Technical analysis is a rather complex but curious subject to study. Knowing the basics of technical analysis helps traders and investors build investment strategies, adjust their portfolios in time, and advantageously deal with assets. Today, we will dive into basic technical analysis and study one of its tools - the exponential moving average (EMA). We will learn how to calculate EMA and what the EMA applications are.

What Is the Exponential Moving Average (EMA)?

Let’s start from the background on exponential moving averages as an audience insight. The EMA is one of the trend-following indicators and is also the standard tool on every trading platform. It is one of the most widely used technical indicators when it comes to stock, forex, and crypto markets.

Definition of EMA

An exponential moving average (EMA) is a type of moving average that calculates the average price over a certain previous period, with the latest closing prices receiving a higher weight. The exponential moving average (AKA exponentially-weighted moving average) includes the recent price changes.

EMA is used to receive buy and sell signals based on intersections and deviations from the historical average. Moving averages are used in chart analysis to visualize bullish (up) and bearish (down) trends in the market. By using them, you’ll see that moving averages smooth short-term price fluctuations so that prevailing trends and possible trend reversals are easier to recognize.

How To Calculate the Exponential Moving Average (EMA)

Keeping in mind that an exponential moving average gives more weight to the recent prices, let’s look at how it should be calculated.

Three factors are required for the calculation of the EMA: the current closing price (Pt), the EMA of the previous period (EMAt-1), and the smoothing factor (k). The latter depends on the length of the period under consideration.

Computing the EMA of security is generally straightforward. The EMA is calculated by applying a percentage of today’s closing price to yesterday’s moving average. The exponential m-period moving average with smoothing parameter k is defined by the formula below.

What Is the Smoothing Parameter?

The smoothing parameter or factor always has a value between 0 and 1 and indicates what share today’s price has in the calculation of today’s exponential average. For example, with an SP (k) of 0.1, the new EMA is composed of 10% of the end-of-day exchange rate and 90%of the previous EMA.

The smoothing parameter k is calculated as follows: k= 2/ (m + 1), where m stands for the selected period.

The larger the SF(k), the greater the share of the current price in the calculated EMA, and the closer the average is to the current price value.

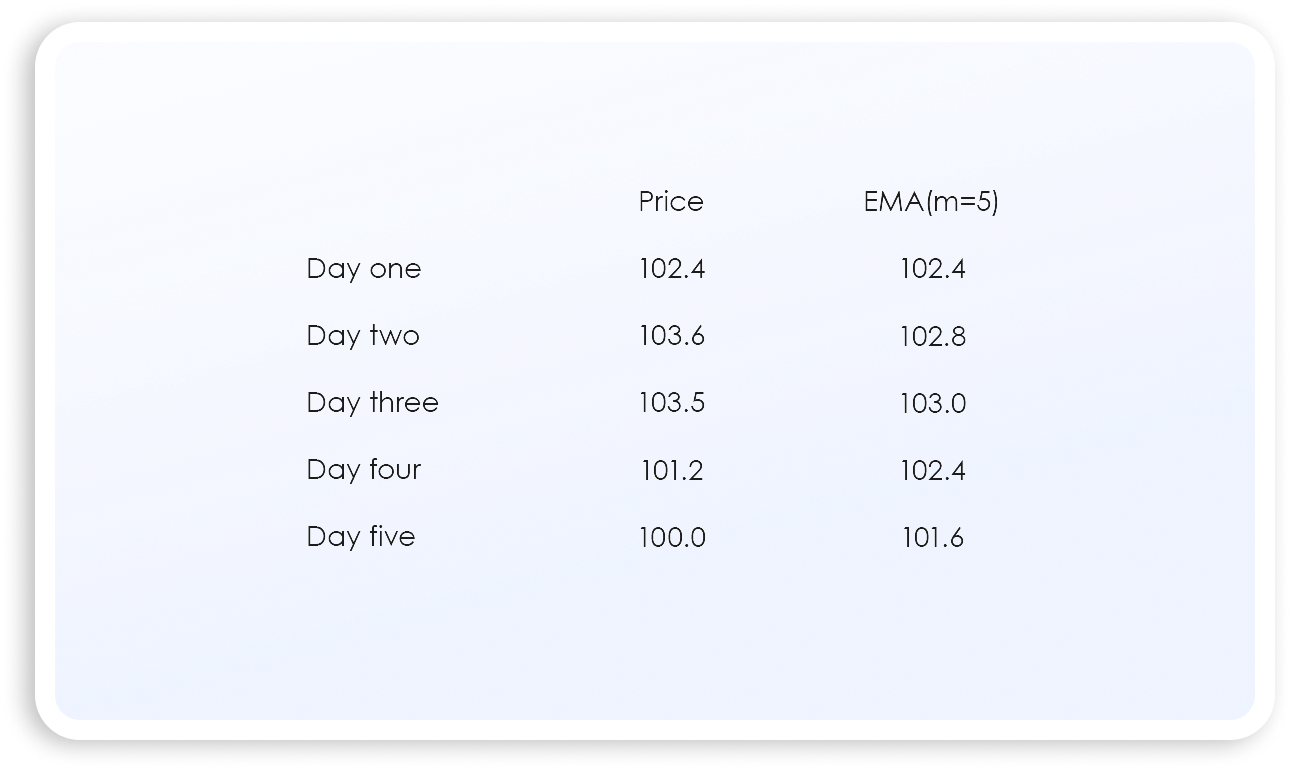

An example below shows the calculation of EMA where m = 5 and, therefore, k=1/3.

Exponential Moving Average vs. Simple Moving Average

EMA and SMA (simple moving average) are the most popular technical analysis tools among moving averages that you can learn with NAGA. EMA and SMA are also quite similar to the MACD indicator in the measurement of trends. Let’s take a look at the exponential moving average and simple moving average in comparison.

The simple moving average is calculated based on the arithmetic mean of the latest prices. Most often, the SMA’s calculation considers closing prices, but it can also be computed based on the opening price and the highest and lowest prices. For example, to determine the 10-day simple moving average, the closing prices of the last 10 days are added together and then divided by the number of days.

Here, we already have the first difference between the two averages. The SMA only looks at the prices that are within the selected period. For example, the 10-day SMA is calculated only from prices within the last 10 days. The eleventh value no longer has any influence on the calculation of the average.

Since the calculation period shifts by one day every day, only two prices are ultimately responsible for the change in the value of the new average: the current price, which is newly added, and the last price, which falls out of the new calculation period.

Especially with very short period lengths, such computing leads to sudden jumps in the average line. Due to this, the SMA can suddenly show sharp rises and declines, even if the current price does not move at all. The EMA does not have this problem. Here, the period length has only an indirect influence on the calculation of the average via the smoothing factor.

SMAs can be quite simply calculated using the formula below for an n-period SMA.

Another difference is the weighting of the individual days. In SMA, every day has the same impact on the average. In the EMA, on the other hand, only the last day has a direct impact on the calculation of the new average. Generally speaking, EMA is a little bit more reactionary to the market fluctuations compared to SMA.

Although this may have little importance for short-term trading, the discrepancy becomes more evident when looking at long-term price tendencies. Current data is telling more about the latest market alterations. For the most part, this is why EMA is more respected and favored among traders than SMA.

What Are the Advantages of Using the Exponential Moving Average?

Each tool in technical analysis has its own specific purpose, different from other tools, and advantages. We will compare the most important factors on which the EMA and SMA indicators are based in order to draw conclusions about EMA’s usefulness and benefits.

The EMA

- The EMA is a quite simple trading tool to look at.

- The EMA accords more weightage to the recent data, so it’s more sensitive to the price changes than SMA, which considers prices for a period equally.

- The EMA triggers a breakthrough signal earlier than the SMA.

- The EMA is a perfect indicator for short-term price fluctuations.

What Are the Limitations of Using the Exponential Moving Average?

Like any instrument, the EMA indicator is not an absolute guarantee of the subsequent price movement and can sometimes be too sensitive to the market situation.

EMA Drawbacks

- The EMA does not provide 100% accurate signals.

