Dubai is a global financial hub, home to the top banks in The Middle East, Africa, and South Asia (MEASA), and an oasis for fintech investment thanks to the support for cutting-edge technologies, artificial intelligence, and blockchain solutions.

Dubai's favorable investment incentives, tax-friendly environment, and reputation for innovative financial services, present a wealth of options for those looking to invest in Dubai in 2026.

Whether you’re an expat, a local, or an international investor curious about capitalizing on Dubai’s growth, this guide will walk you through everything you need to know about how to invest in Dubai in 2026.

How to Invest in Dubai – Quick Step-by-Step Guide

As Dubai’s position as a financial center has continued to mature, so has its demand for a broader range of capital market products and services.

- Define Your Investment Goals. Identify whether you aim for short-term trading profits or long-term wealth building through dividends, rental income, or asset appreciation.

- Choose the Investment Vehicle. Consider risk profile, time commitment, and capital availability when choosing between direct property ownership, stock market, ETFs, or business ownership.

- Open an Investment Account. Use local regulated brokers like NAGA that offer access to UAE and Dubai-listed assets, user-friendly platforms, and strong security.

- Conduct Market Research and Due Diligence. Analyze market trends, company fundamentals, and economic indicators.

- Fund Your Account or Secure Financing. Deposit funds into your trading accounts to invest via the local stock market.

- Build Your Portfolio. To trade or invest in local companies, ETFs, or REITs, access the platform or app and place orders.

- Monitor and Manage Your Portfolio. Stay updated on market news, economic policies, and geopolitical factors.

NAGA simplifies investing in Dubai, offering access to leading Dubai-listed companies and funds through its web and mobile apps tailored for first-time and experienced investors. NAGA is regulated by leading authorities, ensuring safe and transparent investing.

Why Invest in Dubai?

With its highly diversified economy, world-class regulatory environment, and ambitious economic expansion plans, Dubai has established itself as the preferred destination for multinational firms, start-ups, and entrepreneurs targeting growth in the Middle East, Africa, and South Asia (MEASA) region, which is home to a population exceeding 1.7 billion.

The demand for capital markets and wholesale banking is expected to rise along with trade and investment. This confirms Dubai's status as the de facto center connecting all the key markets in the area, which explains why over US$350 billion in trade passes through Dubai annually.

Dubai offers a unique blend of economic strength, strategic location, and diverse investment opportunities:

Global financial hub

The Dubai International Finance Centre (DIFC) is the financial heart of the MEASA region, filling the time-zone gap between the leading financial centers of London and New York in the West, and Hong Kong and Tokyo in the East. With a fast-growing GDP and 40% of the population under the age of 25, offers options for digital financial services and has become a magnet for those looking to invest in Dubai.

Growing financial markets

The Dubai Financial Market (DFM) has been one of the best-performing exchanges globally in recent years, offering access to a range of listed companies. The Dubai Financial Market (DFM) General Index gained approximately 10.6% in the first half of 2025, making it one of the best-performing exchanges in the Gulf region. Substantial sectoral gains in materials, industrials, and financials drive this upward momentum.

A vibrant banking and trade sector

DIFC hosts most of the world’s largest banks, top law firms, and the world’s most prestigious wealth and asset management companies. Credit card giants Visa and MasterCard are also headquartered in Dubai. DIFC is also home to Dubai’s stock exchange, a buoyant insurance sector, and derivatives equities and commodities platforms like Nasdaq Dubai, Dubai Financial Market, and Dubai Mercantile Exchange.

Investors and venture capitalists

Dubai is home to the highest number of investors and venture capitalists in the region. Crowdfunding platforms and lower-cost portfolio products have opened investment and are giving middle and lower-middle-income citizens the ability to become investors. Growth in the provision of credit, an increasing interest in private equity and a rise in venture capital are also helping to drive growth in the middle market.

Leading fintech innovation

As technology is transforming the way financial transactions are enabled and completed, Dubai is taking the lead in the region’s fintech sector with a wealth of start-ups setting up operations in the city. Fintech start-ups have raised hundreds of millions of dollars in funding over the last year. The DIFC is spearheading the city’s innovation ecosystem and is well-placed to drive growth and investment opportunities in Dubai in 2024 and beyond.

