Gold price today: Gold spot (XAU/USD) has surged over 60% in 2025, breaking more than 50 record highs and topping $4,000/oz amid central bank buying, geopolitical risks, Fed easing, and dollar weakness. This historic rally reflects structural shifts like global debasement trades and ETF restocking, with experts debating if $5,000/oz arrives in 2026.

This article provides an in-depth market outlook and gold price predictions for Q4 2025, 2026 and beyond, examining critical market themes and key drivers, as well as valuable insights into price action dynamics, that could play a pivotal role in shaping the precious metal's trajectory.

Gold Forecast & Price Prediction 2026 – Key Notes

Gold rally is forecast to moderate into 2026. A $5,000 test is more likely than a decline towards $3,000, with $4,000 expected to become the new long-term support area.

- Sideways market (50% probability): $4,000-$4,500: Gold prices are forecasted to consolidate the $4,000 level and form upper boundaries around $4,500, in line with the gold struggling trend in 1980, following the impressive returns of 1978-1979. The highest probability gold forecast for 2026 suggests the Fed could stay on pause until the second half of the year, the USD grinds lower, but US growth also rebounds. Central bank and China retail demand are within 3% of 2025 levels, while gold ETF inflows are at 50% of the 2025 pace

- Bull market (30% probability): $4,500-$5,000: The most bullish and frequent gold price forecast for 2026 is $5,000/oz. In this upside scenario, the central bank and China retail demand are expected to remain steady in 2026 compared to 2025, and ETF flows are projected to be 75%-100% the pace of 2025. Any reacceleration of the USD downtrend, volatility/liquidity shock in risk assets, or fear of US stagflation could accelerate and eventually push gold prices above $5,000/oz.

- Bear market (20% probability): $3,500-$4,000: The bearish scenario implies a reversal chart pattern above the $4,000 level as support (neckline). The catalyst for a breakdown is a USD rebound/stabilization and improved growth in 2026, especially if AI delivers productivity gains and ROI. This would likely hit gold sentiment and prompt profit-taking. Record-high gold prices, which are hindering physical demand, pose another risk. However, the $3,500 level (-20%) should favor a “buy the dip” scenario.

Get more gold sentiment and trading signals, forecasts and news with NAGA Insights.

With NAGA.com, you can trade CFDs on gold spot (XAU/USD), if you want to speculate on price movements.

Fundamental Gold Forecast 2026: Bulls run to continue in 2026

Gold has surged past $4,000 per ounce for the first time ever, signaling strong investor demand beyond typical rate or dollar movements. This milestone reflects a fundamental shift in investor sentiment and global capital flows toward tangible assets amid geopolitical and economic uncertainties.

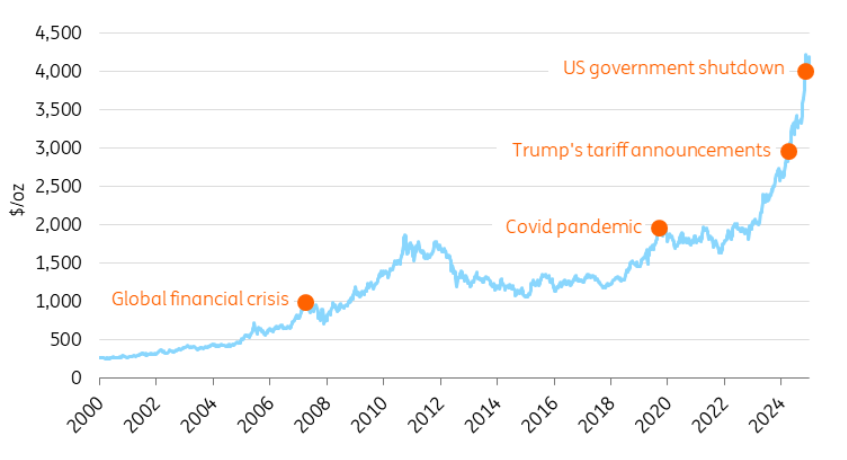

During 2025, gold has gained approximately 60%, doubling its value in two years. Gold thrives amid economic and political turmoil, surging past key milestones: $1,000 post-2008 global financial crisis, $2,000 in COVID, $3,000 on Trump's April tariffs, and $4,000 during the recent US shutdown.

Gold dominated 2025 as the top-performing major asset class, outpacing equities, while gold miners ETFs led leveraged plays.

Rank Asset Return Notes 1. Gold Miners ETFs (e.g., GDX, SGDM) +145% Leveraged to gold's 60% surge 2. Platinum Spot +86% 3. Gold Spot (XAU/USD) ~60% Record highs >$4,000; best year since 1979 4. Silver Spot ~50% Industrial and safe-haven demand. 5. NIKKEI 225 ~25% Yen carry traders, export strength 6. STOCKS 600 ~23% Rate cut boost Euro finance 7. SP500 ~23% Tech-led but lagged commodities.

