Bucharest Stock Exchange (BSE) stands as the primary gateway to Romania’s growing capital market, offering investors access to a diverse range of equities and financial instruments. Romania’s economy is expanding steadily, supported by favorable regulatory frameworks and increasing market transparency, making BSE an attractive destination for both domestic and international investors aiming to diversify their portfolios.

This guide will help you navigate the Romanian stock market, covering essential topics such as market structure, key investment options, and the process to open a trading account on platforms like NAGA.com, empowering you to make informed decisions and execute your first trades confidently.

How to Invest in the Bucharest Stock Exchange – Quick Guide

- Research your options: For direct stock exposure, consider individual Romanian blue-chip companies such as Banca Transilvania (TLV), OMV Petrom (SNP), or Hidroelectrica (H2O). If you are seeking for a diversified exposure, you may prefer an ETF.

- Define your approach: Decide if you are long-term growth or an income-oriented investor and pick your BVB stocks accordingly.

- Take your position: Open an account with a regulated broker, such as NAGA, offering secure trading platforms and local support.

- Get social: Use social and copy trading features on platforms like NAGA to connect with and learn from other investors.

Discover NAGA as your gateway to seamless investing in the Bucharest Stock Exchange.

Overview of the Bucharest Stock Exchange (BSE)

The Bucharest Stock Exchange, known as BVB, is the main stock exchange where investors can buy and hold shares of Romanian companies. It operates two markets: the Main Market for established companies, and AeRO for SMEs with more relaxed listing requirements. The benchmark index, BET, tracks the 20 most liquid and largest companies listed on the Main Market.

As of November 2025, the BET index is trading near an all-time high, slightly below 23,000 points, marking around a 30% increase compared to the previous year. The market capitalization of the regulated segment reached around RON 396 billion by mid-2025, a 13% increase from the previous year, reflecting robust market growth amid increased trading activity.

On the Bucharest Stock Exchange (BSE) are listed some of the Romania's leading blue-chip companies like OMV Petrom (SNP), Banca Transilvania (TLV), or Hidroelectrica (H2O), and sectors covering energy, banking, telecommunications, and healthcare.

With NAGA.com you can access a wide range of real stocks listed on the Bucharest Stock Exchange (BSE) and benefit from dividend income and potential capital appreciation.

Why invest in stocks listed on the Bucharest Stock Exchange (BSE)?

The Bucharest Stock Exchange (BVB) offers a growing and dynamic market environment, with increasing integration into European financial frameworks, making it an attractive destination for global investors. Romania’s economy, supported by growth and expanding industries, provides diverse opportunities for both private and institutional investors. The BVB also benefits from regulatory improvements and technological advancements, facilitating accessible and transparent trading.

Here are key reasons why investors may find Romanian stock market attractive:

- Economic growth and EU integration: Romania’s economy continues to expand with support from European Union funds, reinforcing sectors like IT, manufacturing, and energy, leading to attractive growth prospects beyond traditional industries.

- Strategic location in Eastern Europe: Romania acts as a gateway between Western Europe and emerging Eastern European markets, benefiting from strong trade connections and regional development initiatives.

- Government initiatives and reforms: Ongoing efforts to enhance corporate governance, market regulation, and investor protection boost confidence and market stability.

- Attractive frontier and emerging markets potential: As a frontier to emerging market, Romania offers higher growth potential compared to developed economies, driven by expanding consumer markets, infrastructural investments, and increasing foreign direct investment interest.

- Strong 2025 market performance: The Bucharest Stock Exchange demonstrated resilience in 2025, with the BET index posting solid gains (+30%) driven by robust earnings from key companies in energy, financial services, and technology sectors, attracting increased local and international investor interest.

With these advantages, the Bucharest Stock Exchange (BSE) may present meaningful opportunities in terms of stock investments for 2026 and beyond.

Key Romanian stocks to consider

The Bucharest Stock Exchange (BVB) has exhibited notable performance recently, with the BET index rising approximately 18% in 2024 and maintaining positive momentum with gains near 31% during the first 10 months of the year. This growth reflects increased investor interest in Romanian companies with strong fundamentals and growth potential across various sectors.

The best BVB stocks in terms of YTD performance include Transgaz (TGN), with an impressive 170% total return, and Codmag SA, with over 160% as of 12 November 2025. TEL, SNG, and EL are other key winners of the Romanian stock market, with impressive gains in 2025.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

Other top Romanian stocks to consider for 2026 are:

- OMV Petrom (SNP): The largest energy company in South-East Europe, primarily engaged in oil and gas exploration, production, and refining

- Hidroelectrica (H2O): Romania’s largest electricity producer, specializing in hydroelectric power generation.

- Banca Transilvania (TLV): The largest bank in Romania by market share, serving a broad customer base with a diversified portfolio of financial products.

- Romgaz (SNG): One of the largest natural gas producers in Romania and a vital player in the country's energy market.

- BRD - Groupe Société Générale (BRD): Another leading Romanian bank that offers retail, corporate, and investment banking services.

