Throughout the stock market’s history, certain months have constantly delivered higher returns than others. November through January is statistically quite bullish, while August and September are historically bearish. Analysts have suggested that there is a turn-of-the-month effect, where stocks tend to see more gains at the end of each month and the beginning of the subsequent month.

Trading the last four days of a month and then the next two days produces positive gains 64% of the time. If the turn-of-the-month phenomenon is a real trend, do stocks tend to rise even more at the end of a calendar year?

The Santa Claus Rally suggests so, and a compelling setup for risk assets is taking shape. These elements historically align for rallies in 75% of years; however, the outcome in 2025 depends on sustained global liquidity and the absence of major shocks.

Santa Claus Rally – Key Takeaways

- Proven historical edge: Average S&P 500 gains of +1.3% in 79% of the time since 1950 across the last five trading days in December and the first two trading days in January.

- 2025 catalysts align: Several factors are setting the stage for a potential stock market Santa Claus Rally despite concerns about the AI sector.

- Sector leaders: Retail/consumer discretionary, technologies, and financials outperform the market during Christmas and the New Year.

- Ride it with NAGA: Short-term trading via CFDs or long-term holding via stocks with ownership, along with insights and trade signals.

Understanding the Santa Claus Rally

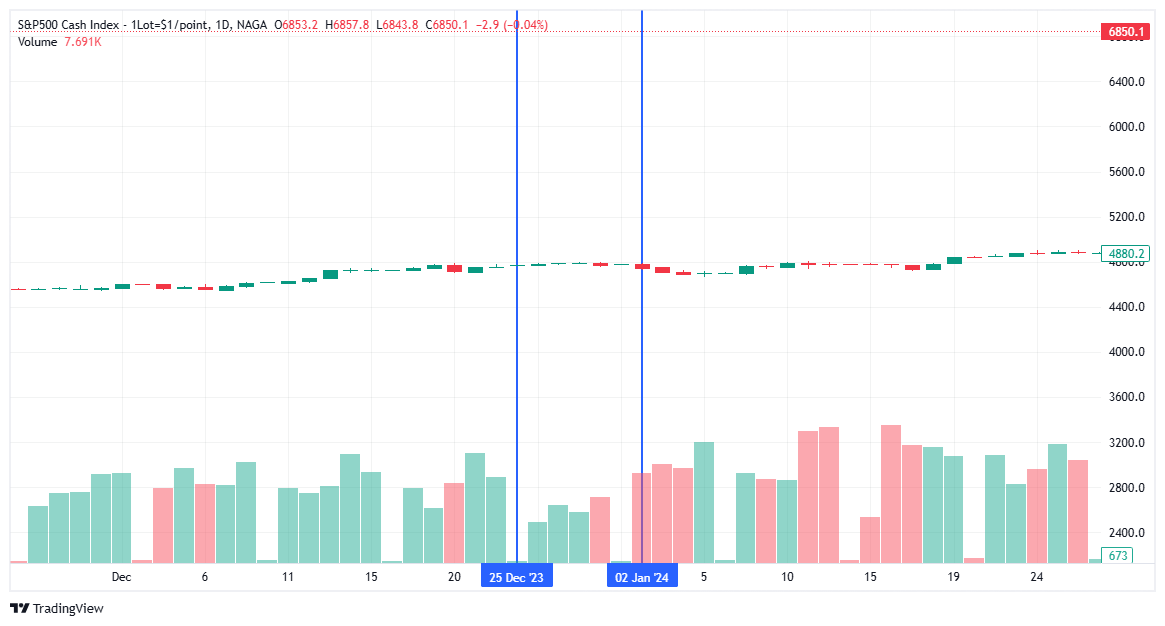

The Santa Claus Rally is a well-known seasonal phenomenon in the stock market, referring to the observed rise in stock prices during the last five trading days of December and the first two trading days of January. First documented by Yale Hirsch in 1972 in The Stock Trader’s Almanac, this rally has occurred approximately 79% of the time since 1950, with the S&P 500 gaining an average of 1.3% during this period.

