Many industrialized countries raised interest rates sharply in 2022-2023 in response to significantly rising inflation rates. In 2024-2025, interest rate cuts began in many places. Last year, the Fed cut from 5.25-5.50% to 3.64%, the ECB to 2%, the BoE to 3.75%, while the BoJ hiked to 0.75% amid reflation.

A synchronized move toward lower key interest rates globally is not expected in 2026. While the US Federal Reserve is likely to continue lowering interest rates, other countries are expected to see stagnating or even rising interest rates. This is due, on the one hand, to persistent inflation rates and, on the other hand, to resilient labor markets and rising growth expectations, partly caused by fiscal policy.

As 2026 starts, investors are closely watching economic data and central bank signals for clues on the next moves. Find out what experts predict for the months ahead.

Will interest rates continue to fall?

- US: The Federal Reserve lowered interest rates to 3.50-3.75% in December. The markets are anticipating further interest rate cuts, but these may not come too early in the year, given robust growth data and persistent inflation. Many market participants expect 1-2 interest rate cuts of 25 basis points each.

- Eurozone: The ECB's key deposit rate has remained unchanged at 2.0% since June. Further interest rate cuts are not expected due to persistent inflation and improved growth prospects, while interest rate hikes could begin at the end of 2026 or in 2027.

- UK: The Bank of England recently lowered its key interest rate to 3.75%. Further interest rate cuts are considered likely due to declining inflation and weak economic data.

- Canada: The Bank of Canada recently kept its key interest rate at 2.25%. It is expected that inflation in 2026 will not lead to interest rate changes and that the greatest possible influence on monetary policy is likely to be a possible renegotiation/review of NAFTA.

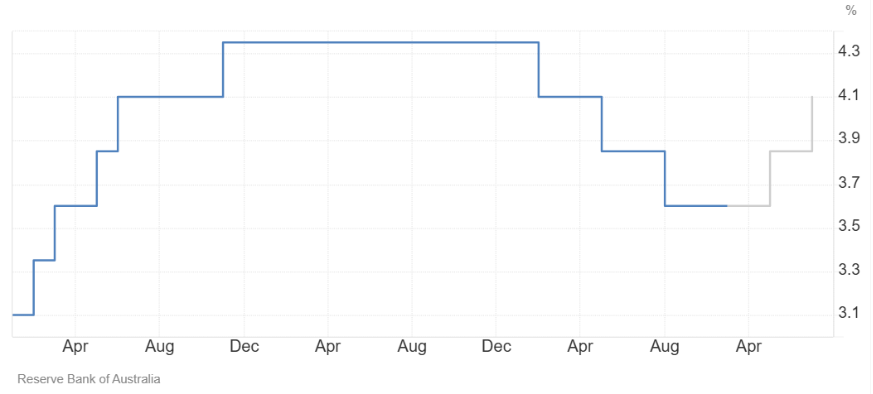

- Australia: The Reserve Bank of Australia left the key interest rate unchanged at 3.6%. Due to continued high inflation, interest rate hikes are considered likely, possibly as early as February.

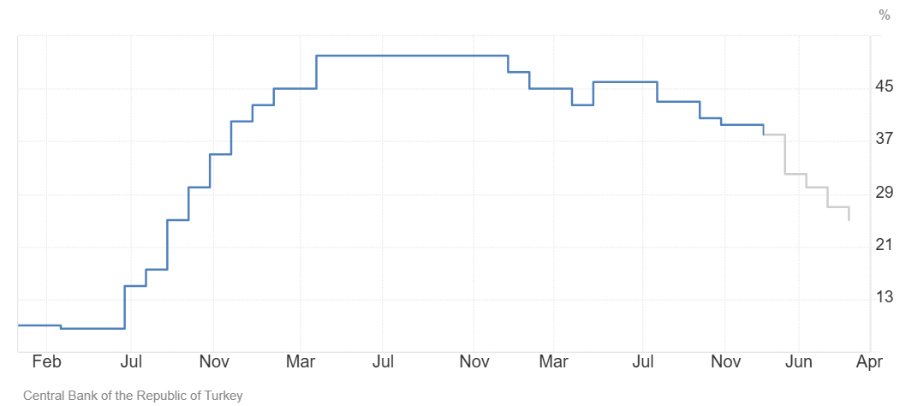

- Turkey: The Central Bank of Turkey lowered its key interest rate in December to 38%, which was more than many market participants had expected. Further easing is expected as long as inflation remains on a downward trend.

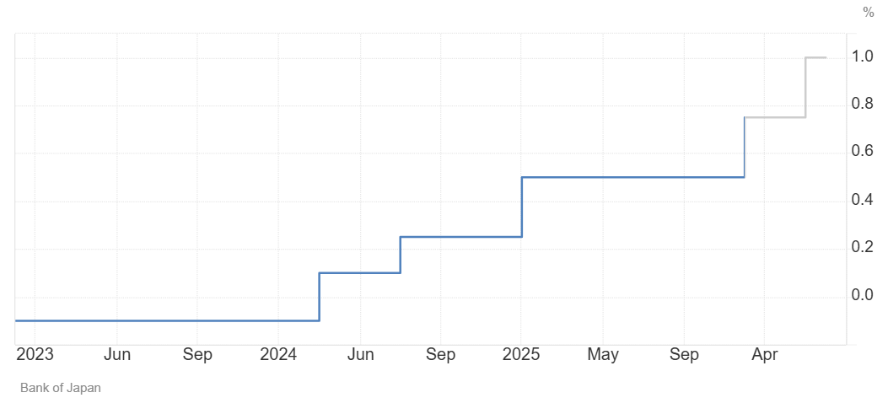

- Japan: The Bank of Japan recently raised its key interest rate to 0.75%, the highest level in 30 years. Further interest rate hikes are considered likely, although the timing and extent are still unclear.

In the later easing cycle, central banks go their separate ways

In 2022, central banks in industrialized nations began cutting key interest rates in response to sharply rising inflation rates. This continued in 2023 and led to a brief plateau phase until the easing cycle started in 2024 and, in some cases, early 2025.

The next steps will increasingly be determined from meeting to meeting, as emphasized by Jerome Powell, Christine Lagarde, and Andrew Bailey.

Central banks are now carefully balancing the need to control inflation with the potential risks of overtightening, which could stifle economic growth.

The impact of previous interest rate hikes is still reverberating through the economy, with higher borrowing costs affecting consumers and businesses alike. However, the labor market has remained surprisingly resilient, and fears of an imminent recession have somewhat abated. Central banks are now closely monitoring economic data, including inflation, employment, and consumer spending, to determine the appropriate path forward.

A return to near-zero interest rates seems unlikely in the near term. Each central bank weighs up this trade-off between economic stimulation and inflation risks for itself. This is likely to result in a divergence in monetary policy in 2026. While further interest rate cuts are expected, particularly in the US and UK, Europe is heading for a phase of stable interest rates, which may be followed by interest rate hikes. In Australia, interest rate hikes are likely relatively early in the year. Japan occupies a special position, as it is beginning to tighten its monetary policy after decades.

The Elusive Path to Lower Rates: A 2026 Perspective

The Federal Reserve continued the cycle of interest rate cuts that began in 2024, later than the markets had long expected. The FOMC decided on a total of three interest rate cuts of 25 basis points each, marking a significant shift in monetary policy after a period of aggressive tightening. However, the question now is: will these cuts continue, and at what pace?

While markets initially anticipated a more rapid and substantial easing of monetary policy, the Fed has adopted a more cautious approach. The central bank is closely monitoring inflation data, economic growth, and the evolving labor market to determine the appropriate path forward.

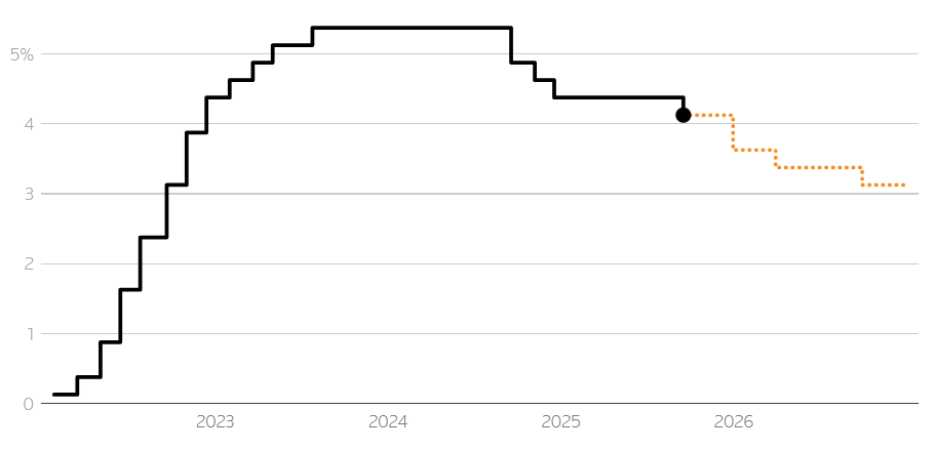

Interest Rates Forecast in the US

According to the CME FedWatch Tool, market participants expect US key interest rates to fall in 2026. The probability of interest rates remaining constant is therefore only around 5%, while the probability of interest rates falling is 95%. The highest probability is for interest rates to fall by 25 to 75 basis points by December 2026.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

Why could interest rates go down in the US from 1Q 2026?