To find out more about BVB stocks outlook, visit our research and analysis of the top 12 components:

*Note: While these BSE stocks seem promising, always carry out your own research or consult financial advisors to align investments with your risk tolerance and goals.

Romanian's moderate economic expansion forecast, along with improving investment prospects and increased investor confidence, supports a positive evolution for the Bucharest Stock Exchange, as stronger economic fundamentals typically enhance market attractiveness and corporate earnings potential. However, risks remain from external demand weakness and fiscal uncertainties that could moderate this positive stock market outlook.

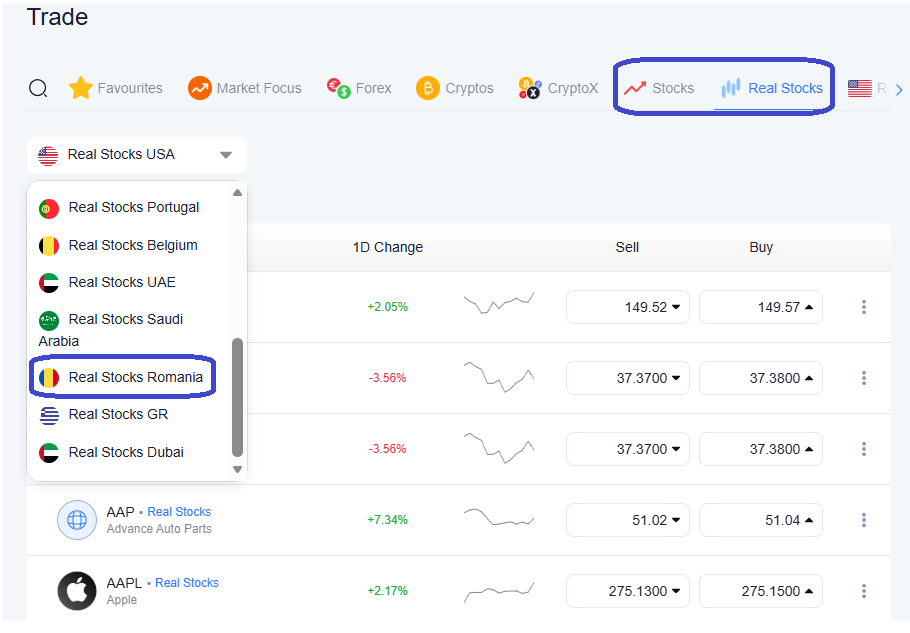

How to invest in real stocks listed on the Bucharest Stock Exchange with NAGA

NAGA.com is a leading online trading platform offering easy access to Romanian stocks and other financial instruments with features tailored to both beginners and experienced traders.

To get started, follow these steps below:

Step 1. Sign up with NAGA.com

Sign up on NAGA.com and complete Know Your Customer (KYC) verification, which includes uploading ID documents to confirm your identity.

Note: For buying and holding Romanian stocks directly, you need to open an Invest Account.

Step 2. Fund your account

Deposit funds in supported currencies such as EUR. NAGA supports various funding methods (over 20), including bank transfers, credit cards, and e-wallets for ease of deposit.

Step 3. Select your stocks

Use NAGA’s research tools, real-time market data, and analyst insights to identify promising Romanian stocks. Decide between long-term ownership for potential capital appreciation or an income-oriented approach with dividend stocks based on your investment strategy.

Step 4. Place your order

Submit buy orders directly through the intuitive NAGA Web App or mobile apps. You can set market orders, limit orders, and stop orders to manage your trades efficiently.

Step 5. Manage your portfolio

Monitor performance, dividends, and news updates all within the platform. Use NAGA’s copy trading feature to follow expert investors or automate your trades.

Final tips for investing in stock listed on the Bucharest Stock Exchange

Finally, if you plan to access the Romanian stock market as a long-term investor here are some useful tips to consider:

- Conduct thorough research on market trends, company fundamentals, and relevant economic factors before making investment decisions.

- Diversify your investment portfolio across various sectors and assets to spread risk effectively.

- Understand the risks involved and apply appropriate risk management strategies.

- Stay informed about local news, economic reforms, and regulatory updates to anticipate market shifts.

- Adopt a long-term investment perspective to build sustainable wealth while remaining alert to suitable short-term opportunities to optimize returns.

- NAGA Insights provides access to advanced charting and technical analysis tools, AI-powered trade signals, economic data, analyst forecast, hedge fund activity and more.

By following these practical guidelines and leveraging NAGA’s comprehensive trading tools, investors can confidently navigate the Romanian market landscape and maximize their investment potential.

Free resources

Before you start investing in stock listed on the Bucharest Stock Exchange, you should consider using the educational resources we offer like NAGA Academy or a demo trading account. NAGA Academy has lots of courses for you to choose from, and they all tackle a different financial concept or process – like the basics of analyses – to help you to become a better trader or make more informed investment decisions.

Our demo account is a suitable place for you to learn more about leveraged trading, and you’ll be able to get an intimate understanding of how CFDs work – as well as what it’s like to trade with leverage – before risking real capital. For this reason, a demo account with us is a great tool for investors who are looking to make a transition to leveraged trading.

Sources: