The United Arab Emirates (UAE) has emerged as one of the most attractive investment destinations worldwide. The country offers dynamic economic growth, investor-friendly regulations, and tax-efficient investment opportunities, especially in its stock market. Whether you are a resident, an expat, or an international investor interested in the Middle East, investing in the UAE stock market can be one of the best options to diversify your portfolio.

This guide will walk you through everything you need to know about investing in UAE stocks, from understanding the market structure and available investment options to setting up your account on the NAGA.com and making your first trade.

How to Invest in the UAE Stock Market – Quick Guide

- Research your options: if you want to research and build a personalized portfolio go with individual UAE stocks such as EMAAR, EmiratesNBD, or Dubai Islamic Bank; If you want to gain diversified exposure across many assets choose ETFs like the iShares MSCI UAE ETF.

- Define your strategy: Choose CFDs if you want flexibility to trade the UAE stock market in both directions with leverage; choose direct stock ownership if you are focused on long-term growth and stability.

- Take your position: Open an account with a regulated broker that offers a reliable app to manage your investment securely and benefit from local support.

- Get social: Join the leading social trading platform, which allows you to connect, copy, collaborate, and inspire fellow traders.

Discover NAGA, your gateway to straightforward investing in the UAE stock market:

Overview of the UAE Stock Market

There are three stock exchange markets in the UAE where you (as an individual investor) can buy and sell stocks:

- Dubai Financial Market (DFM): The leading UAE stock exchange based in Dubai, offering a diverse range of securities and a focus on innovation and liquidity.

- Abu Dhabi Securities Exchange (ADX): The main stock exchange of Abu Dhabi, known for its strong government-backed listings and emphasis on stable investments.

- NASDAQ Dubai: An international exchange in Dubai’s financial center, providing a platform for dual listings and regional-global financial instruments.

Each exchange has its own regulations, listing requirements, and trading hours. They list some of the UAE's leading blue-chip companies like Emaar Properties, First Abu Dhabi Bank (FAB), Emirates NBD, and sectors covering real estate, banking, telecommunications, and energy.