Interest rates in the US could decline in 2026 due to several factors. If inflation continues easing toward the Fed’s 2% target, policymakers may feel comfortable cutting rates to support economic growth. A slowdown in the US economy, marked by rising unemployment or weaker GDP, could also prompt rate cuts to prevent a recession. Additionally, global economic weakness may push investors toward safer assets, influencing lower rates. A shift in Fed policy toward a more dovish stance could further accelerate rate reductions.

Why could interest rates in the US stay high for a longer time?

However, several factors could keep interest rates elevated for longer. Persistent inflation may force the Fed to maintain higher rates to control price pressures. Strong economic growth could also deter rate cuts, as reducing borrowing costs might reignite inflation. Geopolitical risks or unexpected global market disruptions may lead the Fed to hold rates steady. Additionally, expansionary fiscal policies, such as increased government spending or tax cuts, could add upward pressure on interest rates. Ultimately, the Fed’s decisions will depend on economic data, inflation trends, and broader market conditions.

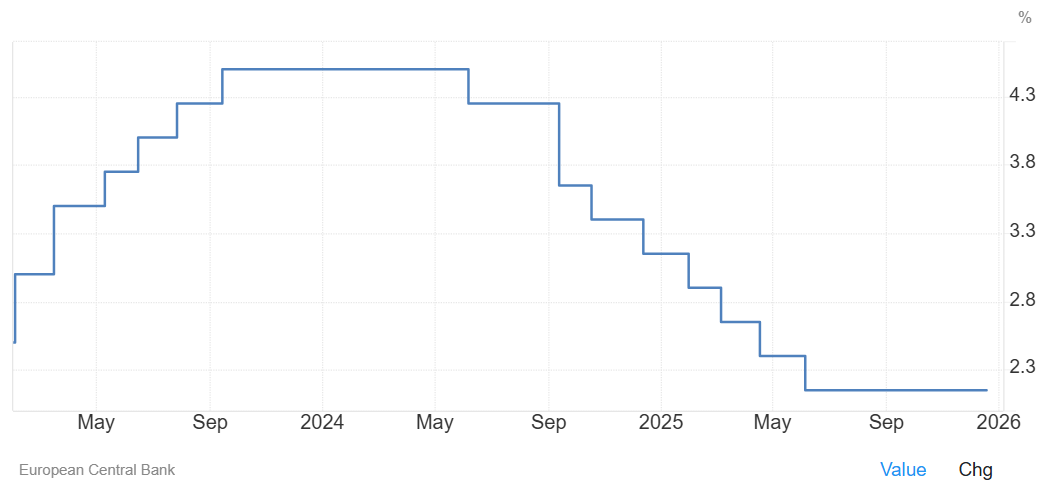

Will interest rates continue to fall in the EU?

In 2025, the European Central Bank (ECB) lowered the key interest rate for the eurozone four times by 25 basis points each time, responding to the downward trend in inflation. The last interest rate cut took place in June: since then, interest rates in the monetary union have remained constant.

Eurozone: First a pause in interest rates, then an increase?

There are no signs of monetary policy easing in the eurozone either. ECB Director Schnabel hinted that the ECB's next interest rate move could be an increase after a prolonged pause, pointing to persistently high core inflation in the currency union, which stood at 2.4% in November for the third month in a row.

ECB President Christine Lagarde also signaled that growth rates in the eurozone could be higher than previously assumed by the central bank.

The ECB has taken a cautious, data-dependent approach. And that's how it will remain: the central bank wants to proceed "without a fixed interest rate, path or timing for a possible change" (ECB President Christine Lagarde). Interest rate decisions will be made based on an assessment of the inflation outlook and the associated risks, taking into account incoming economic and financial data, the dynamics of underlying inflation, and the strength of monetary policy transmission. "We have received further confirmation that we are in a good position, but that does not mean we are static," Lagarde commented after the ECB's interest rate meeting in December.