For instance, in 2008-2009, during the financial crisis recovery, the S&P 500 surged by 7.4% during this period, illustrating the rally’s potential for strong positive returns even in turbulent times. Conversely, there have been exceptions such as the reverse Santa Claus rally in 2024-2025 when the S&P 500 sold off consistently between Christmas and New Year’s — a rare event that highlights the importance of cautious analysis rather than blind reliance on historical trends.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

Will a Santa Claus Rally occur in 2025?

Although data has shown that the Santa Claus rally period has generated more positive returns than negative returns, there is no way for traders/investors to predict whether it will happen again. It is important to note that past performance is not indicative of future results.

Factors that can fuel a stock market Santa Claus Rally

Macro indicators predicting a stronger Santa Claus rally include cooling inflation, high Fed rate cut probabilities, robust corporate earnings beats, and resilient consumer spending data.

- Federal Reserve rate cuts: Over 80% odds of a December 25-basis-point cut, amid cooling producer prices (2.6% YoY), support risk assets and reprices equities higher.

- Global liquidity from Japan: 21.3 trillion yen ($191B) fiscal stimulus stabilizes USD/JPY, supercharging yen carry trades that fund US equity purchases.

- Strong corporate profits: 83% of S&P 500 firms beating earnings estimates, the highest since 2021, bolsters valuations.

- Holiday spending data: Projections >$1T U.S. retail sales reflect consumer health, lifting sentiment and retail/consumer stocks.

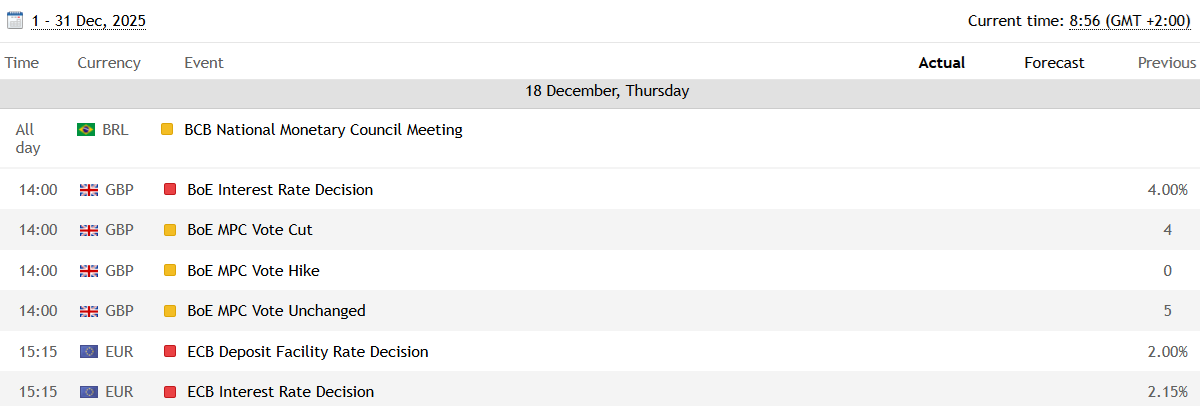

- Bank of England rate cuts: Markets are pricing in a 90% chance that the BoE will cut the interest rate in December, as the budget was seen as avoiding any seriously inflationary measures.

But there are market forces that could leave the bulls finding a lump of coal in their stocking. The drivers behind the volatility in November have not magically disappeared, with some investors and market watchers still voicing concern over the pace of AI hyperscale spending.

Whether you believe in the Santa Rally or not, December will cap a fascinating year for asset classes worldwide, making 2026 stock market predictions tough to call.

Global events in December:

- December 10: Federal Reserve policy decision

- December 11: Swiss National Bank policy decision

- December 18: Bank of England policy decision

- December 18: European Central Bank policy decision

- December 19: Bank of Japan interest rate decision

- December 19: European Leaders summit in Brussels

Follow the economic calendar and open an account to receive news and insights from Tip Ranks and Trading Central.

Sectors that typically outperform during a Santa Claus rally

Holiday spending, e-commerce surges, and year-end trading volumes can potentially support specific sectors to outperform the market during the Christmas and New Year period.

Top performing sectors:

- Retail and Consumer Discretionary: Benefit directly from record holiday shopping, with e-commerce leaders like Amazon and omnichannel retailers like Urban Outfitters seeing strong sales growth (projected 3.7-4.2% in holiday retail).

- Technology: E-commerce platforms, digital payments, and AI-related firms (e.g., AWS, TSMC) gain from seasonal digital trends and portfolio positioning.

- Financials: Brokers such as NAGA Group and investment banks thrive on elevated retail trading volumes and rebalancing activity.

Secondary beneficiaries:

- Travel and Leisure: Cruise lines like Carnival capitalize on bonus-driven demand and travel optimism.

- Mid/Small-Caps: Often outpace large-caps in rallies, driven by anticipation of the January effect.

Energy shows mixed results, tied to weather and oil prices, while broader indices such as the S&P 500 average 1.3% gains during this period. Analysts suggest focusing on these for a potential 2025 Santa Claus Rally positioning amid Fed cuts and liquidity boosts.

Top 25 Stocks that might benefit from a 2025 Santa Claus Rally

Certain stocks tend to benefit more during the Santa Claus Rally due to seasonally higher consumer demand, end-of-year spending, and investor sentiment. Here is a list of the top 25 stocks known for strong performance during this period, often supported by historically high revenues and market interest:

US stocks - high holiday revenue drivers

Stock Description Analyst Ratings 12 Month Forecast Amazon (AMZN) E-commerce experiences peak sales from Black Friday through Christmas, driving revenue and stock momentum Strong Buy $295.63 (+29%) Apple (AAPL) Holiday sales of devices like iPhones and AirPods spike, boosting earnings Moderate Buy $291.64 (+3.9%) Walmart (WMT) Retail giant sees increased foot traffic and holiday sales Strong Buy $123 (+6.23%) Microsoft (MSFT) Enterprise and consumer software sales accelerate with year-end budgets Strong Buy $630.64 (+31.15%) Target (TGT) Holiday discounting and sales surge revenues. Neutral $102.33 (+4.66%) Best Buy (BBY) Electronics sales peak during the holiday shopping season Buy $79.65 (+6.84%) Nvidia (NVDA) Tech demand surges for gaming and productivity hardware Strong Buy $258.10 (+40.75%) Procter & Gamble (PG) Consumer staples see steady demand year-round with holiday boosts in some product categories Buy $172.70 (+13.52%) Coca-Cola (KO) Seasonal advertising and holiday consumption increase revenues Buy $98.97 Tesla (TSLA) End-of-year deliveries and regulatory credits can impact earnings Neutral $383.04 (-14.26%) Sign up for more insights

European stocks - luxury & retail holiday boosts

Stock Description Analyst Ratings 12 Month Forecast Adidas (ADSG) Holiday apparel and sports gear sales surge via festive campaigns and gifting, especially in DAX markets. Buy €230.27 (+44.14%) LVMH Luxury gifting peaks with exclusive holiday collections, such as Advent calendars and bespoke items, driving momentum in the Euro Stoxx 50. Moderate Buy €635 (+0.28%) ASOS Online fashion retailer sees Black Friday-to-Christmas traffic explosion from discounted partywear and gifts. Neutral £346.82 (+39%) Zalando (ZALG) E-commerce clothing platform benefits from European holiday shoppers seeking affordable luxury outfits and accessories. Buy €36.77 (+66%) Inditex (ITX) Fast fashion holiday lines capitalize on last-minute gifting and festive wardrobe demands across Europe. Strong Buy €51.35 (+4.65%) Sign up for more insights

Asian stocks - electronics & e-Commerce festive demand

Stock Description Analyst Ratings 12 Month Forecast Sony (SONY) PlayStation consoles and electronics sales boom during year-end gifting in Japan and Asia-Pacific markets. Buy €29.85 (+18.85%) Samsung Electronics (0593) Smartphones, TVs, and appliances see holiday promotions driving Nikkei rally contributions. Buy ₩130.575 (+20%) JD.com (JD) Chinese e-commerce platform surges with Singles' Day spillover into Christmas deals and global festive shopping. Buy $40.05 (+27.51%) PDD Holdings (PDD) Ultra-low-cost e-commerce via TEMU drives massive holiday bargain hunting and gifting sales in Asia and expanding global markets. Buy $133.92 (+4.45%) Sign up for more insights