FED easing a dual sword for gold in 2026

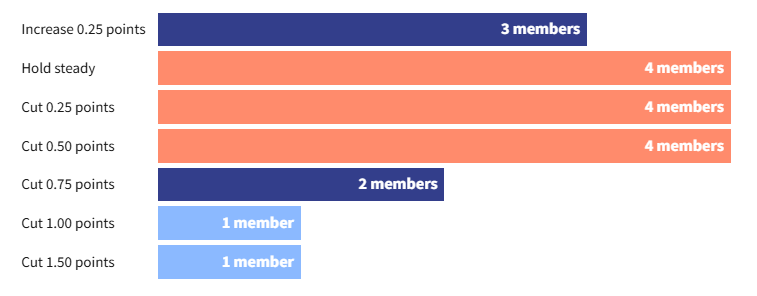

The Fed delivered its third consecutive 0.25% rate cut on Dec 10, 2025, bringing the federal funds rate to 3.75% amid labor market weakness and tariff-induced inflation overshoots, prioritizing maximum employment per Powell's Jackson Hole pivot. The newest set of Fed projections shows policymakers sharply divided on where rates could go next year, with expectations ranging from a small hike to cuts totaling as much as 1.50 percentage points.

Kevin Hassett emerges as frontrunner for next Fed chair, raising concerns about independence amid White House pressure, although he stresses the importance of data-driven decisions. Goldman Sachs forecasts two cuts (March/June) to a 3-3.25% interest rate cut amid cooling employment. Reuters notes that rebounding growth (a 2.3% GDP projection) and sticky inflation (2.5% core PCE) may prompt a pause. Other sees repricing risks if data disappoints, with markets eyeing 2026 volatility. Gold typically rallies when the Fed shifts from tightening to an easing monetary policy.

The Fed continues to face a conflict of objectives between inflation and unemployment. The latest labor market data from the US points to a weakening of the labor market. The US Federal Reserve could cite downside risks in the labor market, as it did in early 2025, as a reason for easing monetary policy. Poorer labor market data in the first quarter increases the likelihood of more interest rate cuts than are currently priced in.

Beyond the key interest rate, there is another component of US monetary policy that should be considered for the gold price forecast for 2026: the end of quantitative tightening. The Fed officially ended its quantitative tightening (QT) program on 1 December 1, 2025, after withdrawing around US$2.4 trillion from the financial system since the start of the tightening cycle in June 2022. Gold typically rallies when the Fed shifts from tightening to an easing monetary policy.

However, regardless of how far-reaching the Federal Reserve's monetary easing measures may be, this easing cycle is not expected to take place in lockstep globally. A weaker US dollar makes gold purchases cheaper for investors outside the US, which can stimulate demand.

Tariffs could support gold in 2026

The U.S. government specified that gold bars are now subject to tariffs, notably a 39% tariff on imports from Switzerland, one of the biggest producers of gold bars. This unexpected levy on gold imports increases the cost and creates upward pressure on gold prices since investors must pay the tariff when acquiring gold bars as a hedge against inflation and trade taxes. This policy shift has contributed significantly to the surge in gold prices in 2025.

If tariffs generate less revenue in 2026, the Treasury will likely increase long-term debt issuance to plug the shortfall, thereby boosting supply and nudging the term premium up despite Fed rate cuts. This split—easing short-term while tightening longer out—might force the Fed into deeper cuts to keep markets steady, dragging real yields lower and cementing gold as a go-to hedge.

