In the fast-paced world of financial markets, recognizing and utilizing key patterns is a critical skill for traders. Price action traders are often captivated by the simplicity and reliability of inside and outside bar patterns, two key candlestick formations that can offer valuable trading insights.

While relying solely on individual candlestick patterns may not always yield consistent results, incorporating them within the broader chart context can significantly enhance the strength of trading signals. Both patterns, when used effectively, can serve as powerful tools for identifying potential market movements.

How to Trade Inside Bar & Outside Bar – A Quick Guide

- Learn the principles of technical trading at Naga Trading Academy.

- Sign up for a live account and gain access to thousands of stocks, indices, ETFs, forex pairs, cryptocurrencies and more.

- Identify bar patterns using our comprehensive charting tools, including advanced charts to view your trading positions.

- Open an account and monitor your position.

Not ready to trade with real capital? Open a demo account to test your price pattern strategy with $10,000 in virtual money.

What is a Bar Pattern candle?

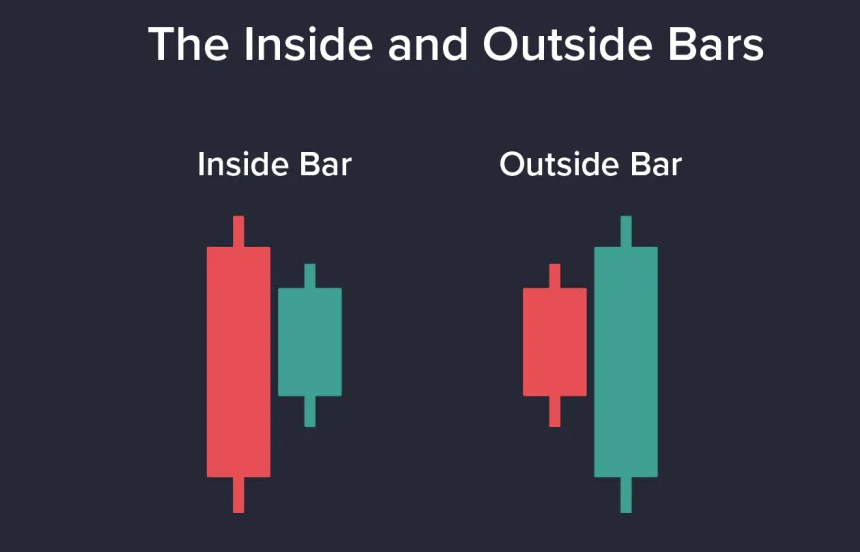

Bar patterns, including inside bars and outside bars, are fundamental tools in technical analysis and trading strategies, offering traders insights into market behavior and potential price movements. Both patterns involve the relationship between two consecutive candlesticks, each reflecting specific dynamics of price action and market sentiment.

What is an Inside Bar pattern?

An inside bar forms when a candlestick’s high and low remain entirely within the range of the previous candlestick, often referred to as the "mother bar." This pattern signifies a period of market consolidation or indecision, where buyers and sellers reach a temporary equilibrium. It is not inherently a signal of trend reversal but rather an indication that the market is pausing, which could lead to either a continuation or reversal of the previous trend. Inside bars are commonly seen in both uptrends and downtrends and can be applied to various financial instruments, including stocks, forex, cryptocurrencies, and indices.

What is an Outside Bar pattern?

In contrast, an outside bar occurs when a candlestick completely engulfs the range of the previous one, reflecting heightened market activity and potential momentum. This pattern typically signals a significant shift in market sentiment, often leading to a trend continuation or reversal. For instance, a bullish outside bar emerges when a larger bullish candle fully encompasses the range of a preceding smaller bearish candle, indicating strong buying pressure. Similarly, a bearish outside bar suggests increasing selling pressure when a larger bearish candle engulfs a smaller bullish one.

For illustrative purposes only

Both inside and outside bars are invaluable for traders seeking to interpret price action. While the inside bar highlights a phase of consolidation or indecision, the outside bar underscores a decisive market move, often acting as a precursor to a new trend or reversal. Together, they form essential components of a trader's toolkit, enabling informed decisions in diverse market conditions.

Learn more about Japanese candlestick patterns

Identify Inside Bar candle & Outside Bar candle Setups

Identifying inside bar and outside bar setups is crucial for traders seeking to leverage these patterns effectively. Each setup has unique characteristics and requires careful observation of market conditions, candlestick formations, and key technical indicators to make informed trading decisions.