The projections for inflation and GDP growth have recently been raised slightly. The central bank expects inflation to be 1.9 per cent in 2026 and 1.8 per cent in 2027. For the first time, there are also projections for 2028. At the end of the 2028 projection horizon, economists at the ECB and national central banks expect an inflation rate of 2.0% and GDP growth of 1.4%.

Interest Rates Forecast in EU

The European Central Bank has lowered the key interest rate for the eurozone in 2025 in four steps of 25 basis points each. Further interest rate cuts are generally not expected for 2026; in fact, interest rate hikes later in the year seem possible given the improved growth forecasts.

LBBW Research does not expect any further key interest rate cuts. "The market is currently expecting the first interest rate hikes at the end of 2026. However, we consider this to be premature in view of today's figures. We expect the ECB to hold steady on key interest rates at least until the end of 2026."

Oliver Eichmann, Head of Rates, EM & Short Duration, Fixed Income EMEA at DWS, also expects interest rates to stagnate in 2026: "The latest ECB press conference was clear: the ECB sees itself 'in a good place'. The data supports this view: there is no acute pressure to act, and therefore the interest rate outlook remains unchanged."

ING expects key interest rates to remain stable until 2027.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

Will interest rates go down in the EU in 2026?

The European Central Bank (ECB) began a cycle of easing in June 2024 and has since cut interest rates eight times, most recently in June 2025. Further interest rate cuts are generally not expected for 2026, as the central bank believes it is in a good position in the conflict of objectives between inflation and growth, and growth expectations have recently been raised.

The ECB is taking a cautious, gradual approach to rate cuts, balancing the need to bring inflation back to its 2% target while supporting economic stability.

This data-driven approach will continue to be pursued. The Governing Council of the ECB stated in December that inflation is likely to stabilize at the 2% target in the medium term. The inflation forecast for 2026 has been revised upwards to 1.9%.

Further interest rate cuts could be on the cards, particularly in a scenario where both growth and inflation are below expectations. Michael Field, chief strategist for the European market at Morningstar, believes that inflation could remain below target in 2026 and that overall growth could remain weak: "In that case, there is nothing to stop the ECB from cutting interest rates further."

Why could interest rates in the EU stay high for a longer time or even rise?

Several factors could lead to interest rates in the EU staying elevated for a longer period. Persistent inflation is a major concern, as if inflation remains more stubborn than expected, the ECB may need to maintain higher rates to control inflationary pressures, particularly if core inflation or wage growth stays high. Additionally, stronger-than-expected economic growth could make the ECB hesitant to lower rates too soon, as robust recovery might reignite inflationary concerns, prompting a more cautious stance. Geopolitical risks also pose a threat, as escalating tensions or unexpected global events could create financial instability, leading the ECB to keep rates higher as a precaution.

Lastly, expansionary fiscal policies by Eurozone governments, such as increased spending or tax cuts, could exert upward pressure on interest rates due to heightened government borrowing competing with private sector demand for funds, potentially driving up borrowing costs.

EurUsd Forecast & Price Predictions 2026

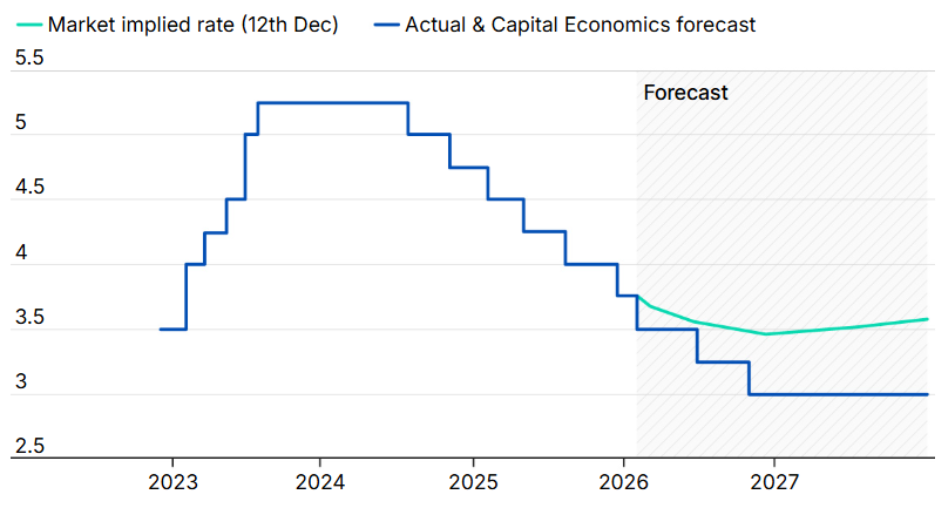

When will interest rates go down in the UK?