Gold investment demand could reach all-time highs in 2026

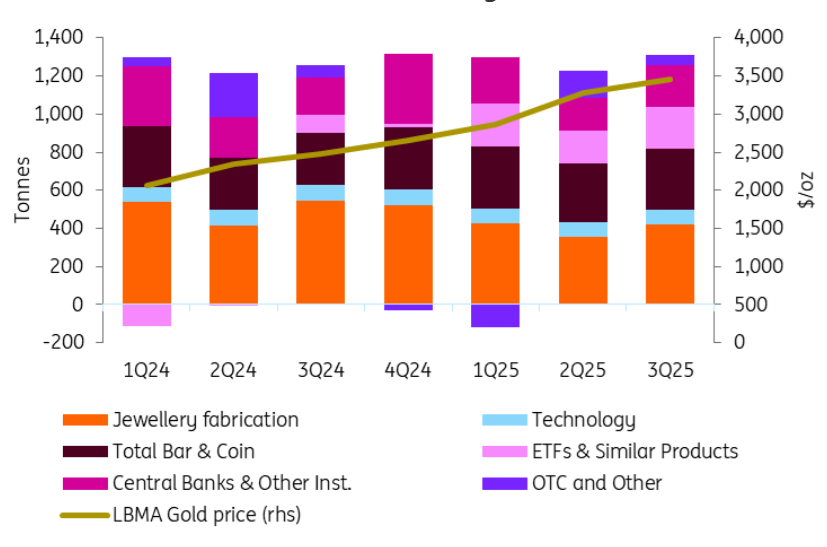

According to the World Gold Council, global gold demand reached 1,313 tones in the third quarter of 2025, the strongest quarterly total on record. This surge was driven by strong investment demand, including purchases through exchange-traded funds, bars and coins, as well as significant buying by central banks. Geopolitical shifts and de-dollarization are driving diversification, with China, India, and Japan leading the trend.

- China: Surging institutional gold demand from insurers' pilot allocations and sovereign custody plans drives diversification amid trade tensions and de-dollarization push.

- India: Rapid economic growth, ETF AUM exploding 15.5x since 2020, and cultural buying sustain robust retail investment despite softening jewelry volumes.

- Japan: Yen weakness and NISA incentives fuel record ETF/ITM inflows (123t YTD), with pro-growth policies ensuring sustained hedging demand into 2026.

Central banks to continue to add gold in 2026

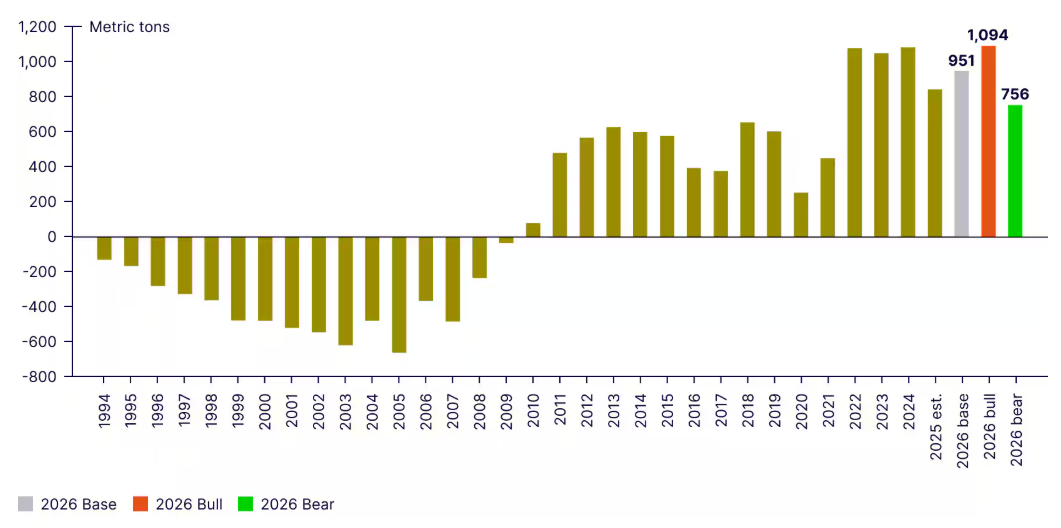

Central banks globally are significantly increasing their gold reserves in 2025 despite record-high prices. After two quarters of moderation, central bank buying reaccelerated in 3Q’25 to ~220t of net purchases, reaching 634t—below the same period in each of the past three years but well above the pre-2022 norm of 400-500t. Emerging market central banks remain the primary drivers of official sector demand, with Poland, Brazil, and China leading the gold purchases.

To estimate 2026 central bank demand for gold, State Street began with 634t reported through 3Q’25 and projected 4Q using historical seasonal patterns, resulting in a full-year estimate of 845t. Based on historical year-over-year trends, gold demand in 2026 is forecasted to range from 756 tones to 1,100 tones. This would make 2026 one of the top five years for gold demand since 1971.

Past performance is not indicative of future results

ETF demand could drive the next leg of gold’s rally in 2026

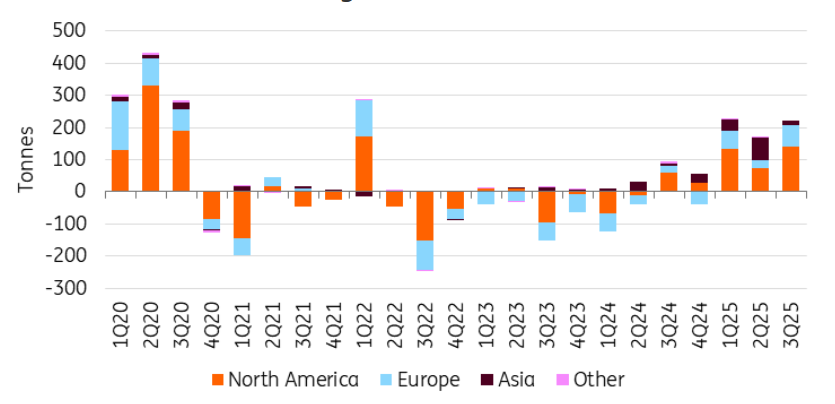

Gold ETFs posted five consecutive months of global inflows, driving 2025 totals to a record $72 billion or 674 tones, which surpasses 2020's full-year haul with two months remaining. North America led with $43 billion YTD, including $16 billion into US funds in Q3 alone, grabbing 62% of worldwide flows. India's ETFs reached $2.9 billion, nearly matching the prior five-year total, while even a massive market plunge saw North American funds add $334 million, demonstrating the resilience of gold demand.

Experts forecast further gold resilient inflows at historical 8.75 tones/week averages, projecting 114-455 tones across scenarios but still far below past peaks like 2008-2012. Holdings lag pandemic highs with no over-allocation signs, leaving room for institutional builds amid debasement plays. This steady demand bolsters gold's bull forecast to $4,500-$5,000 as Fed cuts pull cash from bonds and equities.

Past performance is not indicative of future results

According to Morgan Stanly, gold ETFs account for only 0.17% of US private financial portfolios, defined as equities and bonds. That share remains well below its 2012 peak, even after years of strong gold performance. Morgan Stanley calculates that a one basis-point increase in gold’s share of US portfolios, driven by fresh buying rather than price effects, would lift the gold price by around 1.4%.

The OTC market accounted for 55 tones of global demand. According to the WGC, this reflects the continued interest of institutions and family offices.

However, demand for gold jewelry was weak due to price factors. Demand in this segment was 19% lower in the third quarter than in the same period last year. The purely seasonal increase in demand for gold jewelry in India and China does not change the year-on-year comparison.

Gold supply is inelastic, and exploration is increasing

The global gold supply is responding to high prices but, unsurprisingly, remains inelastic mainly in the short and medium terms. According to WGC data, global supply reached a quarterly record of 1,313 tonnes in the third quarter of 2025. Mine production increased by 2% to 977 tonnes, while secondary supply from recycling grew by 6% to 344 tonnes. Recycling activities were dampened in part by expectations of further price increases.

This is also linked to the widespread practice of pledging gold against loans. In India, for example, 200 tonnes of gold jewellery were pledged in the formal sector alone this year.

Metals Focus forecasts record gold mine production and a 6% increase in gold recycling in 2026. The new supply is partly the result of the commissioning of gold mines that have been in development for many years. In addition to the lengthy construction of mines, which is associated with ever-greater challenges, especially in Tier 1 jurisdictions, gold producers can increase production with shorter lead times by ramping up throughput rates, as in the case of the Greenstone Mine in Ontario.

Data shows that gold supply is also beginning to respond to the price environment. The S&P Global Market Intelligence Pipeline Activity Index (PAI) for the gold sector increased 24% month-over-month in October 2025 to 135. The PAI considers, among other things, drilling results, initial resource announcements, significant financing and positive milestones in project development.

Gold fundraising activities by junior and intermediate gold mining companies reached their highest level since records began in January 2014, at USD 1.75 billion in October. The number of registered transactions also rose significantly from 101 to 183. However, due to long lead times, exploration activity only affects gold supply after a delay of many years.

Gold strength forecasted to continue in 2026

These five catalysts explain why gold prices have hit record highs and are forecasted to continue firm in 2026, as the following Gold price predictions from banks and experts highlight.

Central banks keep snapping up gold, Trump's trade wars rage on, geopolitical tensions stay high, ETF holdings expand steadily, and Fed rate cut hopes grow stronger—all pointing to this bull run having plenty of room left, with gold prices forecasted to trade around $4,500 per ounce in 2026.

Downside risks, such as a sharp market crash forcing gold sales, fading safe-haven appeal if tensions ease, or central banks offloading reserves, could pressure gold prices to decrease in the following months. However, any dips should prove short-lived as retail and institutional buyers return.

Find out more about your gold investing options.

Gold Outlook: Is it worth investing with prices near the record high?

Determining whether it's the right time to buy gold or invest in gold assets depends on various factors, including your financial goals, risk tolerance and overall portfolio strategy. For the right investor, though, the current economic climate and market conditions may present an opportune moment to consider gold as part of a diversified investment strategy.

Experts say there are a few reasons to consider investing in gold in today's market:

- Gold still has room to grow: Despite recent gains, experts widely forecast gold to continue its uptrend with no immediate resistance in sight. The recent surpassing of $4,000 an ounce marks a new peak, suggesting strong market momentum remains. Anticipated Federal Reserve rate cuts, persistent inflation pressures, and the depreciating US dollar decline could accelerate further and create a favorable environment for gold to gain further appeal as an investment.

- It's a low-risk portfolio diversifier: Gold behaves differently from stocks and bonds, meaning when other assets decline, gold often remains stable or even increases in value, providing a protective balance. Its long-standing history as a monetary asset with no counterparty risk makes it a reliable store of value. It serves as a financial safeguard, helping investors manage risk.

- It doesn’t require a lot of capital to start: One popular choice are derivatives such as CFDs, which allows trading smaller quantities like 1/10th of an ounce. This approach offers flexibility for investors to speculate on price movements or hedge their portfolios. Other options include buying shares in gold funds, gold ETFs, or mining companies, all designed to make gold investment achievable and practical for diverse financial goals.

However, it's crucial to approach gold investment with a balanced perspective. While gold can offer portfolio diversification and potential protection against economic downturns, it does not generate income like dividend-paying stocks or interest-bearing bonds. Gold prices can also decrease in the short term, so it's best to view this investment as a longer-term option.

Technical Gold Forecast 2026: From +30% rally to –20% crash

In the institutional gold forecast’s most bullish scenarios, gold prices are expected to increase by up to 30% during 2026. In the most bearish scenario, gold prices could decrease up to 20%, potentially dropping to a range of $3,360 to $3,990 per ounce from the $4,200 resistance levels.

As visible in the 2026 gold technical analysis chart, the institutional projection aligns remarkably well with the support zone between $3,340 per ounce level (38.2% Fibonacci Retracement of the last leg up starting in October 2022) and over $3,440 per ounce (the previous key resistance level). These are the maximums drawn from April to August 2025.

This technical validation is significant. The gold fundamental analysis of macroeconomic scenarios, which predicts $3,360-$3,990 under reflation conditions, corresponds almost precisely with XAU/USD chart-based support levels at $3,300-$3,440, where the precious metal established multiple highs during the first half of 2025, before the breakout to all-time highs.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

Even such a strong correction wouldn't signal a change in trend and sentiment for the gold market from a technical perspective, but only a healthy technical correction and an opportunity to buy the dip. Although this would mean going below the 200-day exponential moving average (200 EMA), if gold began to decline gradually, the 200 EMA would also find itself at the height of this zone or below it, so the uptrend would theoretically be maintained.

A decline in gold prices to $3,300-$3,440 represents a retest of previous resistance-turned-support, not a change in the primary trend. As long as the 200 EMA descends to meet prices at this support zone, the technical structure of higher lows and higher highs remains intact.

Gold 2026 Technical Levels

Level Price Technical Significance Current Price $4,200+ Dec 2025, near all-time highs -5% Decline $4,000 Upper end of the minor correction -10% Decline $3,800-3,820 Mid-range correction scenario -15% Decline $3,650 Deeper correction level -20% Decline $3,360-3,400 Maximum decline in the gold bull trend (secondary reaction) Key Support Zone $3,300-$3,440 April-August 2025 maximums, key technical base 200 EMA (projected) ~$3,300-$3,400 Would descend to support on gradual decline

Gold Support Levels 2026

The alignment between the maximum downside in the gold fundamental outlook and the technical support zone provides dual confirmation, as both fundamental scenario analysis and chart pattern point to the same price region as the likely floor under bearish conditions - actually, the best buy-the-dip opportunity in the gold market during 2026.

However, even though the institutional gold price predictions outline a 20% probability of a 20% possible 20% pullback, some of the biggest banks on Wall Street still forecast gold prices to increase in 2026 and beyond.

Take your trading to the next level with additional pro-level tools integrated into NAGA and enhance your Gold technical analysis and price prediction:

- TradingView: Access advanced charting, technical analysis, and live market data.

- Trading Central: Get AI-powered trade signals, Economic data, in-depth market analysis, and technical strategy insights.

Will Gold prices rise in the coming days?

According to the daily chart, the overall trend for the gold spot price remains strong and upward. Bulls are now looking for a follow-through above the $4,200 per ounce resistance level. Investors are currently unconcerned with price reaching all-time record levels. Instead, they are focused on the continuation of the factors driving the gold market's gains, which include the path of US rate cuts, increasing global trade and geopolitical tensions, central bank purchases of gold bullion, and the trajectory of the US currency.

The 14-week Relative Strength Index (RSI) is below the 70 overbought line again. At the same time, the MACD indicator's two lines are also in a sharp upward position.

Will Gold prices decrease in the coming days?

Short-term technical signals suggest a minor corrective pullback after retesting the highs but with bullish momentum intact. Support at around $3,959 - $4,000 is critical for maintaining the short to medium term bullish trajectory, with potential resistance targets towards $4,400 in the near term.

A break below the 50-day Moving Average signals that gold prices are more likely to decline in the coming days towards the $4,000 key support level.

How to Trade Gold How to Buy Gold

Gold price predictions for 2026 from experts

Many sources and experts provide gold forecasts and gold price predictions for 2026 based on different models, methods, and assumptions. Despite its current price tag, many investment banks continue to maintain a bullish gold rate forecast for 2026 and the next 5 years.

Please note that most forecasts from earlier this year have already been met:

- The World Bank gold prices to increase by a further 5% in 2026.

- Goldman Sachs warns gold may reach $5,000+ if FED’s Independence is compromised

- Bank of America raised its gold price forecast for 2026 to $5,000, with an average of $4,400

- Morgan Stanley predicts Gold Prices to reach $3,800 by the end of 2025

- JPMorgan Chase & Co. predicts the gold price to also reach 5,200 - 5,300 by the end of 2026.

- Deutsche Bank hikes gold price forecast to $4,500, with a wide range of $3,950 to $4,950

- Citigroup raised its three-month gold price target to $3,800/oz

- UBS lifts 2026 mid-year gold price forecast to $4,500

- Commerzbank raised its gold forecast to $4,200 by the end of 2026.

- ING forecast gold prices to average $4,100 in 2026.

- TD Securities forecasts gold to trade above $4,400/oz level in the first half of 2026.

- Metals Focus expects an average gold price of $4,560 in 2026, with a peak price of $4,850.

The World Bank’s Gold Prediction 2026

The World Bank, one of the key players among central banks and a global financial institution offering loans and grants to developing nations for various projects, released a mid-year gold forecast.

Following the sharp increase in 2025, gold prices are expected to rise more moderately—by 5% in 2026—supported by continued (though softening) central bank purchases and expectations of further U.S. monetary easing, amid still-elevated geopolitical tensions and policy uncertainty. Prices are then projected to decline by 6% in 2027, partly reflecting a normalization of ETF investment flows. Despite the anticipated moderation, prices are envisaged to remain more than 180% above their 2015-19 average in 2026.

Goldman Sachs’s forecast gold may break $5,000$ in 2026

Goldman Sachs supports its bullish gold rate forecast with mathematics. Private ownership of the U.S. Treasury market—America's IOUs—is worth about $57 trillion. If investors were to move just 1% of that money into gold, it would mean $570 billion flowing into the gold market, which is tiny by comparison. The bank noted that the entire gold exchange-traded fund (ETF) market—what regular investors use to buy gold as they would a stock—is about the same size as what would be moving over from Treasurys.

They argue that extra demand would cause the price of gold to rise above $5,000 target. They also note that risks are skewed to the upside, as private sector diversification into the relatively small gold market could push prices even higher than their models predict.

BofA Gold Price Forecast 2026

Bank of America notably raised its gold price forecast to $5,000 per ounce for 2026, with an average expected price around $4,400 per ounce, citing strong investment demand amid geopolitical tensions, US fiscal deficits, and expectations of US Federal Reserve interest rate cuts. While they acknowledge the possibility of short-term decrease in gold prices, they forecast that a 10-15% increase in investment demand could easily elevate prices to this level.

Morgan Stanley's Gold Rate Forecast 2026

Morgan Stanley has released a bullish gold outlook for 2026, as investor diversification builds. The bank’s forecast rests less on macro shocks and more on portfolio construction. They believe the rally still has room to run and sees meaningful upside risk to its end-2026 forecast of $4,900 per ounce. Morgan Stanley notes that investor positioning in gold remains surprisingly light, particularly among US-based investors. Western gold ETF holdings are broadly in line with levels implied by interest rates alone, but do not yet reflect any significant shift toward diversification or hedging against fiscal and monetary debasement.

JP Morgan’s Gold Rate Prediction 2025 - 2026

JPMorgan Chase & Co has a very bullish gold forecast for 2026, seeing prices averaging around $4,753/oz with a strong possibility of hitting $5,000+ (even $5,055 by Q4), calling it their "highest conviction long" bet due to strong central bank buying, investor demand, and persistent inflation/geopolitical factors, with some projections even touching $5,200-$5,300 or higher by 2026.

Deutsche Bank Gold Price Prediction 2025 - 2026

Deutsche Bank has raised its average gold price forecast for 2026 to $4,450 per ounce from $4,000, projecting a trading range of $3,950 to $4,950. A peak of $4,950 would stand roughly 14% above the current December 2026 futures.

The bank attributed the forecasted gold price increase to resilient investor appetite, continued central bank accumulation and a muted supply response.

Citigroup’s Gold Rate Prediction 2026

Citigroup forecasts that the gold bull market to persist in the short term.

Citi has shifted to a neutral-to-bearish gold outlook for the next 6–12 months. Their concern is not that gold prices will fall much but that it won’t go up. The bank predicts that gold could ease to $3,600–$3,800 by the end of 2026 in a base case. However, Citi’s silver price forecast for 2026 is more optimistic.

UBS’s Gold Rate Forecast 2026

UBS forecasts a significant rise in gold prices through 2026, with a mid-year target of $4,500/oz (up from $4,200) due to ongoing Fed rate cuts, US fiscal concerns, de-dollarization, and robust central bank demand, potentially reaching even higher in an upside scenario. However, though they remain cautiously optimistic about gold stock miner earnings. According to the bank, gold prices could increase up to $4,900/oz by the end of 2026.

Commerzbank’s Gold Prediction 2026

Commerzbank raised the target to $4,200/oz, aligning with broader bank consensus amid central bank-sustained demand and macro risks, while silver hits $50/oz.

Commerzbank also forecast Silver to benefit from the upward trend in gold, as a cheaper alternative.

ING’s Gold Rate Forecast 2026

The Dutch bank sees gold prices averaging $4,325/oz in 2026, as central banks are still buying, Trump’s trade war is ongoing, geopolitical risks remain elevated, and ETF holdings continue to expand while expectations of more Fed rate cuts intensify, suggesting this bull run still has further to go.

Downside risks include a major market sell-off, which could force investors to dump gold to raise cash. Other downside risks include reduced safe haven demand amid easing geopolitical tensions. Central banks selling their gold reserves pose another risk to our outlook.

However, they expect the downside to be limited as any weakness will likely attract renewed interest from both retail and institutional buyers.

TD Securities' Gold Price Prediction 2025 - 2026

TD Securities see gold prices to increase over the $4,400/oz mark into 2026, once it becomes apparent that the US central bank is continuing with the easing cycle amid a weaker economy, materially above-target inflation, and a Fed that likely will be filled with doves. TD forecasts gold's new long-term range will be between $3,500-4,400 per ounce.

Metals Focus Gold Price Forecast 2026

Metals Focus forecasts a further annual high in the average price of gold of US$4,560, with a rise to the US$5,000 mark in 2026 and a potential record high of US$4,850 in the fourth quarter. The trends underlying the record-breaking rise in gold prices are expected to continue well into next year.

Gold price predictions for 2026 (AI-Based)

Although there is still potential for the price of the precious metal to decline after reaching all-time-highs around $4,400 recently, agencies and AI-based websites are still optimistic that prices would offer potential to rise above $5,000 per ounce by the end of 2026 and towards $6,000 be the end of 2027.

Wallet Investor - Bullish Gold price prediction 2026

Wallet Investor forecasts that gold prices will close 2026 at $4,418. Their 1-year gold price prediction is $4,700, with a precious metal continuing a steady uptrend, not rally, during 2026.

Coin Price Forecast - Bullish gold price prediction 2026

According to Coin Price Forecast, gold is expected to reach $5,500 by the end of 2025, indicating a 64% increase from the beginning of the year. They also project that gold will hit $5,200 - 5,300 by mid-2026, and $6,300 by the end of 2027.

Long Forecast - Bullish gold price prediction 2026

According to Longforecast.com, gold prices are projected to experience significant growth over the next few years. The platform forecast gold prices to reach $6,000 by the end of 2026, with potential highs reaching $6,600 - 6,700 (highest gold price target). This upward trend is anticipated to continue, with prices potentially trading above $8,000 in 2027.

Gold price prediction for the next 5 years

Though it is hard to say for sure for such a long period of time, experts from different resources concur that gold will continue rising. However, they have opposite opinions about the speed of this growth. The recent momentum from 2025 might lead to a slowdown, which occurs in most strong trends over time.

What is the gold price prediction for the next 5 years? See below the forecaster's projections for gold prices in the 5 years approximately.

Gold Price Prediction for the next 5 years from Long Forecast

The Economy Forecast Agency provides a gold price prediction only till the end of 2030. In the next 5 years gold if forecasted to continue its uptrend towards a maximum price target of $9,500 in December 2030.

Gold price forecast for the next 5 years from Wallet Investor

Wallet Investor offers a gold price forecast until February 2030. Their 5-year gold prediction is $6,800. With a 5-year investment, the revenue is expected to be around +57.58%, using technical analysis to predict future values.

Gold Price Prediction 2025-2030 from Coin Price Forecast

According to the latest long-term forecast, gold price will hit $7,000 within the first half of 2028. By the year 2030 they expect the gold price to increase up to $9,000 whereas the 2032-2037 range should be between $10,000 and $14,000.

*It is worth keeping in mind that both analysts and online forecasting sites can and do get their predictions wrong. Keep in mind that past performance and forecasts are not reliable indicators of future returns.

When considering gold price predictions for 2026 and beyond, it’s important to keep in mind that high market volatility and the macroeconomic environment make it difficult to produce accurate long-term gold analysis and estimates. As such, analysts and forecasters can get their gold forecast wrong.

What moves the price of gold in the future?

Unlike almost any other asset, gold is typically neither a safety nor a risk asset, though the popular financial media have often called it both over the years (depending on how gold has been performing in recent months). Instead, it’s a currency hedge for which demand rises when there are concerns about inflation diluting the purchasing power of fiat currencies (particularly those most widely held, like the USD and EUR). In other words:

- In times of optimism (aka risk appetite), gold can either appreciate if markets believe growth will lead to inflation, or it can fall if the desire for higher yields overrides inflation concerns and investors move into more classic risk assets which they believe will provide better returns.

- In times of pessimism (aka risk aversion), gold can either rise if markets believe that stalling growth will lead to rising deficits and/or money printing that could cause inflation, or it can also fall on fears of deflation or a market crash that feeds demand for cash. In times of panic, traders seek cash either to cover margin calls or other obligations or to be ready to go bargain hunting.

If pessimism turns to panic, then gold could either:

– rise if markets are more concerned about the USD or EUR losing their purchasing power than about near-term liquidity needs, as was the case at times from 2009 through 2011.

– fall if markets are more concerned about liquidity than the loss of purchasing power, as was the case in late 2011.

When markets are not concerned about fading purchasing power, the major currencies tend to gain against gold. That can happen due to:

- Low inflation expectations, as we saw starting in late 2011. Concerns about the global economy kept inflation fears low, and so gold began a multi-month downtrend.

- Panic periods are when markets fear a financial crisis, and liquidity becomes the top priority. We saw gold sell-off during times of peak anxiety about the US or EU. During these periods, investors tend to sell gold to raise cash.

How has the price of Gold changed over time?

Below is a Gold chart that shows how the price of gold changed over the past ten years. In order to make your predictions and forecasts as accurate as possible, it’s important to look back at such historical data.

Gold prices increased by around 60% in 2025, doubling in value in under two years. The last significant surge occurred in 1979-80, when gold prices almost doubled amid soaring U.S. inflation, oil price shocks, a weakening dollar, and geopolitical turmoil, including conflicts in the Middle East and Afghanistan, which fueled safe-haven demand.

Gold’s current rally has again coincided with heightened geopolitical tensions and a weakening dollar, but unlike in 1979-80, inflation pressures and energy-market disruptions have been less intense. Instead, a key distinguishing feature has been the unprecedented pace of central bank purchases, which have more than doubled since 2022 relative to the 2015-19 average.

Gold has long reflected global economic and political stress, with its price typically rising during periods of heightened uncertainty. In the wake of the global financial crisis, gold surged past $1,000. During the Covid-19 pandemic, gold prices increased to $2,000. Then, when Trump announced tariffs in April, it surpassed the $3,000 mark. The $4,000 mark was hit during the recent prolonged US government shutdown.

Conclusion: Is Gold a good investment for 2026 and beyond?

Drawing from these expert insights, they anticipate a slight uptick in gold prices also this year in general. The average cost could hover around $4,500 per ounce by year’s end. With the right conditions gold could potentially break into the $5,000 and correct towards $3,500. However, it’s crucial to note that this remains a forecast. Things can change, and there’s always a level of uncertainty.

For potential gold investors, experts from Morgan Stanley, among others, recommend some gold in a well-balanced, conservative portfolio to protect against inflation diluting the purchasing power of fiat currencies and geopolitical factors. But before you invest in gold, do your homework. Understand the risks and costs of buying and selling gold. And keep a close eye on market trends and conditions.

To sum up: experts can make educated gold forecasts and price predictions, but as with any investment, there's no 100% guarantee.

Trade Gold with NAGA.com

Make sure to create a free demo account on NAGA.com! You will be up to date on interesting updates about Gold as an investment asset, and the user-friendly interface will come in handy if you decide to start trading Gold or any other asset.

Visit NAGA Academy to learn more about trading and investing with our free courses.

Sources:

- https://openknowledge.worldbank.org/bitstreams/9dbf64e4-975f-4905-ab9b-dceb8f285169/download

- https://www.morganstanley.com/insights/articles/gold-price-forecast-rally-into-2026

- https://www.gold.org/goldhub/research/gold-outlook-2026

- https://www.goldmansachs.com/insights/articles/gold-forecast-to-rise-by-the-middle-of-2026

- https://www.federalreserve.gov/newsevents/pressreleases/monetary20250917a.html

- https://www.jpmorgan.com/insights/global-research/commodities/gold-prices