- The EMA is usually used by experienced traders.

- The EMA needs to be customized by yourself and for particular goals.

- The EMA can react too sharply to market changes.

- The SMA is more useful than the EMA when trying to determine support or resistance levels.

How To Use the Exponential Moving Average (EMA)

Answering the question of how we use the exponential moving average, we say that there are several major ways to use them, just like with simple moving averages.

- Determining the trend direction

- Highlighting the entry and exit points

- Finding the support and resistance levels

Identifying Trends

The first way to use this tool is to follow the direction of the exponential moving average to determine the price trend. By outlining the directions where the major trend is going, the EMA allows investors to better understand whether to buy or sell.

If there’s a rising moving average, the market is in an uptrend.

If there’s a falling moving average, the market is in a downtrend.

Entry and Exit Points

Crossing points of price and moving average represent potential buy or sell signals.

When a short-term moving average breaks above a long-term MA, this serves as a bullish signal in the market and is known as a golden cross. On the contrary, when an EMA with a shorter period falls below one with a long-term, it’s a bearish signal. Such a crossover is called a death cross.

Such signals are used to define a change in the overall trend and determine exit and entry points. If you are out of the market, you can open a trade in the direction of a new trend. If you have ongoing trades, you can close them based on the signal of the trend’s return.

Support and Resistance Levels

The EMA serves as support and resistance levels for the price. The support level is the level from which the falling price is supposed to reverse up when approaching. This level seems to “support” the price, preventing it from going lower. A growing EMA may serve as a support level.

The resistance level is the level where assets meet sellers’ pressure since they want to sell more at that price. A falling EMA tends to show resistance to price movement.

You can also use this function of the EMA to determine entry points. You can buy when the price is near support EMA and sell when the price approaches a resistance EMA.

Exponential Moving Average Applications

So, now you know what the EMA is and what it reveals. Now, you’re probably wondering how to incorporate it into your strategy. As you have already learned how to highlight trends and use the moving average as support or resistance levels, you should check how to apply the indicator on the price chart.

The key parameter of the exponential moving average is its period. The period length used in the EMA computation is freely selectable and can range from 1 to 200. The most common moving average periods are the 9/10, 12, 21, 50, 100, and 200.

The 9/10, 12, and 21 periods are usually used for small timeframes, and large ones (50, 100, and 200) for big timeframes. That is because small periods give more signals, but many of them can be fake. In contrast to this, the large periods give fewer signals, but they are more reliable.

However, if you use large periods on small timeframes, then the signals could appear too late since the EMA is already a lagging indicator. That means that signals could be given with a delay.

Traders should note that the EMA can react strongly to small changes in the event of increased price fluctuations, and false signals can arise in short periods. Therefore, the longer the selected period, the more accurate the signals are.

These ideas will give you an approach to your strategy. So, if you want to incorporate these into your trading, you should test both because you have to find out which periods are particularly effective for you and your strategy.

In practice, the EMA line moves closer to the price line than that of the SMA. A second one should always be used to compare the signals. Both graphs together also generate buy and sell signals by intersection. As a common approach, traders and technical analysts usually use both EMA and SMA. But, if we put both on the chart simultaneously, we’ll see that their movement is really similar, yet there’s a gap between them, as you can see on the graph with Apple CFD. Here, the red one is the EMA, and the green one is the SMA.

Moving averages work best in trending markets. They smooth the values so that clearer signals for trend reversals are generated. You should take precautions if no clear trend is discernible, as moving averages calculation is based on the current price, which can lead to misinterpretations of a trend.

Takeaway

An exponential moving average is a technical tool that can be used both to determine trends and to generate trading signals. It can be incorporated into your strategy and may also serve as the levels of support and resistance. To use the indicator, you need to choose the desired time period for which the indicator will be calculated. It is believed that the EMA is a quite simple trading tool to look at.

You can try trading various assets, including futures, with this indicator on the NAGA trading platform. NAGA provides a demo account where you can test EMA. It’s advisable to go through training in order to trade as thoughtfully and cautiously as possible. Also, you can open a margin account, but you should be aware of the risks that such an account may carry.