Other international stocks - Festive staples & local holiday consumer plays

Stock Description Analyst Ratings 12 Month Forecast Almarai (2280) Dairy and food products experience Saudi holiday demand for family gatherings and iftar-style feasts. Strong Buy 62.62 SAR (+41.68%) Savola Group (2050) Edible oils, sugar, and confectionery sales soar with Middle Eastern Christmas sweets and celebrations. Buy 31.16 SAR (+28%) Emaar Properties (EMAAR) Mall retail, such as Dubai Mall, experiences spikes in tourist shopping during holiday season events. Strong Buy 18.23 AED (+34.5%) Alro (ALR) Aluminum products see an indirect holiday boost via increased manufacturing for gifts, packaging, and consumer goods on the Bucharest Stock Exchange. Strong Buy 2.1 RON (+40%) OMV Petrom (OMV) Energy demand rises from holiday travel, heating, and festive lighting, supporting stable winter revenues. Neutral 0.8167 RON (-14%) Sign up for more insights

These companies tend to see stronger quarterly earnings and positive investor sentiment during the late fourth quarter, thanks to holiday-driven consumer behavior and business cycles.

Why the Santa Claus/Christmas Rally happens: underlying causes

Multiple factors contribute to the Santa Claus Rally phenomenon.

- Investor psychology plays a crucial role, as optimism typically rises during the holiday season, often accompanied by broader economic confidence.

- Institutional investors engage in “window dressing,” buying stocks that historically perform well late in the year to improve the appearance of their investment portfolios in annual reports.

- Tax considerations prompt investors to finalize purchases and sales before the end of the calendar year, potentially shifting markets upward.

- Lighter trading volume during the holidays due to vacations means that even small buy orders can push prices higher.

- Year-end bonuses and inflows from retirement accounts are often invested in the stock market, increasing demand for shares.

Despite variations in exact timing, the Santa Claus/Christmas Rally remains a popular topic for investors seeking to capitalize on typical market patterns during the holiday season.

How indexes perform during the Christmas period

Historical evidence suggests that major indexes such as the Dow Jones Industrial Average, S&P 500, and NASDAQ-100 typically gain between 1% and 2% during the Santa Claus Rally period. These gains are not guaranteed every year but show a high probability, supporting the notion of a recurring seasonal anomaly in equity markets.

Index Avg. Gain Success % Best Year Worst Year S&P 500 +1.3% 79% +7.4% (2009) -4.2% (2018) DJIA +1.4% 74% +6.8% -3.9% NASDAQ 100 +1.8% 82% +9.2% -5.1% DAX 40 +1.13% 72% +4.5% -2.8% NIKKEI 225 +1.1% 71% N/A N/A Historical Santa Claus Rally Returns (1950-2025)

Periods following years where the Santa Claus Rally did not materialize often see a stronger-than-usual rebound, demonstrating the cyclical nature of this effect. These seasonal surges have been so consistent that they feature prominently in many market calendars and trading strategies.

Santa Claus Rally 2025 predictions and expectations from the experts

Here are five Santa Claus rally predictions and expectations for late December 2025 (Dec 24–Jan 3 period), based on recent analyst outlooks:

- Cautious optimism (AInvest): Historical 79% success rate favors gains, supported by 80% Fed rate cut odds and cooling PPI (2.6% YoY), but S&P 500 resistance at 6,850 and AI volatility cap upside; expects modest rally with hedging.

- Bullish year-end targets (J.P. Morgan): S&P 500 to 6,000 (J.P. Morgan) or 6,600 (Goldman Sachs) by year-end, driven by double-digit earnings growth, economic resilience, and seasonal reassertion after 2024 failure.

- Strong rally likely (deVere Group/CFRA): CFRA predicts gains into 2026 via holiday spending (> $1T retail sales, +3.7-4.2%), 83% earnings beats, and dip-buying; Bank of America sees S&P surpassing 7,000 soon.

- Liquidity-fueled rally (Financial Post): Fed 25bps cut (>80% odds) + Japan’s 21.3T yen stimulus supercharges yen carry trades, amplifying global risk appetite and institutional rebalancing for year-end momentum.

- Positive setup (Seeking Alpha): S&P 500 5% pullback improves odds; December Fed cut, strong profits, and market breadth expansion signal rally continuation into 2026 despite uncertainties.

These Santa Claus Rally 2025 predictions align on modest to strong upside (~1-2%+ base) but caution high valuations and event risks.

How to take advantage of the Santa Claus Rally

For traders and investors seeking to capitalize on the Santa Claus Rally, several common strategies exist. One approach is to buy ETFs that track major indices, such as the SPDR S&P 500 ETF Trust or QQQ, during the last week of December and hold them through early January. Another approach is to select individual stocks with strong fundamentals during the holiday season, such as those in the retail, technology, and consumer goods.

For more active traders, exploiting short-term volatility during this calendar period through CFDs is a compelling option. Platforms such as NAGA enable traders to access stocks, ETFs, and indices with leverage, allowing amplified potential gains (and potential losses) during high-probability market rallies while managing risk through stop-loss orders.

Long-term investors can use the Santa Claus Rally as an opportunity to dollar-cost average into favored stocks or sectors at seasonally strong prices, keeping in mind global economic fundamentals and valuation.

How to trade a potential Santa Claus Rally with NAGA

To invest or trade in a Santa Claus Rally that might also occur in 2025, follow these steps:

Step 1: Create and verify your NAGA account for Santa Claus Rally

Visit naga.com and sign-up using email, phone, and basic details—takes 2 minutes. Open a demo account with $10,000 virtual funds to practice Santa Claus Rally strategies on stocks like Amazon or LVMH without risk.

Complete KYC with ID and address proof for quick verification (hours), unlocking real trading during the rally window (last 5 Dec days + first 2 Jan).

Step 2: Fund your account securely ahead of rally timing

Deposit minimum $250 via card, bank, Skrill, Neteller, or crypto—no fees, multi-currency support. Time funding for Dec 20-26 to catch a potential Santa Claus Rally (76% historical success).

Use NAGA's calculator for position sizing on rally stocks; VIP bonuses activate on deposits for enhanced tools during low-volume holiday surges.

Step 3: Explore rally stocks and global markets

Browse 4000+ assets listed on the major global stock exchanges. Analyze charts, sentiment, consensus, forecasts and holiday news inside the platform.

NAGA Academy and the economic calendar highlight rally catalysts, such as year-end bonuses; the leaderboard shows top traders positioning for a potential Santa Claus Rally.

Step 4: Set up and execute rally trades

Calculate position size based on the general rule of thumb to risk no more than 1-2% of your trading capital on a single trade and the maximum potential loss; Add stops and take profit orders to optimize the risk/reward ratio.

Review ticket (spreads, swaps) and execute trades or AutoCopy lead traders riding holiday optimism.

Step 5: Monitor positions and secure potential rally profits

The dashboard tracks live P&L amid light volumes, amplifying moves; set alerts for earnings/news that boost consumer stocks. Close manually or via stops by January 3.

Withdraw gains within 1-3 days or reinvest the potential profits.

Conclusion: The Santa Claus Rally is a valuable market indicator and trading setup

The Santa Claus Rally remains one of the most reliable calendar effects in financial markets, providing traders and investors with a seasonal boost supported by decades of historical data. While not infallible, its consistency makes it a valuable element in portfolio and trading strategies.

Stocks tied to holiday consumer spending, technology upgrades, and stable consumer staples are usually top beneficiaries during this period. Leveraging platforms like NAGA.com can help access these opportunities with flexible trading conditions and tools.

Understanding the Santa Claus Rally’s timing, its historic success rate, and the market psychology behind it enables better informed positioning during the final trading days of December and into early January. The rally not only offers potential opportunities but also insight into broader market sentiment going into the new year.