AI and Robotics

The city also ranked first globally in attracting foreign direct investments (FDI) for AI and Robotics, reporting tens of billions worth of FDI in high-end technology transfers in the last years; the most coming from the European Union and the U.S. With its own focus on attracting investment in technology, including robotics and AI, Dubai is ideally positioned at the region's heart to lead the fintech and blockchain revolution.

Tax and government incentives

By adopting international best practices, introducing tax incentives, and robust regulatory and legal frameworks, Dubai has become an attractive business destination for start-ups and multinationals. There is no corporate and personal income tax levied in Dubai-based free zones. World Bank's Doing Business report ranked Dubai first for ease of doing business in the Middle East & North Africa.

Popular investment opportunities in Dubai

From equities to stocks and businesses to properties, we break down some of the primary areas for investment in Dubai.

- Stock market investment: Dubai has a vibrant stock market ecosystem managed primarily through the Dubai Financial Market (DFM)

- Real estate investment: Dubai’s property market is one of the most accessible and profitable avenue

- Forex and Commodities trading: Dubai’s status as a financial hub includes robust online trading environments with access to major currency pairs, precious metals, and energies

- Business and commercial investments

Stock Market Investment in Dubai

Investing in Dubai allows foreigners and locals, individuals or companies, to provide businesses with the money they need to grow, which means they will play an important role in the local and regional economy. Dubai has a vibrant stock market ecosystem managed primarily through the Dubai Financial Market (DFM).

How to access the Dubai Stock market

To start investing in Dubai stocks via DFM, investors need to open a trading account with a licensed broker. Platforms like NAGA.com simplify this process by providing seamless digital access to UAE stocks along with intuitive trading tools. Once registered and verified, investors can trade shares directly from their accounts on DFM-listed companies, gaining exposure to a broad range of sectors.

DFM operates under strict regulations enforced by the UAE Securities and Commodities Authority (SCA), ensuring a transparent and secure investing environment. Additionally, DFM has integrated clearing and settlement with Dubai Central Clearing and Depository, providing enhanced efficiency and security for transaction processing.

Dubai trading sessions operate from 10:00 AM to 3:00 PM local time with pre-open and post-close phases allowing for order placements and adjustments. Depending on their trading strategies, investors can place market orders, limit orders, or stop orders.

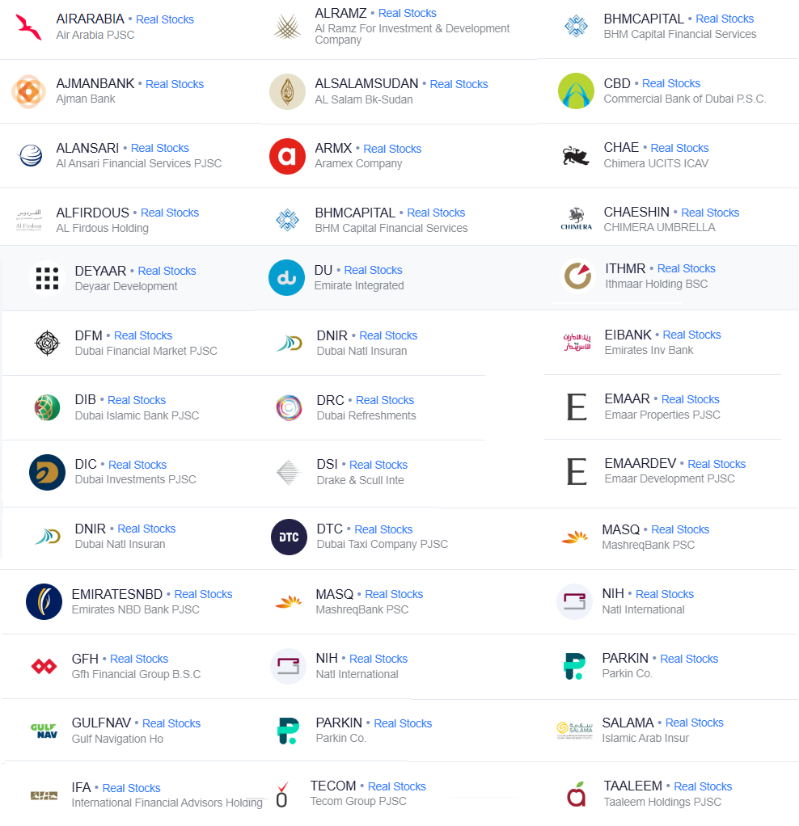

Top stock investments in Dubai

Several blue-chip companies dominate the Dubai stock market and are popular picks among investors:

- Emaar Properties: The real estate giant known for iconic developments like Burj Khalifa and Dubai Mall. Emaar offers investors exposure to Dubai’s property boom and urban expansion.

- Dubai Islamic Bank: A leading Islamic finance institution providing Shariah-compliant banking services, with strong fundamentals and steady dividends.

- Emirates NBD: One of the largest banking groups in the UAE, offering diverse financial services and an important role in regional economic development.

- Dubai Investments: A diversified investment company with interests spanning real estate, financial services, manufacturing, and healthcare.

These companies form the backbone of the DFM and provide portfolio diversification with exposure to key growth sectors. However, investors can invest in the UAE stock market via ETFs.

One of the most liquid and popular ETFs that provide broad exposure to the Dubai stock market is iShares MSCI UAE ETF (UAE), which seeks to track the investment results of an index composed of the top 40 UAE equities. EMAAR Properties, Dubai Financial Market (DFM), Dubai Islamic Bank (DIB), and Dubai Investment (DINV) are some of the best investments in UAE for expats They are among the top holdings in the UAE ETF.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

Indirect Dubai investment

Additionally, you may explore opportunities beyond UAE stock markets, such as international stocks or exchange-traded funds (ETFs). Dubai is a dependable and significant economic partner of the United States. It is also the United States’ number one export market in the Middle East region.

More than 1,500 US firms have a presence in the UAE, from Uber, to Microsoft, and Starbucks. Major global companies — such as Lockheed Martin, Boeing, Northrop Grumman, General Motors, FedEx, Eli Lilly, and Cigna Healthcare – recognize the opportunities offered by the UAE economy, and many base their headquarters and regional offices in Abu Dhabi and Dubai.

Benefits of investing in the Dubai stocks market

Dubai stock market offers both local and international investors a gateway to participating in Dubai’s economic growth. Here are some of the benefits of investing in the Dubai stock market:

- Potential for dividend income and capital gains: Many DFM-listed companies regularly pay dividends to shareholders, providing a steady income stream alongside potential stock price appreciation.

- Transparent and regulated market environment: DFM operates within a strict regulatory framework overseen by SCA, ensuring investor protection, corporate governance, and fair trading.

- No tax on capital gains or dividends: Dubai offers a tax-free investing environment for individuals, significantly enhancing net returns compared to many global markets.

Dubai’s stock market continues to evolve with increasing liquidity, new listings, and technological innovation, making it a compelling choice for both novice and seasoned investors looking to tap into the UAE’s economic growth.

Spot investment opportunities in Dubai with NAGA

With NAGA you can invest in Dubai through derivatives and stocks with ownership listed on the DFM and ADX or trade the iShares MSCI UAE ETF. You can also access +4000 instruments listed on the global exchanges, including commodities, indices, forex, and cryptocurrencies.

Real Estate Investment in Dubai

The property market continues to be one of the most accessible and attractive investment opportunities in 2025, offering a wide range of options for investors with different goals and capital sizes. With its strong legal framework, zero property tax regime, and attractive rental yields, real estate remains a cornerstone of Dubai's investment appeal.

Residential vs. Commercial Real Estate

Investors in Dubai’s real estate can choose between residential and commercial properties. Residential properties intended for a living generally require a lower initial investment than commercial properties utilized for business operations.

Commercial real estate typically involves longer lease terms and is supported by businesses and professionals, offering financial dependability. However, these properties demand a higher initial investment and are subject to greater market fluctuations.

In contrast, residential properties are considered less volatile during economic downturns, though they may generate lower returns. Each real estate investment trust and type has distinct benefits and risks that should be balanced against your financial objectives and risk tolerance.

Investing in Dubai through REITs

A business that owns, manages, or finances income-producing real estate is a real estate investment trust (REIT). They allow investors to diversify their potential risks, particularly those with small investment amounts, and earn dividends from real estate without having to invest, manage, or finance any property themselves.

They own homes, apartments, condos, office space, retail stores, and other real estate in various markets. As a result, they are sufficiently diversified to guard against the risks that any micro market may pose. This has led many investors to favor REITs as a preferred option.

Dubai’s REITs encompass residential, commercial, and industrial portfolios, generating dividend income from rental revenues. Some of the best Dubai real estate companies are:

EMAAR Properties

- Emaar Properties is Dubai's leading developer and the largest developer in the Arab world. It is a public joint-stock company and holding, uniting 60 active companies. It has a collective presence in 36 markets across the Middle East, North Africa, Pan-Asia, Europe, and North America.

- The main sectors are development, hospitality (Emaar Hospitality Group, Investments and business (Emaar Industries & Investments), medicine and health care (Emaar Healthcare), etc.

- Emaar Properties is the developer of Dubai's legendary projects such as Burj Khalifa – the tallest skyscraper in the world, Dubai Creek Tower – a structure under construction 100m higher than Burj Khalifa, Downtown Dubai, Dubai Mall – the largest shopping mall in the world, and Emaar Beachfront.

Investors can buy shares of EMAAR Properties or trade the iShares MSCI UAE ETF (UAE) which holds 2.2 million shares of EMAAR (13.21% weighting).

EMAAR Development

- Emaar Developments is the UAE-based property development arm of Emaar Properties. The company develops residential and commercial property, shopping malls, and other retail assets, as well as hospitality and leisure attractions.

- With the support of the parent company, Emaar Properties, Emaar Development has developed projects such as Emirates Living, Dubai Marina, and Downtown Dubai.

- Since 2002, Emaar Development has delivered over 34,500 residential units, and, according to JLL, approximately 22 percent of all freehold residential units in Dubai are located in Emaar Development's communities.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

With NAGA Web App, investors can trade or buy shares of EMAAR Development or trade the iShares MSCI UAE ETF (UAE) which holds 200,000 shares of EMAAR (1.17% weighting).

Key benefits of real estate investment in Dubai

Dubai’s real estate market in 2025 stands out globally for its exceptional investment advantages. Here are the key benefits that make real estate investment in Dubai highly attractive:

- High rental yields: Dubai properties typically achieve rental returns between 5% and 8%, significantly higher than many global cities.

- Capital appreciation: Infrastructure projects, Expo 2020 legacy, and population influx sustain upward pressure on property values.

- Strong legal protection: Dubai offers clear regulations, investor-friendly laws, and ownership security with title deeds registered by the Dubai Land Department.

- Tax efficiency: Dubai has no income, capital gains, or property taxes, making net returns highly attractive.

- Growing international demand: Dubai’s dynamic economy and lifestyle attract multinational residents, boosting rental demand.

For investors seeking both steady income and long-term growth, Dubai remains one of the world’s most compelling property markets.

Spot real-estate investment opportunities in Dubai with NAGA

With NAGA Web and Mobile apps, you can trade or purchase shares of publicly traded REIT stocks listed on the DFM and ADX stock exchanges. Additionally, with UAE ETF you can get exposure to a wide range of Dubai real estate companies, such as Emaar Properties and Emaar Development.

Forex and Commodities Trading in Dubai

Dubai, as a leading financial center in the Middle East, offers a robust environment for forex and commodities trading. Leveraging advanced technology and strict regulatory oversight, Dubai provides investors and traders access to major global currency pairs and key commodities with confidence and convenience.

Gold and other commodities

Dubai's strategic position as an energy and precious metals trading hub extends into commodities trading:

- Gold: A traditionally safe haven asset, gold trading is supported by Dubai’s status as a global gold trade center. Discover how to invest in Gold in UAE.

- Oil: Dubai crude oil prices influence global markets, and investors actively trade oil futures and CFDs tied to Brent and WTI benchmarks. Discover how to trade and invest in Oil in UAE.

- Silver and Other Metals: Silver, platinum, and copper complement traders’ portfolios, offering both hedging and speculative opportunities. Discover how to trade and invest in precious metals in UAE.

Through CFD trading, investors can speculate on rising or falling commodity prices without owning physical assets, allowing flexible capital deployment and potential leverage.

Due to its tax-free atmosphere and gold souks, Dubai has become a major player in the global gold market, drawing in both domestic and foreign investors. Clearly defining your goals is essential when thinking about investing in gold in Dubai. Gold buying options include physical gold, digital gold investing includes gold ETFs, and stocks of gold mining companies, while gold trading options include futures and CFDs. Each has special considerations, such as market expertise for derivatives, funds, and stocks, and storage and insurance for physical assets.

Gold prices are influenced by several factors such as geopolitical developments and indicators of the world economy. It frequently acts as a hedge against conventional asset classes and acts as a hedge during recessions. To ensure adherence to Islamic finance rules, investors seeking Sharia-compliant assets are also catered to by Dubai's gold market.

Despite gold’s reputation as a safe haven asset, it’s important to acknowledge the inherent risks associated with any investment.

Forex Trading in Dubai

The Central Bank of the UAE supervises Forex brokers, ensuring they adhere to strict regulations to protect investors and the market’s integrity. The DFSA within the DIFC and the FSRA in the ADGM work in tandem to provide a secure environment for currency trading and investing in Dubai.

They require brokers to maintain adequate capital and implement fair treatment of clients, along with measures to prevent financial crimes. The progressive economic policies of the country are in line with this oversight, which helps to build the reputation for Forex trading in the UAE.

Dubai investors can trade popular currency pairs, including majors like USD/EUR, GBP/USD, and USD/JPY, as well as emerging market currencies. Brokers licensed in Dubai typically offer leverage in line with regulatory limits (up to 1:30 for retail clients) and enforce strong risk controls such as negative balance protection.

Technology and Trading Platforms

The presence of sophisticated brokers and stable infrastructure means trading apps like NAGA provide seamless access to forex with fast execution, flexible order types, and real-time market data. Traders enjoy 24/5 market availability with competitive spreads and a range of analytical tools.

NAGA’s technology offers intuitive interfaces, mobile and desktop access, advanced charting, and customizable alerts. Traders also benefit from risk management tools like stop-loss and take-profit orders to protect investments.

Social and copy trading features allow users to follow experienced traders or develop automated strategies, enhancing accessibility for both beginners and pros.

Explore our Forex Trading products in Dubai

Discover trading Forex CFDs and commodities on our versatile WebApp platform and mobile trading apps. At home or on the go, you can trade CFDs on major, minor, and exotic FX pairs, with tight spreads and fast order execution as well as a wide range of commodities futures and cash.

Open a demo Learn more about Forex trading Discover commodities trading

Dubai offers a highly attractive environment for business and commercial investments, supported by progressive regulatory frameworks, strategic location, and a thriving economy. Investors can either set up businesses within Dubai’s free zones or on the mainland, with opportunities for full foreign ownership in many cases. This section explores the key aspects and benefits of investing in Dubai’s business landscape.

Setting Up Business in Dubai Free Zones and Mainland

Dubai hosts over 30 free zones, each catering to specific industries such as technology, finance, media, healthcare, and logistics. Free zones offer distinct advantages:

- 100% foreign ownership without the need for a local sponsor.

- Simplified licensing processes tailored to commercial, industrial, or professional activities.

- Options for office space include traditional offices, flexi-desks, or virtual offices suited for startups and SMEs.

- Fast and mostly digital business setup requiring submission of key documents like passports, business plans, and licenses via online portals.

- Streamlined visa processing for investors and employees, facilitating easy relocation and staffing.

Mainland business setup still requires a local partner for certain activities; however, recent reforms have expanded areas where full foreign ownership is allowed on the mainland as well. Mainland companies can conduct business anywhere in Dubai and outside free zones, giving them operational flexibility.

Promising Sectors for Investment

Dubai’s diversified economy supports a wide range of high-growth sectors attractive for investment:

- Tourism and Hospitality: Dubai’s global appeal pushes demand for hotels, food services, and entertainment ventures.

- Retail and E-commerce: Booming consumer markets and a bustling retail sector offer numerous commercial investment possibilities.

- Logistics and Transportation: Dubai’s strategic position as a logistics hub fuels demand for warehousing, freight, and supply chain services.

- Education: Investment in private schools, training centers, and edtech startups caters to a growing expatriate and local population.

- Technology and Startups: Dubai’s emphasis on innovation and smart city initiatives create fertile ground for tech ventures, fintech, AI, and digital transformation startups.

Extensive Support for Entrepreneurs

Dubai provides an enabling ecosystem for entrepreneurs and business owners, including:

- Access to angel investors and venture capital networks driving startup funding.

- Numerous business accelerators and incubators offering mentorship, networking, and operational support.

- Government grants, incentives, and free zone authority support to encourage innovation and business growth.

- Comprehensive services around company registration, legal compliance, banking, and visas to ease operational burdens.

This ecosystem is designed to help businesses launch quickly, scale sustainably, and integrate into Dubai’s fast-growing economy.

Tips for Investing in Dubai

Successful investing in Dubai requires a strategic approach that balances opportunity with risk management. Whether you are new to the market or an experienced investor, these practical tips will help you build a resilient and profitable investment portfolio in 2025.

- Diversify Your Investments Across Sectors and Instruments: Spread your capital across different asset classes such as real estate, stocks, ETFs, commodities, and startups to reduce risks and capture growth from multiple sources.

- Leverage Demo Accounts and Educational Resources: Use demo trading accounts and learning platforms like NAGA Academy to practice strategies, understand market dynamics, and build confidence before committing real capital.

- Avoid Speculative Frenzy; Focus on Fundamentals: Invest based on solid financial analysis and market fundamentals rather than hype-driven speculation to achieve sustainable returns over the long term.

- Be Mindful of Currency Risks (AED) if Investing Internationally: Understand potential currency fluctuations when converting funds in and out of UAE Dirhams (AED), especially if your income or expenses are in other currencies.

- Consult with Financial Advisors or Investment Specialists: Seek professional advice tailored to your financial goals, risk tolerance, and tax considerations to optimize your investment decisions.

By following these tips, investors can navigate Dubai’s vibrant markets more confidently, minimize unnecessary risks, and position themselves for success in one of the world’s most promising investment hubs.

In Conclusion: Why, How and Where to Invest in Dubai?

As the MENA region’s most diversified economy, Dubai is a magnet for foreign investment and a fast-growing hub for entrepreneurs.

Options for investing in Dubai through the capital market vary, depending on what you’re looking to trade and your risk appetite. Stocks, exchange-traded funds, derivatives, exchange-traded commodities, and Real Estate Investment Trusts (REITs) are some of the most popular options to invest in Dubai.

Today, there is a wide range of ADGM-regulated online platforms such as NAGA.com that give relatively straightforward access to a broad cross-section of global assets, including stocks and ETFs, REITs, commodities, currency pairs, and cryptocurrencies.

Free Resources

Before you start to invest in Dubai, you should consider using the educational resources we offer, like NAGA Academy or a demo trading account. NAGA Academy has lots of free trading courses for you to choose from, and they all tackle a different financial concept or process – like the basics of analyses – to help you become a better trader or make more informed investment decisions.

Our demo account is a suitable place for you to learn more about leveraged trading, and you’ll be able to get an intimate understanding of how CFDs work – as well as what it’s like to trade with leverage – before risking real capital. For this reason, a demo account with us is a great tool for stock investors who are looking to make a transition to leveraged trading.

Sources:

- https://www.visitdubai.com/en/invest-in-dubai/dubai-for-investors/investment-options

- https://www.nasdaqdubai.com/exchange/about-us/why-nasdaqdubai

- https://www.dfm.ae/discover-dfm/why-dfm

- https://www.ishares.com/us/products/264275

- https://properties.emaar.com/en/about-emaar