2026, with fluctuations of several cents above and below that level over the year.

Long Forecast projects a 9.5% rally in GBP/USD, reaching 1.4750 by the end of 2026. The Pound to Dollar price predictions for 2027 and 2028 are also bullish, with a price target for December 2028 around 1.5500.

Wallet Investor forecasts a gradual GBP/USD appreciation towards 1.3750 by the end of the year. This AI suggests a strong trend during 2027, also, with the Pound to Dollar forecasted to trade around 1.4000 by December 2027.

Euro to Pound price predictions (EUR/GBP)

Long Forecast’s price prediction for the Euro to Pound rate is bullish, with the pair expected to close 2026 above the 0.91 price tag.

Wallet Investor predicts the pair to consolidate around 0.87 by the end of 2026 and continue its sideways movement during the entire 2027.

Pound to Yen (GBP/JPY)

Trading Economics forecasts the British Pound Sterling Japanese Yen to be priced at 210.64 by the end of Q1 2026, and at 209.20 in one year, according to its global macro models' projections and analysts' expectations.

Long Forecast expects GBP/JPY to close the year at 241.00, while Wallet Investor forecasts the pair to close 2026 at 224.20. They also forecast the Pound to Yen to advance as high as 237.00 during 2027.

What drives the GBP/USD Currency Pair

The EUR/USD trend depends on what stage of the cycle the global economy is at. During a recession, the demand for safe-haven assets, including the US dollar, increases. As a result, the pound/dollar goes down.

During a recovery from a recession, investors are not that focused on preserving money. Retail investors search for ways to multiply the deposit. At this stage, the fundamentals driving the GBP/USD currency pair are the GDP growth rates and the monetary policy of central banks.

A strong economy is a strong currency. The rapid rebound of GDP after the recession is a reason to buy securities of the country. In particular, the belief that the US economy will fully recover from the 2020 recession in the second quarter of 2021 and exceed its potential level in 2022 contributed to the USA 500 rally by 18% from January to early August. As a result of the capital inflow into the US stock market, the US dollar was strengthened.

The GDP rate is a tier-1 indicator but, unfortunately, lagging. The GDP report is published a month or month and a half after the end of the quarter. Therefore, it is very difficult to determine whose economy is growing faster at a particular time, which doesn’t provide a clear picture of the current economic situation to investors. That is why forex traders have to monitor some leading indicators, such as the US and UK PMIs.

The more the economy heats, the more likely the central bank to phase out the quantitative easing program and hike the interest rates. As a result, the assets denominated in the local currency grow more attractively. That is why the US dollar is currently strengthening against a basket of major currencies.

To understand the Fed’s intentions, one should track such economic indicators as inflation and unemployment rates. When these indicators reach the thresholds set by the Fed, the central bank starts scaling back monetary stimulus. In this case, the greenback will grow in value.

Speeches of central bank representatives are important in forecasting the GBP/USD exchange rate. The officials’ comments give a clue on how the central banks’ policies could change, and investors could develop trading strategies based on this.

Pound Forecasting and Trading Tips

Monitor the global financial markets. If the S&P 500 and oil are rallying up simultaneously, it is a reason to buy the Pound versus US Dollar. If the stock index is growing and the black stuff is falling in value, or both financial assets are depreciating, it may be relevant for traders to look for sell opportunities in the GBPUSD. A necessary condition to look for buy opportunities in the long term is the sync trends in the global economy. If the US GDP features robust growth, but the UK area faces problems, traders may look for sell opportunities. Use technical indicators in trading the GBP/USD to determine the current market state and key support/resistance levels. If the moving averages often cross the GBPUSD chart, the market is trading flat. If the price chart is above the EMA, the trend is bullish; if the price is below the indicator, the underlying trend is bearish. Use Japanese chart patterns and western chart patterns like head and shoulders, double top and bottom, or triangles to identify entry and exit points. Study the history of the financial asset’s quotes. An example that took place in the past may emerge in the future as a potential GBP/USD price movement. Do not try to use all popular trading strategies; you’d better find the one that suits you best. Always observe the rules of your online trading system.

Summary of Pound Price Predictions

GBP/USD, EUR/GBP, and GBP/JPY, are expected to be influenced by various factors including the Bank of England's interest rates, a bearish US Dollar, optimism about the implications of the coming fiscal boost in EU, and a bullish Bank of Japan. These factors will play a crucial role in shaping the Q4 2025 performance of the British Pound.

The British pound is labeled as “a currency that is struggling to regain its former glory” despite playing an “outsized role” in global foreign exchange markets. Looking at the key fundamentals of the UK, we can see some reasons to be upbeat on the outlook for the Pound in Q4 2025 and in the beginning of 2026, but there are challenges too.

It’s important to remember that any long-term forecasts, even the GBP/USD forecast, or any other currency pair, are too unreliable to believe in. Too many factors may affect the rate of the currency pair, and it’s best to be up-to-date with what’s happening in the global arena in order to make realistic and reliable predictions.

If you do decide that trading this currency pair is something for you, and you believe in the future of the British Pound vs. US Dollar pair, first, you need to decide on a suitable trading strategy for you and work it out first on a demo account, and then on a real account.

A great reason to open a trading account with NAGA.com! We provide a user-friendly trading app with an outlook for novices as well as experienced traders and investors.

Read also our daily and weekly updates on commodity and stock market:

- EURUSD forecast and price prediction

- Turkish Lira forecast and price prediction

- USD to INR forecast 2026, 2027, 2030

- AED to INR forecast 2026, 2027, 2030

- SAR to INR forecast 2026, 2027, 2030

- Gold forecast and price prediction

- Oil forecast and price prediction

- Dow Jones forecast and price prediction

- Nasdaq-100 forecast and price prediction

- Natural Gas forecast and price prediction

- Silver forecast and price prediction

Sources:

- British Pound - Quote - Chart - Historical Data - News (tradingeconomics.com)

- Bank of England pushes back on calls for early 2024 rate cuts | Snap | ING Think

- Will politics and policy spoil the Pound Sterling party? (fxstreet.com)

- Bank Of England To Stay On Hold Well Into 2024 (fitchsolutions.com)

- https://www.bankofengland.co.uk/monetary-policy-report/2024/february-2024