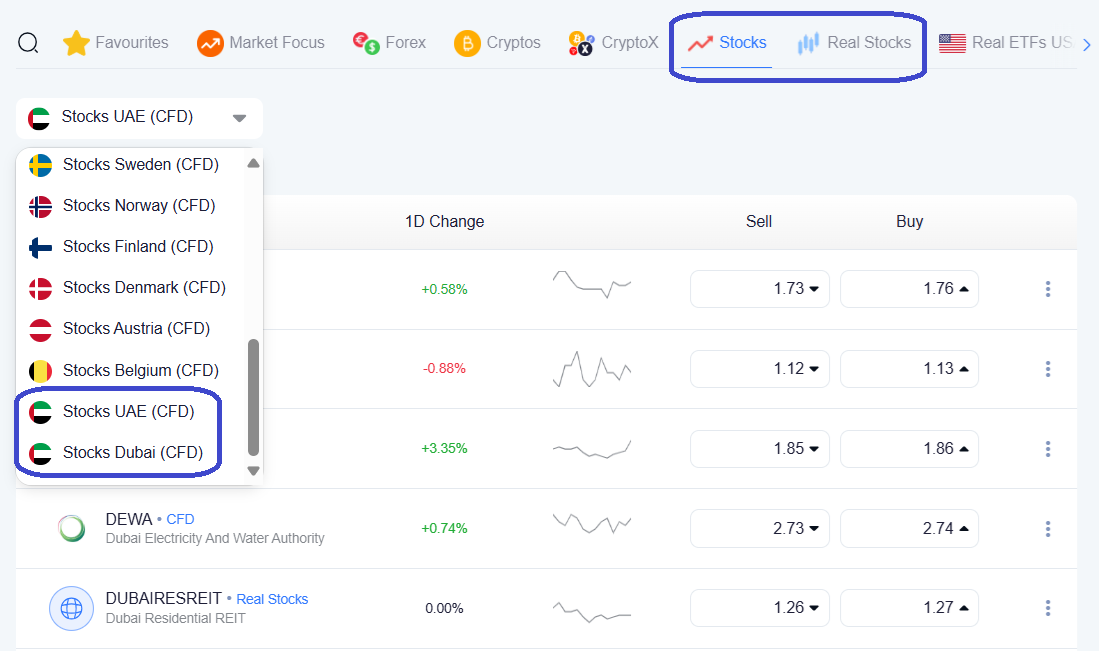

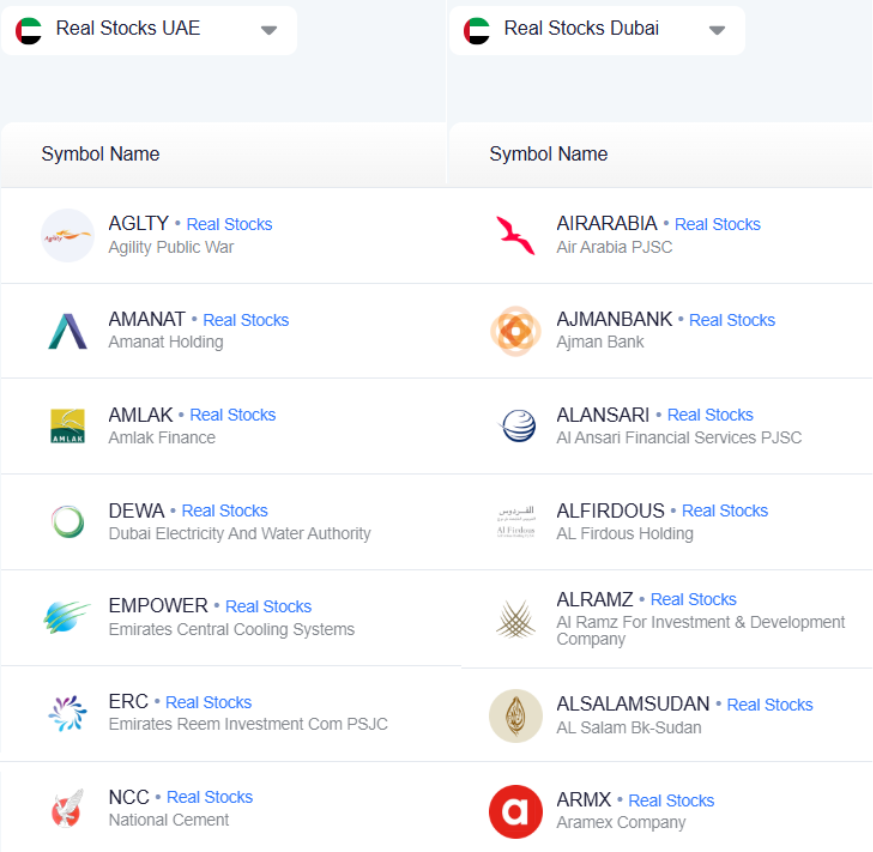

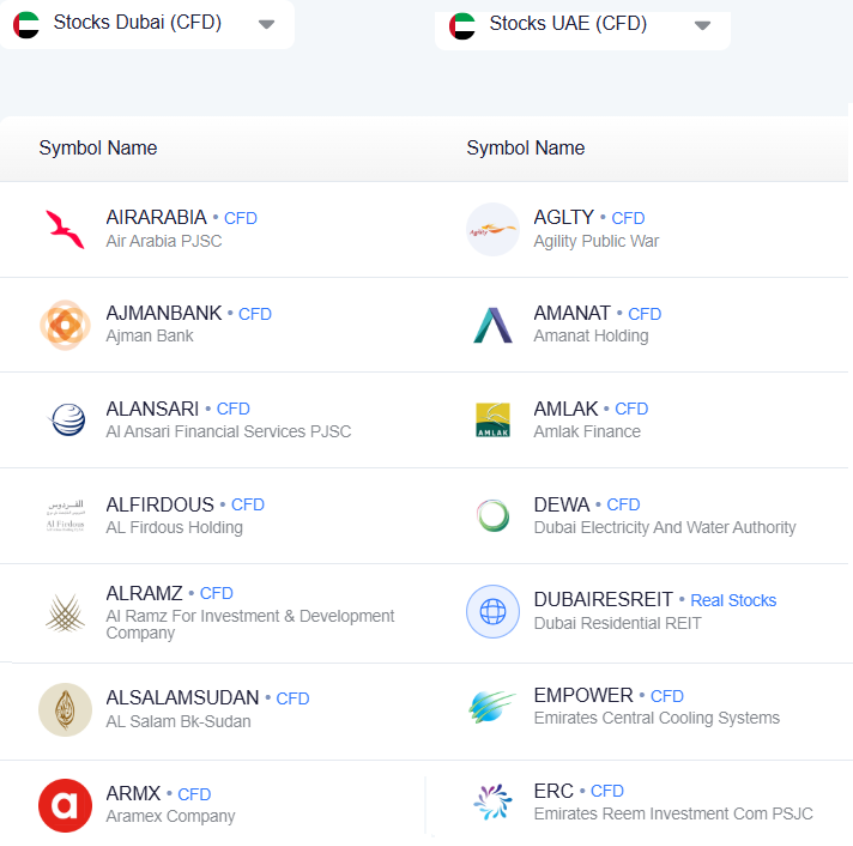

With NAGA.com you can access a wide range of stocks listed on the major UAE stock exchange markets through CFD trading or stocks with ownership.

Why Invest in the UAE Stock Market?

No taxes on capital gains and dividends, historically strong market performance, and diverse investment opportunities are some of the benefits of investing in the UAE’s stock market. Additionally, the country has streamlined investing for expats and non-residents, enabling them to access the stock market easily through brokerage firms or online trading platforms.

Here are some of the primary reasons private and institutional investors worldwide invest in the UAE stock market:

- Economic diversification: The Vision 2071 initiatives are driving the growth of emerging industries such as artificial intelligence, renewable energy, and space technologies, expanding opportunities beyond the oil sector.

- Prime geographic position: Situated as a crossroads between East and West, the UAE benefits from strong trade ties with Asia, Europe, and Africa, fueling sustained economic development.

- Strong government support: Major companies like First Abu Dhabi Bank and ADNOC Distribution receive significant backing from the state, ensuring market resilience and stability.

- Favorable tax regime: Investors enjoy exemptions from capital gains, dividends and personal income taxes on stock investments.

- Diverse investment choices: A wide array of instruments including direct stock ownership, ETFs, and CFDs are available to suit different investment strategies and risk profiles.

With these compelling advantages in mind, let’s explore the various ways to invest in the UAE stock market effectively.

Ways to Invest in the UAE Stock Market

There are several ways to access the UAE stock market. Choose the option below that best represents how you want to invest in stocks, and how hands-on you’d like to be in choosing the best stocks you invest in.

The main things to consider when defining your investment strategy are your time horizon, your financial goals, risk tolerance, tax bracket, and your time constraints. Based on this information, there are two main approaches to invest in the UAE stock market.