How to Identify Inside Bar Setups

Inside bar setups occur when the current candlestick is entirely contained within the range of the preceding candlestick, as mentioned earlier often referred to as the "mother bar." This pattern indicates a temporary market pause or consolidation. To identify inside bar setups, consider the following:

Visual Recognition: Identify smaller candlesticks fully contained within the previous bar, indicating reduced volatility and short-term market balance. Relative Bar Sizes: Confirm that the inner bar is significantly smaller than the mother bar, reflecting the market's consolidation phase. Candlestick Formation: Focus on patterns that suggest a market pause, as they often precede a breakout in either direction. Technical Context: Ensure the inside bar aligns with a broader market trend or is near support or resistance levels to gauge its significance.

How to Identify Outside Bar Setups

Outside bar setups involve a candlestick that completely engulfs the range of the previous candlestick, signaling heightened market activity or a potential shift in momentum. To identify these setups:

Candlestick Observation: Look for larger candlesticks that encompass the high and low of the preceding bar, showing increased volatility and strong directional pressure. Support and Resistance Levels: Use technical tools such as trend lines, Fibonacci retracements, or moving averages to identify key support and resistance zones. These levels often influence whether an outside bar setup will lead to a breakout or reversal. Market Context: Assess market sentiment and upcoming economic events that may drive the price action following the outside bar formation. Risk-Reward Analysis: Evaluate whether the setup offers a favorable risk-reward ratio before taking a position.

By combining technical analysis with a clear understanding of the context surrounding these patterns, traders can increase their chances of successfully identifying and capitalizing on inside and outside bar setups.

Comparing Inside and Outside Bars

Inside bars and outside bars are distinct candlestick patterns that serve different purposes in trading analysis. While both provide valuable insights into market behavior, they reflect opposing conditions in terms of volatility and momentum.

An inside bar occurs when the second candle is fully contained within the range of the preceding candle (mother bar), signaling market consolidation. This pattern often precedes a breakout in the direction of the prevailing trend, offering traders an opportunity to anticipate potential continuation moves.

In contrast, an outside bar forms when the second candle has a higher high and a lower low than the previous bar, indicating a surge in volatility. This pattern suggests intense buying or selling pressure, potentially leading to either a reversal or an extension of the current trend, depending on the market context.

- Inside Bar: Represents market consolidation and hints at a potential breakout

- Outside Bar: Reflects heightened volatility and signals either a reversal or an extension of the trend.

Comparison of Inside and Outside Bar Patterns: Market Signals and Trading Opportunities

Feature Inside Bar Outside Bar Definition The high and low of the second candle stay fully within the previous candle's range (mother bar). The second candle's high is higher and low is lower than the previous candle's range. Market Condition Signals market consolidation and temporary indecision. Indicates increased volatility and market momentum. Typical Outcome Often precedes a breakout in the direction of the prevailing trend. Can lead to either a trend reversal or continuation, depending on context. Trader's Focus Useful for breakout strategies and capturing continuation moves. Best for identifying strong reversals or continuation in volatile markets. Trading Strategy Capitalize on breakouts following consolidation. Look for momentum shifts and possible trend exhaustion or acceleration.

Traders may choose to focus on either pattern depending on their strategy and market conditions. Inside bars are ideal for those looking to capitalize on breakouts, while outside bars are often preferred for identifying strong reversals or continuation setups in volatile markets.

How to Trade Inside / Outside Bars Candles

Trading inside and outside bars effectively requires not just recognizing these patterns but applying strategic approaches tailored to their unique dynamics. These patterns can signal continuation, reversals, or consolidation, depending on their context within the broader market structure.

For inside bars, the key trading strategy is breakout-based. Traders often set pending orders above the high or below the low of the mother bar to capture price movement in either direction. A stop-loss is crucial, placed just beyond the opposite side of the inside bar to minimize risk in case of false breakouts. Combining this approach with confirmation from indicators such as RSI or moving averages strengthens the setup, particularly on daily charts where signals are more reliable. For outside bars, strategies often focus on either reversal or trend continuation. A reversal approach involves monitoring for price action that breaches the outer bar’s high or low, indicating a shift in momentum. Alternatively, in trend continuation setups, outside bars appearing during pullbacks offer entry opportunities in the trend's direction once the price clears the bar's high or low. These trades benefit from aligning with prevailing market sentiment and incorporating additional confluence from technical indicators or support/resistance zones.

Both patterns require disciplined execution, risk management, and a focus on the broader market context to achieve consistent results. Whether riding a trend or capturing a reversal, inside and outside bar strategies provide versatile tools for traders across various timeframes and instruments.

The Best Qualities of an Inside Bar and Outside Bar Approach

Inside Bar and Outside Bar patterns are highly versatile tools in price action trading, offering traders clear signals to navigate market trends and potential reversals. Their effectiveness lies in their ability to capture key market movements while remaining adaptable across different timeframes and trading scenarios. Below are the key qualities that make these patterns essential for any trading strategy.

Duration

Both the Inside Bar and Outside Bar patterns work effectively on daily timeframes. Shorter timeframes tend to generate false signals due to market noise, while excessively long timeframes may dilute the patterns’ predictive capabilities. The daily chart strikes a balance, providing reliable setups for market continuations or reversals.

Market Trends

Inside Bars and Outside Bars perform best in trending markets. For Inside Bars, a strong trend enhances the reliability of the breakout signals. Similarly, Outside Bars indicate heightened volatility and can confirm trend continuation or reversals when aligned with the prevailing market direction. These patterns are less effective in ranging markets where erratic price behavior dominates.

Size and Structure

For Inside Bars, the smaller the inner bar relative to the Mother Bar, the more precise the signal, especially when it forms within the upper or lower half of the Mother Bar. For Outside Bars, the engulfing candlestick should clearly encompass the previous bar’s range, signaling strong momentum. Both patterns are most actionable when their proportions reflect decisive market behavior.

Breakouts and Momentum

Reliable trading signals for both patterns emerge during or after significant price breakouts. An Inside Bar breakout suggests potential continuation or reversal, depending on the market context. Similarly, an Outside Bar following a breakout indicates strong market momentum and a possible shift in direction. These setups allow traders to align their strategies with prevailing trends or anticipate reversals with appropriate risk management.

This combined approach highlights how these candlestick patterns excel in various scenarios, offering traders versatile tools to navigate diverse market conditions.

Typical Errors in Inside Bar and Outside Bar Trading

Understanding common mistakes in trading both inside and outside bar patterns is as important as mastering their strategies. These errors, often made by traders at all levels, can be minimized with proper preparation and analysis.

- Ignoring Market Context: Trading inside or outside bars without considering the overall market trend or context can lead to false signals. Always assess broader market conditions, such as key support or resistance levels, before entering a trade.

- Misinterpreting Pattern Size: For inside bars, trading on patterns with overly large inner bars relative to the mother bar can weaken the signal. For outside bars, overlooking their size and momentum can misrepresent the potential breakout or reversal strength.

- Overtrading: Taking positions on every visible pattern without confirmation can be risky. Both patterns demand selectivity and patience to identify quality setups.

- Neglecting Stop Loss Orders: Failing to set stop losses exposes traders to excessive risk. For inside bars, stop losses are often placed above or below the mother bar. For outside bars, they are typically set at the bar’s high or low, depending on the direction of the trade.

- Disregarding News Events: Major news releases can disrupt patterns and lead to unexpected volatility. This is especially critical for outside bars, as they often form during periods of heightened market activity.

By avoiding these common mistakes, traders can enhance their ability to capitalize on the strengths of both inside and outside bar setups.

How to Trade Inside and Outside Bars with Naga.com

- Identify the Pattern: Locate the Inside Bar or Outside Bar on the chart. Understand that Inside Bars indicate consolidation, while Outside Bars suggest volatility.

- Evaluate Market Context: Assess the market trend and whether the pattern forms near key support or resistance levels for stronger signals.

- Determine the Trade Direction: For Inside Bars, trade in the direction of the breakout. For Outside Bars, enter as the bar closes if it aligns with your strategy.

- Set Stop Losses and Take Profits: Place stop-loss orders based on the high or low of the previous bar. Use a clear risk-reward ratio to define your take-profit targets.

Final Words

In conclusion, the Inside Bar and Outside Bar patterns are powerful tools in technical analysis, offering valuable insights into market behavior. The Inside Bar signifies consolidation and potential breakouts, while the Outside Bar indicates heightened volatility, often leading to reversals or strong trends. Both patterns provide traders with clear entry points, but understanding the broader market context and using proper risk management are crucial for success.

By combining these patterns with technical indicators and sound trading strategies, traders can improve their decision-making process and enhance profitability. Whether trading for breakouts with Inside Bars or capitalizing on volatility with Outside Bars, careful analysis and patience are key to making informed trades.

Trading tools

Before you start trading Inside & Outside Bars, you should consider using the educational resources we offer like NAGA Academy or a demo trading account. NAGA Academy has lots of free trading and investing courses for you to choose from, and they all tackle a different financial concept or process – like the basics of analyses – to help you to become a better trader or make more-informed investment decisions.

Our demo account is a suitable place for you to learn more about leveraged trading, and you’ll be able to get an intimate understanding of how CFDs work – as well as what it’s like to trade with leverage – before risking real capital. For this reason, a demo account with us is a great tool for investors who are looking to make a transition to leveraged trading.

Sources:

- https://candlecharts.com

- https://www.cfainstitute.org/insights/professional-learning/refresher-readings#sortCriteria=%40field_curriculum_year%20descending

- https://www.cmegroup.com/education/courses/technical-analysis/chart-types-candlestick-line-bar.html