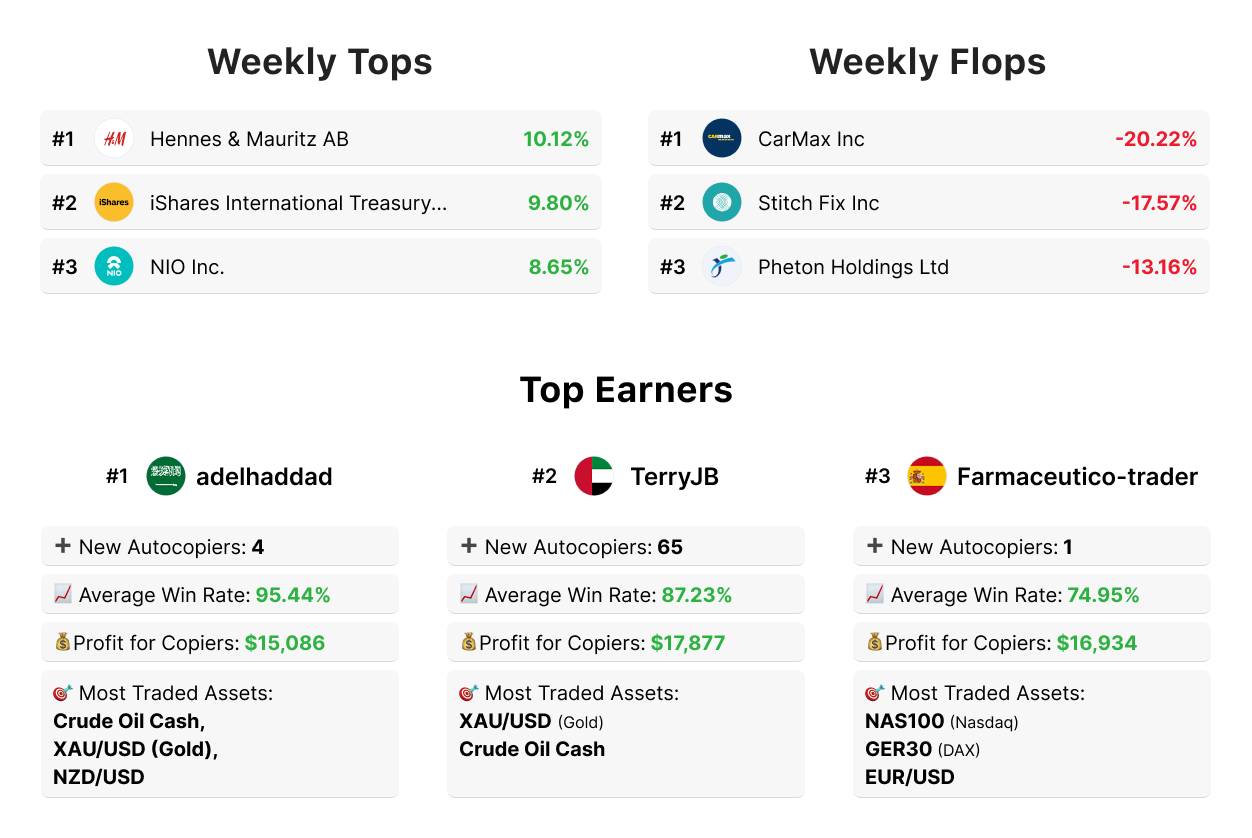

Markets were on edge this week as traders juggled central bank chatter and fresh geopolitical headlines. The S&P 500 dipped about 1% after a strong run, while European stocks felt the squeeze from higher energy costs and shaky fiscal outlooks. Bond yields kept swinging, safe havens caught a bid, and commodities became the go-to for directional clues.

The big question: where do rates go from here? The Fed’s latest cut has traders debating how fast easing could come, while the ECB stays cagey with inflation still sticky. Add geopolitical tension to the mix, and you’ve got a recipe for choppy trading.

It is important to remember to assess your financial situation and risk tolerance, before engaging in copy trading. Past performance and forecast are not reliable indicators of future results.

Eyes on Inflation, Ears on Central Banks

Monetary policy stayed front and center this week, with every speech and forecast picked apart for clues on easing cycles. Inflation is still the anchor — sticky in both the U.S. and Europe — keeping traders on edge. All eyes are now on the next round of policy signals and data drops, with sentiment cautious and positioning staying tight.

Explore Markets on NAGA

*Trading involves significant risk of loss.

Stocks Take a Breather, Europe Feels the Heat

The S&P 500 slid about 1% to kick off the week, dragged down by mega-cap tech and a wave of profit-taking after recent highs. Small caps held up a bit better but swung with shifting rate bets. Across the pond, European markets stayed under pressure from rising energy costs and shaky fiscal outlooks. Corporate news gave a few sectors some moves, but the real drivers are still policy signals and sticky inflation expectations.

*Trading involves significant risk of loss.

Gold Loses Shine, Oil Stuck in the Middle

Commodities grabbed the spotlight this week as gold tumbled nearly $50, weighed down by higher yields and shifting risk appetite — a reminder of just how tied the metal is to rate expectations. Oil couldn’t find a clear direction, swinging between weak demand signals and supply-driven headlines. Industrial metals stayed mixed: copper found some support from supply risks, while others flagged softer growth vibes.

*Trading involves significant risk of loss.

Dollar Holds Strong, FX Traders Eye Divergence

The dollar stayed resilient this week, backed by higher yields and safe-haven flows. The euro slipped as traders questioned how much room the ECB really has to ease with inflation still sticky. Sterling came under fire on fresh fiscal worries, while the yen weakened as policy divergence widened. Emerging market currencies were a mixed bag, swayed by commodity ties and shifting capital flows.

*Trading involves significant risk of loss.