Buying stocks in the UAE stock market

Investors buy stocks in the UAE stock market for long term financial returns. The length of this process will depend on your individual circumstances. Some people invest in stocks to achieve financial independence and retire early, while others fund education or other needs.

Regardless of the aim, buying the underlying asset usually involves following a stock investing strategy with a time horizon of at least a year.

Investors will usually choose UAE stocks that they expect to increase in value when they are ready to convert their investment back into cash. There are no definitive rules about which UAE stocks should go into an investment portfolio, and diversifying your portfolio across different sectors is an option that many experienced investors choose.

Buy stocks in the UAE stock market if you:

- Plan to hold the stock for an extended period

- Only aim to profit from upward price movements

- Are happy to pay the full value of the trade upfront

- Don’t want to use leverage to increase their exposure

Trading in the UAE stock market

Trading in the UAE stock market involves speculating on the financial market without owning the underlying assets. With CFDs, you can trade UAE stocks in both directions and use leverage to increase your exposure.

Going short is the reverse of going long, enabling you to profit if you correctly predict a depreciation in a stock's price. However, please note that short selling is a high-risk trading method because stock prices can keep rising – theoretically, without limit. It’s essential to take steps to manage your risk.

Leverage is essentially a loan from your stockbroker that enables you to control a larger amount of money than you have deposited for the trade. For example, leverage of X5 means you can trade $5000 with a deposit of just $1000. Leverage is a powerful tool that can potentially increase your profits. However, it can also increase your losses, so, it’s important to understand the risks.

It’s also worth noting that CFD positions that stay open overnight incur a small fee, relative to the value of the position. This is essentially an interest payment to cover the cost of the leverage that you use overnight.