The Bank of England began cutting interest rates in August 2024. Six interest rate cuts of 25 basis points each brought the key interest rate down from 5.5% to 3.75%. The last key interest rate cut for the time being took place in December 2025. The interest rate cuts were made possible by the fact that inflation on the island fell from its peak of over 10% to just over 3%.

Further interest rate cuts in 2026 are considered likely, with the BoE itself referring to "gradual" easing and making this primarily dependent on further declines in wage growth and services inflation.

The Bank of England is taking a gradual and cautious approach to rate cuts, focused on bringing inflation back to its 2% target while supporting economic growth. Further rate cuts are anticipated in 2026, but their extent and timing will depend on the evolving economic landscape and inflation trends.

The Bank’s decisions will also be influenced by incoming economic data, particularly inflation and growth indicators, along with geopolitical risks and the impact of fiscal policy on monetary policy decisions.

BoE sees the upside risks to inflation as “less pronounced,” but at the same time emphasizes that future decisions on interest rate cuts could be “scarcer.” This is seen as a sign that the key interest rate is approaching its neutral level, which is likely to be somewhere between 3.0% and 3.5%.

Interest Rates Forecast in the UK

Further interest rate cuts in the UK are considered likely in 2026, although the timing is still uncertain.

ING expects that the UK will soon no longer be seen as an "inflation outlier" and forecasts two interest rate cuts in the first half of 2026.

Capital Economics expects three interest rate cuts in 2026. Economists anticipate a faster-than-expected decline in inflation to 2% by the end of 2026 and a rise in the unemployment rate.

Morgan Stanley also expects UK base rates to fall to 3% by the end of 2026, with interest rate cuts in February, April and June. Morgan Stanley then expects base rates to remain at 3% in 2026 and 2027.

HSCB forecasts a base rate of 3% for the end of 2026.

Oxford Economics sees two interest rate cuts to 3.25%, with the rate cuts coming in April and November.

Sanjay Raja, chief economist at Deutsche Bank for the UK, expects interest rate cuts in March and June to ultimately reach 3.25%.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

Why could interest rates go down in the UK in 2026?

The Bank of England has already started reducing interest rates, with further cuts expected throughout the year. While inflation in the UK remains high, it is showing signs of cooling, allowing the Bank to ease its monetary policy without worsening inflationary pressures.

Weak economic development is a particular argument in favor of interest rate cuts. The interest rate cut in December came in a week when the unemployment rate in the UK reached its highest level in almost five years. Growth rates in recent years have been low for a variety of reasons, and forecasts are also subdued.

Lower interest rates are being used to stimulate economic activity and encourage growth.

The Bank of England has taken a cautious, gradual approach to rate cuts, aiming to return inflation to its 2% target while supporting economic growth. Looking ahead, the Bank has signaled that more cuts are likely throughout 2026, though the timing and extent will depend on the evolving economic landscape and inflation trends.

Key considerations such as inflation data, economic growth indicators, and global factors will continue to influence the Bank's decisions.

Why could interest rates in the UK stay high for a longer time?

The BoE’s updated narrative is likely to be that clear progress is being made on inflation, but that it is too early to declare victory, and therefore caution must be exercised when thinking about when and how quickly policy can be normalized.

One possible scenario for a cautious BoE is derived from the performance of the GBP on the foreign exchange market. The pound sterling recovered significantly against the US dollar in 2025, reaching a multi-year high, but lost ground against a resurgent euro. Further significant interest rate cuts by the BoE, alongside other factors such as low growth and fiscal policy risks, could lead to a depreciation of the pound, which in turn could increase the upside risks to inflation and limit the central bank's monetary policy scope.

British Pound (GBP) Forecast & Price Predictions 2026

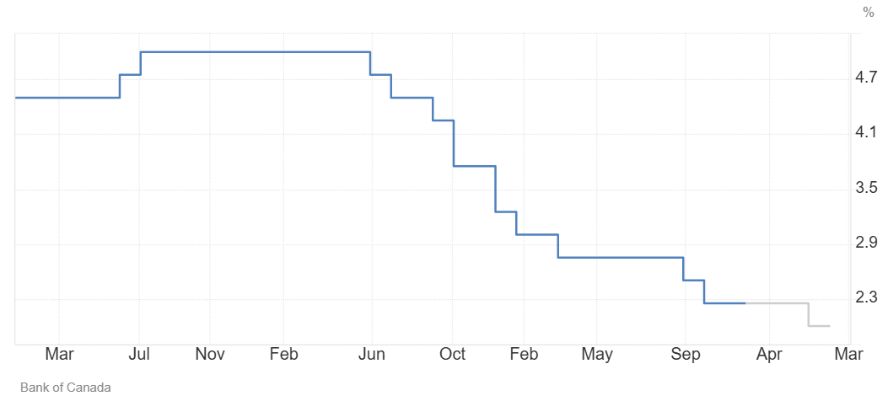

Will interest rates continue to go down in Canada?

The Bank of Canada (BoC) began its interest rate cut cycle in June 2024. In eight steps, interest rates have since fallen from 5% to 2.25%, with the last rate cut occurring in October 2025. Further interest rate cuts are largely not expected for 2026.

The easing cycle created a more favorable borrowing environment for both consumers and businesses in Canada. Several factors were driving this shift.

While inflation remains a concern, it has shown signs of cooling, allowing the BoC to ease monetary policy without reigniting inflationary pressures. The BoC is taking a gradual and measured approach to rate cuts, aiming to bring inflation back to their 2% target while supporting overall economic growth.

The BoC has signaled that further rate reductions are likely throughout 2025, depending on the evolving economic landscape and inflation trends along with the growing uncertainty relating to the political situation with US president Donald Trump taking office in January.

The bank’s decisions will be influenced by incoming economic data, global events, and fiscal policies implemented by the Canadian government.

Interest Rates Forecast in Canada

The Bank of Canada reduced its interest rate to 2,25 in September, with the Bank Rate at 2.5% and the deposit rate at 2.20%. It was the fourth interest rate cut in 2025.

Market participants do not expect any interest rate cuts in Canada in 2026. The core inflation indicators preferred by the Bank of Canada, the adjusted and median consumer price indices, fell from 3.0% in October to 2.8% each, which is still well above the inflation target.

The central bank considers the current interest rate to be appropriate for achieving the inflation target of 2%, provided that inflation and the economy develop in line with the latest forecasts. However, uncertainty is considered to be high.

In January 2025, the Bank also announced its plan to complete the normalization of its balance sheet, ending quantitative tightening. The Bank will restart asset purchases in early March, beginning gradually so that its balance sheet stabilizes and then grows modestly, in line with growth in the economy.

Projections in the January Monetary Policy Report (MPR) published are subject to more-than-usual uncertainty because of the rapidly evolving policy landscape, particularly the threat of trade tariffs by the new administration in the United States. Since the scope and duration of a possible trade conflict are impossible to predict, this MPR provides a baseline forecast in the absence of new tariffs.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

Why could interest rates go down in Canada in 2026?

If the Canadian economy shows signs of facing persistent weakness, characterized by sluggish growth and rising unemployment, the Bank of Canada (BoC) may be forced to lower interest rates further to stimulate economic activity. Additionally, if inflation continues to moderate significantly and falls below the BoC's 2% target, the bank might cut rates to avoid deflationary risks.

A global economic slowdown could also negatively impact Canadian exports and reduce domestic demand, prompting the BoC to lower rates in an effort to mitigate these effects and support the economy.

Why could interest rates in Canada stay high for a longer time?

If inflation proves more persistent than expected, the BoC may need to maintain higher rates for longer to bring inflation back to its 2% target, especially if underlying inflationary pressures, such as wage growth or core inflation, remain elevated. Additionally, if the Canadian economy experiences a stronger-than-expected recovery, the BoC may be cautious about lowering rates prematurely, as robust economic growth could reignite inflationary concerns.

Finally, escalating geopolitical risks or unforeseen global events could introduce uncertainty and volatility into financial markets, prompting the BoC to hold rates higher to safeguard financial stability.

When will interest rates rise in Australia?

The Reserve Bank of Australia began its easing cycle in February 2025, later than other central banks. In three steps, the key interest rate was lowered from 4.35% to 3.6%. Further interest rate cuts are not expected in 2026. On the contrary, most economists even anticipate interest rate hikes due to persistent inflation Down Under.

Australia is forecast to experience interest rate hikes in 2026, with forecasts suggesting the first hike could occur in February, potentially lowering the cash rate to around 4.1% by the end of the year. However, the exact timing and extent of these cuts will depend on economic data and the Reserve Bank of Australia's (RBA) assessment of inflation levels.

