Past performance is not indicative of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

USDJPY on a daily timeframe

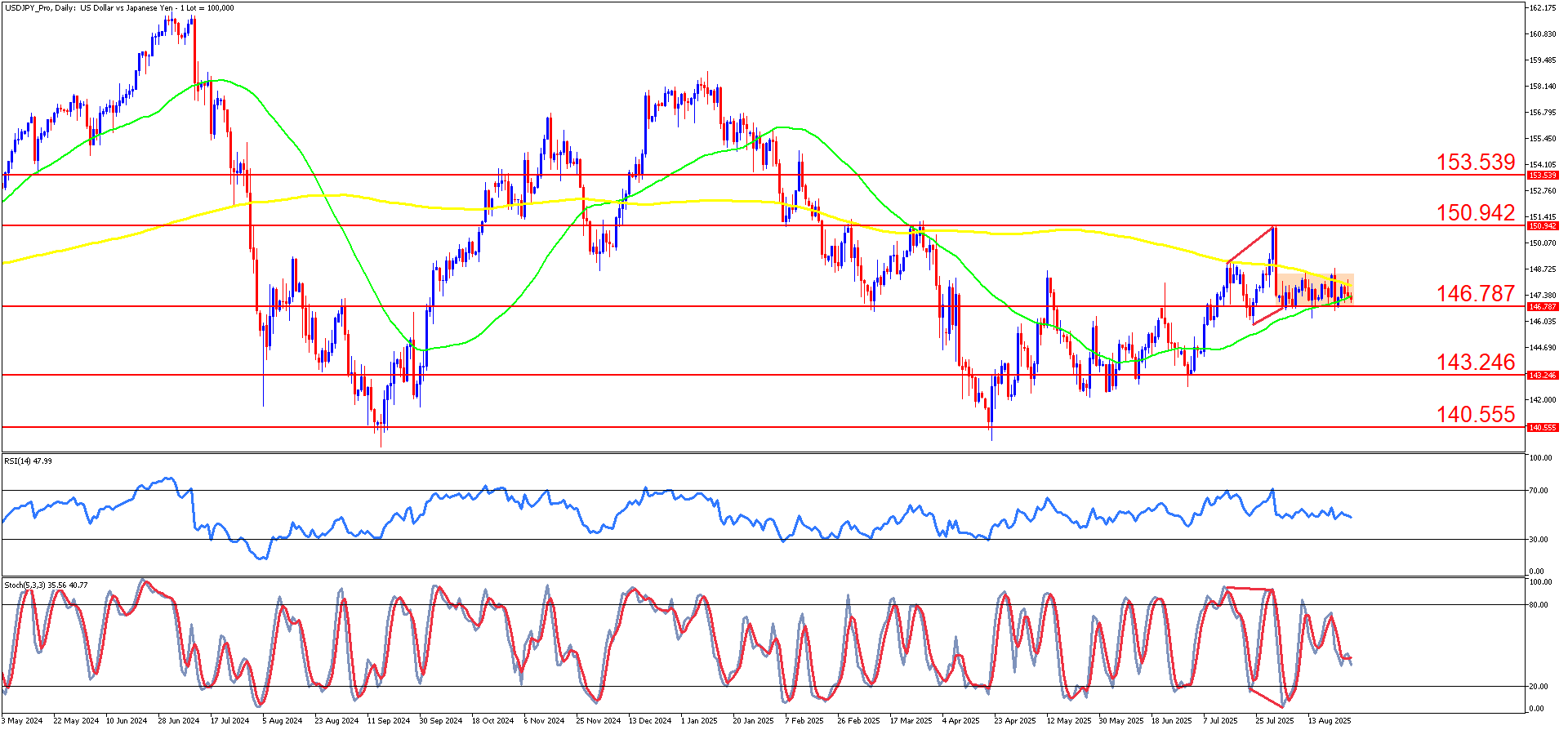

USDJPY on a daily timeframe has been trading in a wide range after a strong rally that peaked near 160.00 earlier this year. Following that high, the pair corrected sharply lower, retracing into the 140.00–145.00 zone before stabilizing. Since then, price action has shown a gradual recovery but with a more sideways structure, consolidating between 146.00 and 151.00 levels in recent months.

In the most recent sessions, price is oscillating narrowly around 146.80, which is marked as a key support and resistance pivot. Candles show indecision, with repeated tests of the 200-day moving average (yellow) and price closing near it. The upward attempt in late July toward 150.90 was rejected firmly, leading to a pullback that has since compressed volatility.

From an indicator perspective, the RSI is neutral at 47, suggesting neither bullish nor bearish momentum dominance. The stochastic oscillator is turning lower from the mid-zone, hinting at weakening buying pressure. The 50-day moving average (green) is slightly below price, while the 200-day moving average remains above, creating a squeeze pattern. Support stands clearly at 143.25 and 140.55, while resistance is set at 150.94 and 153.54.

The main scenario projects a continuation of the consolidation in the short term, with potential downside pressure as long as the pair remains capped below the 200-day moving average. A decisive break under 146.00 could trigger a test of 143.25, and if momentum strengthens, extend toward 140.55.

Alternatively, if bulls manage to hold the 146.80 level and regain momentum, a breakout above 148.50 and the 200-day moving average would shift bias toward retesting 150.94. A clear daily close above this level would likely attract further buying interest and open the path toward 153.54.

Fundamentally, over the past few days, the USDJPY has been influenced by U.S. Treasury yield movements, dovish commentary from the Federal Reserve suggesting rate cuts may begin later this year, and intervention concerns from Japanese officials as the yen remains weak. Traders have also been positioning ahead of U.S. PCE inflation data due later this week, along with the U.S. Non-Farm Payrolls report on Friday, which will be decisive for dollar sentiment. In Japan, inflation data and potential verbal interventions from the Ministry of Finance are the key drivers to watch, as authorities remain sensitive to yen depreciation near 150.00.

SUMMARY

- Range-bound at 146.80: USD/JPY consolidates after a big rally, stuck between 146–151.

- Technical squeeze: Neutral RSI, Stochastic turning lower, price caught between 50 & 200-day MAs.

- Critical levels ahead: Support 143.25 / 140.55, Resistance 150.94 / 153.54 — next break will drive direction.

- Macro catalysts: Fed vs. BoJ policies, U.S. yields, inflation & payroll data, and yen intervention risk in focus.