Trade in the UAE stock market if you:

- Want to speculate in both directions

- Have a lower initial investment

- Want to use leverage to increase their exposure

- Want to hedge an existing stock portfolio

- Are not concerned about owning the underlying asset

Buying stocks vs trading in the UAE stock market

Here is a summary of the key factors to consider when buying stocks vs trading in the UAE stock market:

Trading in the UAE stock market Buying stocks in the UAE stock market Time horizon Frequently ranging from minutes to weeks Generally expressed in years or even decades Approach Short-term Long-term Goal Benefiting from temporary shifts in the market by going both long and short Building wealth over time through capital growth and compounding Risks Higher risk involved due to market dynamics and leverage Lower risk involved due to longer holding time, reduced frequency of decision-making and no leverage Source of profits Buying low and selling high over a short period Long-term capital appreciation and dividends or interest Diversification Less diversification options due to short-term focus Better diversification options to mitigate long-term risks Positioning options Speculating on both rising and falling prices Suitable only for bullish market predictions Costs Frequently buying and selling incur higher costs Lower costs, due to long-term holding nature Analysis Mainly technical analysis, focused on market trends, trading indicators and chart patterns Mainly fundamental analysis of companies’ performance, macroeconomic indicators and market sentiment Key differences between trading in the UAE stock market and buying stocks in the UAE stock market

Key UAE stocks to consider

UAE stock markets have shown strong performance recently, with the Dubai Financial Market (DFM) General Index surging over 27% in 2024 and continuing with up to 20% gain in the first 3 quarters of 2025. This impressive growth has been fueled by the demand for Shariah-compliant stocks, attracting regional and international investors focused on ethical finance. The Abu Dhabi Securities Exchange (ADX) has also recorded gains, albeit more modestly, with key financial and real estate stocks contributing to market resilience.

The best stocks in the UAE stock market include Salik, which has an 80% total return, and Parkin, with over 200% since its IPO in 2024. UPP, AMLAK, and DIB are other key winners in the Dubai stock market, with impressive gains in 2024-2025.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

Other top UAE stocks to consider in 2026 are:

- Emaar Properties (EMAAR): A leading real estate developer with significant projects like Dubai Downtown and Dubai Mall.

- Etisalat (7020): Major telecommunications provider with a growing international presence.

- Dubai Electricity and Water Authority (DEWA): Provider of utilities with stable government backing.

- Emirates NBD (EMIRATESNBD) – Prominent banking institution.

- DB Islamic Bank (DIB) – Sharia-compliant banking.

*Note: While these UAE stocks show promise, always carry out your own research or consult financial advisors to align investments with your risk tolerance and goals.

Economic forecasts support this positive UAE stock market trend, projecting a GDP growth around 4.4% for 2025 and accelerating to 5.4% in 2026, underpinned by diversification across tourism, real estate, financial services, and a recovering hydrocarbon sector.

UAE ETF

Although there is a certain enthusiasm about choosing individual stocks listed on the UAE stock exchanges – sometimes it might be better to consider an ETF. By doing so, you will often invest in a basket of selected UAE stocks in a variety of markets and sectors.

The iShares MSCI UAE ETF (UAE) is concentrated on some outstanding companies trading on the UAE stock exchanges with impressive financial reports. The UAE is projected to grow substantially in coming years and the UAE ETF is concentrated on industries expected to absorb most of the growth.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

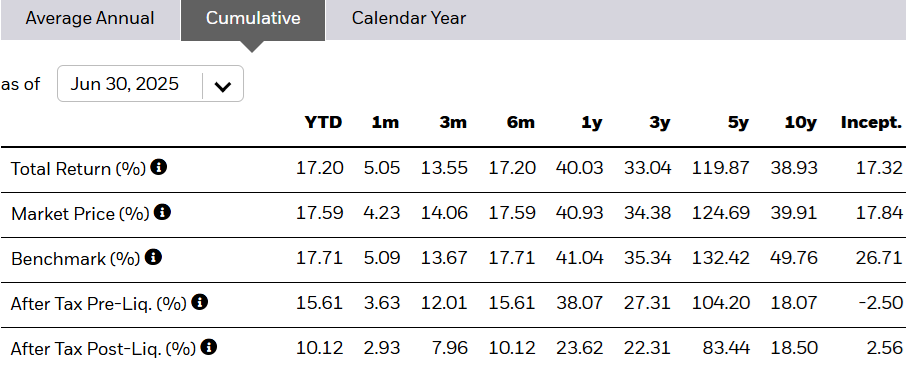

Investment objective and performance

UAE seeks to track the investment results of the MSCI All UAE Capped Index. The index is designed to measure the equity market in the United Arab Emirates (NASDAQ: UAE). It consists of equity securities that are classified in the UAE according to the MSCI Global Investable Market Indices methodology, and securities of companies that are listed in the UAE and have the headquarters and most of their operations based in the UAE.

The fund generally invests at least 80% of its assets in securities of the underlying index or in depositary receipts representing securities of the underlying index. UAE (the ETF) is significantly concentrated on the UAE stock market (stock exchanges include Abu Dhabi and Dubai), though, it is one of the best investments in UAE for expats and not only.

Since its inception, the UAE ETF’s total return has been nearly 20%, with the best performance in 2021, one of the best years of the UAE stock market.

*The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted.

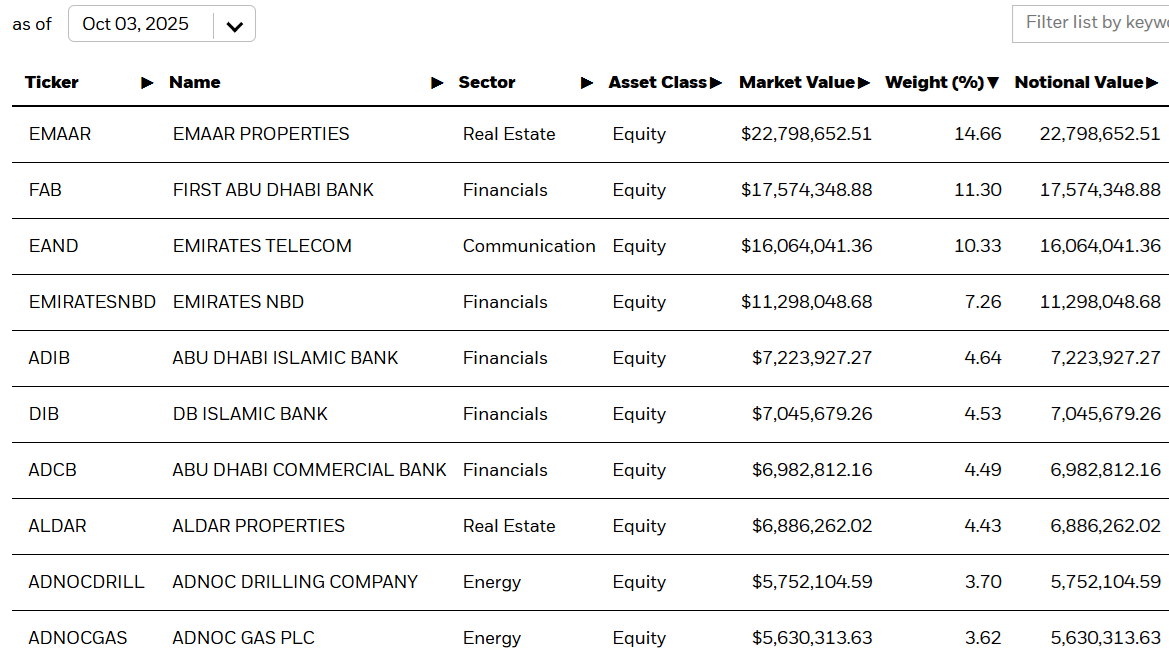

UAE ETF holdings and exposure breakdowns

When you invest in the UAE stock market through the iShares UAE ETF, more than 40% of your investment will be allocated to 4 of the largest companies in the United Arab Emirates and Middle East. In addition to the highly concentrated portfolio weighting to the top 34 holdings, more than 55% of the portfolio is made up of Banks and Real Estate Management and development companies.

As of the beginning of Q4 2025, the industry exposure breakdown shows the Financials leading the fund's assets allocation with over 37%, followed by Real Estate (22%), Communication (11%) and Industrials (11%).

As stated in the Fund's current prospectus, the Expense Ratio is 0.60%.

Why Invest in the UAE stock Market via "UAE"?

The iShares MSCI UAE ETF ("UAE") seeks to track the investment results of an index composed of some of the best UAE stocks today.

- Exposure to a broad range of companies in the UAE

- Targeted access to the top 40 UAE stocks

- Use to express a single-country view

How to Invest in the UAE Stock Market with NAGA.com?

NAGA.com is a leading online trading platform offering easy access to UAE stocks and other financial instruments with features tailored to both beginners and experienced traders.

To get started, follow the steps below:

Step 1. Sign up with NAGA.com

Sign up on NAGA.com and complete Know Your Customer (KYC) verification, which includes uploading ID documents to confirm your identity. Choose between two types of accounts:

- Investment Account: For buying and holding UAE stocks directly.

- Trading Account (CFD): For trading price movements of stocks using leverage, including short selling.

Step 2. Fund your account

Deposit funds in supported currencies such as USD. NAGA supports various funding methods (over 20), including bank transfers, credit cards, and e-wallets for ease of deposit.

Step 3. Select your stocks or ETFs

Use NAGA’s research tools, real-time market data, and analyst insights to identify promising UAE stocks or ETFs like the iShares MSCI UAE ETF. Choose between long-term ownership of stock shares or short-term CFD trading based on your investment strategy.

Step 4. Place your order

Submit buy or sell orders directly through the intuitive NAGA Web App or mobile apps. You can set market orders, limit orders, and stop orders to manage your trades efficiently.

Step 5. Manage your portfolio

Monitor performance, dividends, and news updates all within the platform. Use NAGA’s copy trading feature to follow expert investors or automate your trades.

Final tips for investing in the UAE stock market

Finally, if you plan to access the UAE stock market, either as a long-term investor or a short -term trader, here are some useful tips to consider:

- Conduct thorough research on market trends, company fundamentals, and relevant economic factors before making investment decisions.

- Diversify your investment portfolio across various sectors and asset classes to spread risk effectively.

- Understand the risks involved with leverage, especially when trading CFDs, and apply appropriate risk management strategies.

- Stay informed about local news, economic reforms, and regulatory updates to anticipate market shifts.

- Adopt a long-term investment perspective to build sustainable wealth while remaining alert to suitable short-term trading opportunities to optimize returns.

- NAGA Insights provides access to advanced charting and technical analysis tools, AI-powered trade signals, economic data, analyst forecast, hedge fund activity and more.

By following these practical guidelines and leveraging NAGA’s comprehensive trading tools, investors can confidently navigate the UAE market landscape and maximize their investment potential.

Free resources

Before you start trading and investing in the UAE stock market, you should consider using the educational resources we offer like NAGA Academy or a demo trading account. NAGA Academy has lots of free trading courses for you to choose from, and they all tackle a different financial concept or process – like the basics of analyses – to help you become a better trader or make more informed investment decisions.

Our demo account is a suitable place for you to learn more about leveraged trading, and you’ll be able to get an intimate understanding of how CFDs work – as well as what it’s like to trade with leverage – before risking real capital. For this reason, a demo account with us is a great tool for investors who are looking to make a transition to leveraged trading.

Sources:

- https://www.dfm.ae

- https://www.adx.ae/English/Pages/Markets/Main/default.aspx

- https://www.nasdaqdubai.com/listing/listed-securities

- https://www.ishares.com/us/products/239649/ishares-msci-uae-etf

- simplywall.st/stocks/ae/telecom/adx-eand/emirates-telecommunications-group-company-pjsc-shares

- https://www.marketscreener.com/quote/stock/FIRST-ABU-DHABI-BANK-9058884/

- https://finance.yahoo.com/quote/EMAAR.AE/

- https://www.barrons.com/market-data/stocks/aldar?countrycode=ae

- https://www.bloomberg.com/quote/ADCB:UH

- https://www.reuters.com/markets/companies/ENBD.DU

- https://www.investing.com/equities/db-islamic-bk

- https://www.adx.ae/english/Pages/ProductsAndServices/Securities/SelectCompany/default.aspx

- https://www.wsj.com/market-data/quotes/ae/xads/MULTIPLY

- https://www.morningstar.com/stocks/xads/adnocdist/quote