Interest Rates Forecast in Australia

There is no sign of monetary policy easing in Australia. The Commonwealth Bank of Australia expects a key interest rate hike of 25 basis points to 3.85% in February. A more extensive cycle of interest rate hikes could be necessary if economic growth Down Under gains momentum. The National Australia Bank expects interest rate hikes of 25 basis points in both February and May. Westpac Banking has revised its call for falling interest rates and now forecasts a prolonged period of stagnation in interest rates.

Seven of the 38 economists surveyed in the Australian Financial Review's quarterly poll, including representatives from the Commonwealth Bank and National Australia Bank, expect the RBA to raise interest rates at its first monetary policy meeting of the new year, scheduled for early February.

Jonathan Kearns, former RBA official and current chief economist at Challenger, expects the central bank to raise interest rates in February. “Inflationary pressures will be a concern for the board, and it is becoming increasingly clear that financial conditions are not that tight, given low credit spreads and easy borrowing conditions.”

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

Why could interest rates rise in Australia in 2026?

Several factors could lead to potential interest rate hikes in Australia. Inflation remains above the target range of 2-3% and stood at 3.8% in October (3.3% core inflation). At the same time, the Australian labor market is considered to be rather tight.

A report by Economic Insight for December 2025 states: “The broad-based acceleration in inflation against the backdrop of a still tight labor market is noteworthy ... the extent of price increases and the resilience of economic activity suggest that underlying inflationary pressures have broadened and strengthened.”

Why could interest rates in Australia stay high for a longer time?

Interest rates in Australia may remain high due to factors like accelerating wage growth, persistent supply chain disruptions, or unexpected shocks such as natural disasters or geopolitical crises. Additionally, concerns over financial stability or excessive risk-taking in the financial system could prompt the RBA to keep rates elevated.

Will interest rates continue to go down in Turkey?

The Turkish central bank lowered its key interest rate to 38% in December 2025. It was the fourth consecutive interest rate cut, made possible by a decline in inflation. The easing cycle is not straightforward: in April, the key interest rate was raised from 42.5% to 46%.

The Turkey interest rates forecast for the next 5 years (projected interest rates in 5 years in Turkey) shows the end of the rate-hike cycle. However, the CBT keeps a hawkish bias in place.

Turkey's interest rates had a history of extreme volatility, followed by a period of comparatively stable conditions for the majority of the 21st century, while the CBT underwent significant structural reforms in the wake of the 2001 financial collapse that precipitated the country's economic catastrophe.

Turkey was mostly successful in keeping inflation around 10% between 2005 and 2017, and interest rates followed suit by remaining quite low. Rates dropped as low as 4.5% in 2013, as the nation moved towards the Western economic paradigm of gradual price growth in the wake of the Great Recession.

In reaction to a substantial increase in inflation in 2019, rates increased as high as 20.35 percent before dropping with the inauguration of a new central bank governor. Rates decreased to 8.25% in response to COVID-19 limits that stifled demand before increasing to 19% by March 2021.

A few days after the increase, Erdogan fired Naci Agbal as governor of the Central Bank of the Republic of Turkey. Since then, the rate has continued to decrease because of the president's insistence. Despite rising prices, it reached 8.5% in March as inflation concurrently ballooned, breaching 80% in late 2022.

As of January 2026, expectations for interest rate cuts in Turkey are based on the rate of inflation. The Turkish Central Bank (CBT) is expected to continue cutting interest rates as inflation eases.

Inflationary pressure has recently eased. Consumer prices rose by 31.1% YoY in November, which corresponds to a monthly increase of 0.87%, thus below expectations. In August and September, inflation exceeded forecasts, but fell short of them in October and November.

Interest Rates Forecast in Turkey

As of January 2026, the interest rate set by the Central Bank of the Republic of Turkey (TCMB) was 38%. This was a 1.5 percentage point reduction from the previous rate of 39.5% and another sign the central bank has shifted course.

The central bank's official preliminary inflation target is 16%. The bank forecasts inflation of between 13% and 19% for 2026. However, this forecast is viewed with skepticism by most market participants. ING, for example, expects inflation to fall to 22% and the key interest rate to reach 27% in the fourth quarter of 2026. Inflation expectations among market participants have recently risen again and, according to a survey by the central bank, stood at 23.2% for the end of 2026.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

Why could interest rates go down in Turkey in 2026?

The central bank may lower interest rates due to weakening economic growth, which could result in rising unemployment and declining consumer confidence, prompting measures to stimulate activity. Additionally, if inflation moderates faster than expected and inflation expectations decline, the central bank may ease monetary policy. A global economic slowdown affecting Turkey’s exports and tourism could also lead to rate cuts to mitigate domestic impact.

Furthermore, while the central bank operates independently, government pressure for lower rates to encourage growth and employment could influence its decisions.

Why could interest rates in Turkey stay high for a longer time?

If inflation, particularly core inflation, remains more persistent than expected, the central bank may need to keep interest rates elevated or raise them further to prevent inflation from resurging. Significant depreciation of the Turkish Lira could also drive inflation and diminish consumer confidence, prompting the central bank to hike rates to stabilize the currency.

In the face of rising geopolitical risks, such as regional conflicts or global instability, the central bank might maintain higher rates to ensure financial stability. Additionally, concerns about external debt could lead the central bank to keep rates high to attract foreign capital and stabilize the currency.

Turkish Lira Forecast & Price Predictions 2026

Will Interest Rates in Japan continue to rise in 2026?

The trend towards a steeper yield curve could be reinforced by interest rate developments in Japan, the largest foreign creditor to the US. Yields on 10-year Japanese bonds are just under 2%, a long-term high. The same applies to 30-year Japanese government bonds, which are trading at yields of more than 3.3%.

The Bank of Japan raised its key interest rate from 0.50% to 0.75% at the end of December 2025, the highest level in more than 30 years. The rise in yields in Japan, combined with key interest rate cuts in the US, could prompt Japanese market participants to repatriate foreign assets, including US government bonds. The resulting decline in demand for US bonds could drive up their yields. This effect could be amplified if the global yen carry trade is impacted when the downward pressure on the Japanese yen comes to an end.

Entering 2026, the Japanese economy encounters both challenges and opportunities. Growth is expected to accelerate thanks to expansionary fiscal measures, steady global IT demand, and soft global energy prices. Strong corporate earnings are expected to boost wage growth and investment. Nevertheless, the financial market could remain unstable amid concerns about long-term fiscal health and rising debt-service burdens, which could impact economic performance. Thus, analysts forecast the BoJ's interest rate hikes to be quite gradual.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

Interest rate impact on the US Dollar and Gold

Stable or tighter monetary policy in many parts of the world, compared to the US, could put pressure on the US dollar. Deutsche Bank, Goldman Sachs Group, and other Wall Street banks predict that the US dollar will continue to depreciate in 2026 due to Fed interest rate cuts, after the greenback had already fallen more sharply in the first half of 2025 than it had since the early 1970s. Morgan Stanley, for example, expects a 5% decline in the first half of 2026. According to consensus estimates compiled by Bloomberg, a widely watched dollar index could fall by about 3% by the end of 2026.

A weaker US dollar makes gold purchases cheaper for investors outside the US, which can stimulate demand.

According to asset manager Sprott, the withdrawal of liquidity from global markets as a result of the unwinding of the yen carry trade could increase headwinds for risky assets, which could benefit gold as a safe haven.

Interest Rate Forecast Summary

2026 is littered with conflicting influences for rates. the potential for a chaotic year is absolutely there. We don't forecast that. Instead, we map out what analysts and big banks view as the most likely outcome: an evolution towards normal rates: the ECB holds at normal, the Fed gets to normal, and long-end rates get to levels that map out normal curves.

Central Bank Current Rate (Jan 2026) 2026 End Forecast Key Context FED 3.64% 3.25-3.40% 1-2 cuts; jobs fragility vs sticky inflation ECB 2.00% 1.75-2.00% Data-dependent hold; 1.9-2.2% inflation, politics BOE 3.75% 3.00-3.25% 2 cuts; stagflation, MPC split RBA 3.60% 3.25-3.60% Hawkish pause; wages/housing BOJ 0.75% 1.00-1.25% 1-2 hikes; 2% inflation achieved CBRT (Turkey) 38% 25-28% Aggressive cuts; 13-19% inflation target Table with Interest Rates Forecasts for 2026

Free Resources

Before you start using the above interest rate forecasts from central banks, agencies, and analysts, you should consider using the educational resources we offer, like NAGA Academy or a demo trading account. NAGA Academy has lots of free trading courses for you to choose from, and they all tackle a different financial concept or process – like the basics of analysis – to help you become a better trader or make more informed investment decisions.

Our demo account is a suitable place for you to get an intimate understanding of how trading and investing work – as well as what it’s like to trade with leverage – before risking real capital. For this reason, a demo account with us is a great tool for investors who are looking to make a transition to leveraged securities.

Sources: