Everybody likes a bargain, and stocks with low share prices certainly seem like bargains. With some high-priced stocks costing hundreds or even thousands of dollars for a single share, trading penny stocks can be a tempting way to try to grow your money quickly. While there can be sizable gains in investing in penny stocks, there are also equal risks of losing a significant amount of an investment in a short period.

There is quite a bit you should know before you dive in. If you want to invest in penny stocks right away, here is a quick guide that can help.

Getting Started with Penny Stocks – Quick Guide

- Research your penny stocks – Shortlist the best penny stocks for 2023 using strict criteria in order to pick the good businesses from the bad businesses.

- Define your strategy – trading lets you speculate on the price movement; dealing lets you take direct ownership of the stocks.

- Take your position – create an account with us to buy and trade in penny stocks listed on 10 global exchanges.

Alternatively, you can copy the moves of top performing traders in real-time with NAGA Autocopy.

What is a penny stock?

The exact definition of a penny stock varies, but typically they include stocks trading for less than $5 per share all the way down to even fractions of a penny. But usually, when people say penny stocks, they’re talking about those that trade for less than a dollar. Despite this lower price, penny stocks often don’t trade as many shares as their higher-priced rivals.

The US Securities and Exchange Commission (SEC) has formally defined a US penny stock as one with a share price below $5 per share, having previously been a stock below $1 per share beforehand. The EU and UK do not have their own formal definition although a penny stock is generally considered to have a share price of below €1 or £1.

Penny stocks are regarded as a more speculative investment than larger businesses because they are geared for growth and often loss-making, with many yet to generate any income or develop a viable product or service. As they are small, low-valued businesses, they offer higher risk and reward to traders. Many of these are quoted over the counter (OTC) but some also trade on exchanges.

Understanding penny stocks

Penny stock investors often erroneously think that a low share price indicates that the company has greater potential to grow than those with higher share prices. The valuation of a company -- also known as its market capitalization -- is determined by two factors:

- The stock price

- The number of shares outstanding

That second factor is crucial because how many shares to issue is entirely up to the company. One million shares outstanding at $100 per share is worth exactly as much as 100 million shares outstanding at $1 per share. Moreover, a company with a $100 share price very likely has much stronger growth potential than a company with a $1 share price.

Professional investors measure how expensive a stock is by comparing it to its earnings (the P/E ratio) or other similar metrics. That is, what your share in the earnings of the business is for the price that you pay for that share. On this basis, a profitable company whose stock trades at $200 is much cheaper than an unprofitable penny stock at any price.

Alternative ways to invest on a budget

It is possible to achieve strong returns by investing in young companies with small valuations or depressed stock prices, but typically it’s better to invest money only in companies that are larger and have less speculative valuations. Any risky stock buys should at least be limited to shares of companies that generate meaningful revenues -- or are pursuing clear, realistic paths to growth.

However, according to experts, there are better alternatives to penny stock investing. Thanks to the rise of fractional share trading, which enables purchases of less than one share, you can often invest in stocks for which the share price is extremely high. For instance, a single share in a company like Alphabet (GOOG) costs thousands of dollars, but you can buy any fraction of a share and still gain portfolio exposure to the stock's future performance.

ETFs are another affordable option for those on a budget, and they enable you to quickly diversify your portfolio as well. They're designed to mimic the performance of a market index, like the S&P 500, and so they end up with similar returns to the index itself or invest in a basket of stocks within a sector or specific theme.

How to invest with little money

What are the best penny stocks to trade?

There is an array of penny stocks operating in a broad range of industries for investors to choose from, including some names that will be well-known to investors and consumers. While some penny stocks are small firms chasing growth there are some big names that have subsequently become penny stocks following steep falls in value.

If you’re interested in penny stocks, you’ll need to be an excellent analyst who can pick good businesses from bad businesses.

NAGA Group AG (N4G)

- Price: 0.52

- Market Cap: 120.12M

Juventus Football Club (JUVE.MI) is one of the few football clubs publicly listed on the Milan Stock Exchange, alongside AS Roma and Lazio. Trading at around €2 per share, Juventus remains among Italy’s low-priced equities, with a market capitalization near €1 billion. The club’s latest financial results show steady progress — revenue climbed to about €530 million in fiscal 2025, while net losses narrowed to roughly €58 million from almost €200 million the previous year. This signals improved cost management and stronger commercial performance across sponsorships, broadcasting, and matchday income.

In recent quarters, NAGA has shown steady progress in platform adoption, technological innovation, and user engagement. The company’s focus on AI-driven trading tools, strategic partnerships, and global market expansion reflects its ambition to position itself among leading fintech players. With the increasing demand for accessible trading solutions and community-driven investing, NAGA’s business model benefits from strong secular trends in digital finance.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

While its stock remains in the low-price category, investors view NAGA as a potential growth story within the fintech sector. The combination of a scalable platform, improving revenue streams, and an expanding international footprint provides meaningful upside potential over the medium term. For traders on NAGA.com, the stock represents an opportunity to gain exposure to the digital trading ecosystem’s future growth — with manageable risk and long-term innovation potential.

Trade NAGA shares CFD I Invest in NAGA Stock

Juventus (MTA: JUVE)

- Price: €2.65

- Market Cap: €1.02B

Juventus Football Club (JUVE.MI) is one of the few football clubs publicly listed on the Milan Stock Exchange, alongside AS Roma and Lazio. Trading at around €2 per share, Juventus remains among Italy’s low-priced equities, with a market capitalization near €700 million. The club’s latest financial results show steady progress — revenue climbed to about €530 million in fiscal 2025, while net losses narrowed to roughly €58 million from almost €200 million the previous year. This signals improved cost management and stronger commercial performance across sponsorships, broadcasting, and matchday income.

Despite these improvements, Juventus continues to face challenges linked to its heavy debt load and historical governance issues. The stock suffered a sharp 40% decline in 2021 after investigations into accounting irregularities during the 2019–2021 period. Since then, investor confidence has slowly recovered as management implemented reforms and enhanced transparency in financial reporting. The club’s leadership is targeting a return to break even by 2027 through more disciplined operations and strategic brand expansion.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

From an investment standpoint, JUVE shares remain speculative but potentially undervalued. Independent valuations place the fair value at around €0.65 per share, while the current trading price is significantly lower — suggesting upside potential if the turnaround continues. For traders on platforms like NAGA, Juventus represents a high-risk, high-reward opportunity within the European sports-entertainment sector, ideal for those seeking exposure to recovery-driven and sentiment-sensitive stocks.

Trade JUVE shares CFD I Invest in JUVE Stock

Nokia (HEL: NOK)

- Price: $6.90

- Market Cap: $37B

Nokia (HEL: NOK) remains one of Europe’s most established technology and telecom infrastructure companies. As of November 2025, the stock trades around $6.90 per share, giving it a market capitalization of approximately $37 billion. This price level keeps Nokia among the more affordable large-cap equities, making it appealing to traders seeking low-cost exposure to the global telecom and 5G markets. The company continues to generate stable revenues from network equipment, cloud services, and intellectual property licensing, while advancing its investments in 6G and AI-driven network optimization.

Financially, Nokia has maintained a solid balance sheet and consistent free cash flow, supporting its dividend distribution policy. Recent quarterly results showed steady operating margins and moderate top-line growth, indicating resilience amid global supply chain pressures and competitive pricing in telecom equipment. The company’s focus on operational efficiency and capital discipline continues to strengthen its fundamentals, with management targeting sustained profitability and strategic growth through 2026 and beyond.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

However, despite these positives, Nokia’s share price performance remains relatively modest due to its large share base — about 5.5 billion shares outstanding — which limits rapid price swings. Competition from Ericsson, Huawei, and newer 6G entrants also weighs on sentiment. For traders on NAGA, Nokia represents a low-priced yet fundamentally stable large-cap stock, suitable for investors seeking long-term exposure to telecommunications infrastructure with moderate risk and consistent dividend potential.

Trade NOK shares CFD I Invest in NOK Stock

Aegon (AEX: AGN)

- Price: €6.76

- Market Cap: €12B

Aegon N.V. (AEG) is a Netherlands-based insurance company specializing in life insurance, pensions, and asset management, with operations across multiple geographies. The United States is its largest market, accounting for approximately 42% of earnings, followed by the Netherlands (34%) and the U.K. As of November 2025, Aegon trades at around $6.76 per share on the NYSE, giving it a market capitalization of approximately $12–12.5 billion. This positions Aegon as a low-priced large-cap stock, appealing to value-focused traders looking for dividend income and moderate risk exposure.

Financially, Aegon has strengthened its fundamentals in recent years. The company maintains a solid capital position, generates steady free cash flow, and offers an attractive dividend yield of roughly 5.5–6%. Management has also implemented a share repurchase program totaling €150 million in the first half of 2025, reflecting confidence in the company’s financial recovery and operational stability. These factors, combined with improved earnings metrics, make Aegon an appealing income-oriented investment within the insurance sector.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

However, Aegon still faces sector-specific challenges. Its performance remains sensitive to global interest rate fluctuations, competition in the life insurance market, and long-term liability management. While the stock appears undervalued relative to its intrinsic potential, it carries moderate risk — making it suitable for traders on NAGA seeking stable dividends and long-term recovery exposure, rather than rapid growth or highly speculative plays.

Trade AGN shares CFD I Invest in AGN Stock

WISH.COM Inc. (NASDAQ: WISH)

- Price: $7.40

- Market Cap: $198M

ContextLogic Inc. (LOGC, formerly WISH) was once a widely followed “meme‑stock” during the 2021 retail surge, but today it trades at around $7.40 per share and has a market capitalization in the vicinity of $198\ million. After its peak billions of dollars in market value, the company has undergone a dramatic transformation: it sold substantially all its operating assets (the Wish e‑commerce platform) and now operates primarily as a holding company preserving major net operating loss (NOL) carry‑forwards.

From a financial‑valuation viewpoint, the company presents some very cheap metrics: its price‑to‑book ratio is around 0.8. On the negative side, revenue generation and profitability have collapsed: the platform’s business model is largely discontinued, and operational risks are high — declining user base, delivery/consumer‑experience issues, and the macroeconomic backdrop disfavoring growth companies without strong earnings.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

For traders on NAGA seeking speculative opportunities, ContextLogic could be considered a “cheap play” with interesting upside — owing largely to its NOLs and ultra‑low valuation base — but it should also be treated as a high‑risk bet. Without a clear new operating business model and with the previous platform largely divested, any rebound would require a strong strategic pivot, acquisition, or monetization event.

Trade WISH shares CFD I Invest in WISH Stock

Atara Biotherapeutics Inc. (NASDAQ: ATRA)

- Price: $12.42

- Market Cap: $800M

Atara Biotherapeutics (ATRA) is a clinical‑stage biotech company focused on T‑cell immunotherapies for solid tumors, blood cancers and autoimmune diseases. As of October 2025, its market capitalisation stands at roughly $90‑100 million. This extremely low valuation puts ATRA firmly into the “penny stock / micro‑cap” category. The company’s recent operational metrics include very modest year‑over‑year revenue growth and no earnings in the conventional sense, underscoring the early‑stage nature of its business.

From a valuation standpoint, some metrics look superficially attractive: for example, a very low price‑to‑book or enterprise‑value relative to what might be expected if the pipeline is successful. Yet, the fundamental challenge is clear: Atara must still demonstrate clinical success, regulatory approvals, and scale of commercialization — and until then the value proposition remains highly speculative. The risk/reward trade‑off is accordingly elevated: if its lead programs succeed, upside could be meaningful; if not, downside risk remains high.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

For traders on NAGA, ATRA might appeal as a very high‑risk, high‑potential‑reward play — essentially a “turnaround/pipeline‑bet” rather than a stable income or mature business. Important “watch” factors would include: regulatory milestones (e.g., FDA outcomes), cash‑burn trajectory, any dilution from new equity issues, and signs of substantive commercial traction. It’s not suited for risk‑averse investors, but could be of interest to those comfortable with biotech micro‑caps and willing to monitor developments closely.

Trade ATRA shares CFD I Invest in ATRA Stock

Borussia Dortmund

- Price: €3.34

- Market Cap: 380M

Borussia Dortmund is the only German professional football club listed on the public market, having floated shares in October 2000 at an issue price around €11. Today the shares trade in the low-€3 range (≈ €3.50 as of late 2025) with a market capitalization near €380 million (per recent market data). The club generates revenue not just from matchday, broadcast and commercial rights, but also through merchandise, licensing (sports equipment) and other ventures — providing a broader business base than many pure sport-only operators.

Despite the diversified revenue streams, Dortmund’s share price has under-performed for years — including significant value loss since its peak levels, driven by sporting inconsistency, rising costs and the sensitivity of a football business to on-field results. For the 2023-24 financial year revenue rose to about €509.1 million (+21.7% y/y) and operating proceeds at €639 million (+24.0%) but the market response was muted, with the share price hovering around €3.60. The fact that the “brand” is strong and the club remains in Bundesliga and European competition provides a base for medium-term potential, but any material upside will depend on consistent performance and improved profitability.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

From a trading or investment perspective on platforms like NAGA, Dortmund can be seen as a speculative “cheap stock” in the sports-entertainment league: with a low absolute share price and modest market cap, there is appeal for high-risk, high-potential setups. However, the risks are significant — sporting results, transfer market exposure, broadcasting rights cycles and macro headwinds all affect the business. For traders comfortable with volatile assets, BVB offers exposure to a global football brand at a relatively low cost, but it should be treated as part of a broader diversified speculative portfolio rather than a stable “income” or conservative play.

Trade BVB shares CFD I Invest in BVB Stock

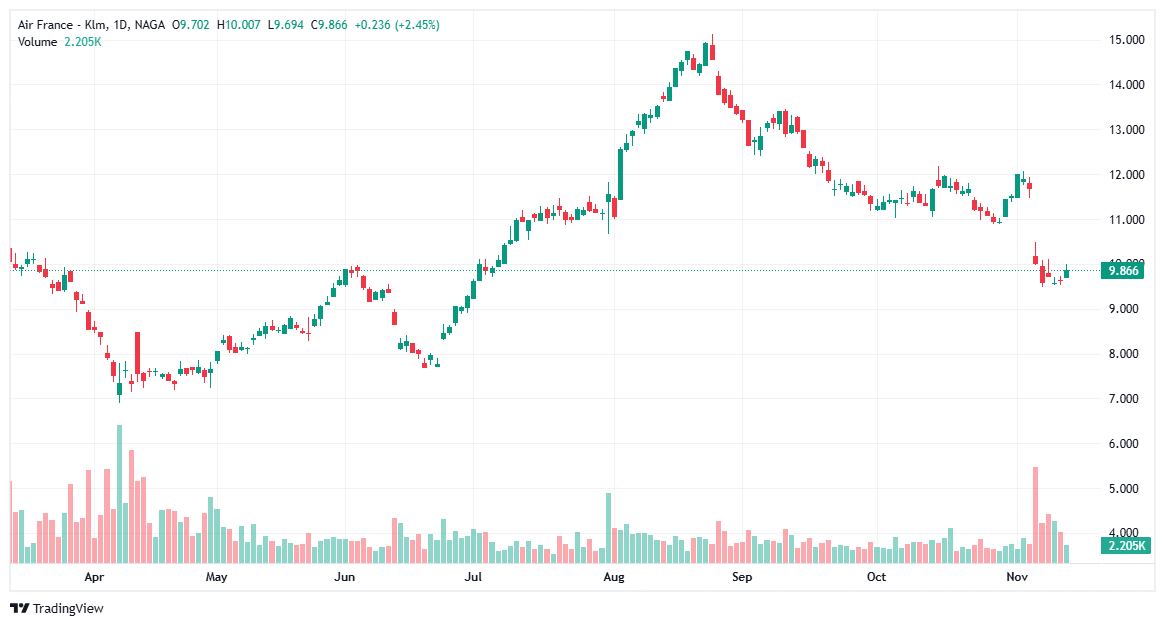

AirFrance (PAR: AF)

- Price: €9.6

- Market Cap: €2.5B

Air France-KLM is a major global airline group, with core operations in passenger transport, air-cargo, and aircraft maintenance services. As of November 2025, the company’s market capitalisation is approximately €2.5 billion, reflecting a sizeable drop from its pre-pandemic levels. The group reported full-year 2024 revenues of €31.5 billion and an operating result of €1.6 billion (operating margin of about 5.1 %). These figures illustrate that the business is recovering, but still operating at relatively thin margins for the industry.

From a valuation and fundamental perspective, Air France-KLM appears undervalued in certain metrics. For example, its EV/EBITDA is around 2.7×, which is very low for a large airline group. Return on equity (ROE) figures appear very high in some datasets (over 100%), which likely reflect accounting quirks or equity base distortions rather than a purely sustainable profitability model. On the flip side, the company remains exposed to industry risks (fuel cost volatility, labor/union issues, regulation, and macroeconomic weakness), which help explain the low valuation and moderate market expectation.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

For traders on NAGA, Air France-KLM may represent a high-risk, high-potential “cheap stock” in the travel/airline sector. The low price and modest capitalisation relative to the group’s global scale hint at upside if the industry recovers strongly and the group executes its strategy successfully. However, it should be approached with caution: the business is cyclical, margins remain tight, and execution risk is meaningful. As such, it might serve as a speculative addition to a diversified portfolio rather than a core “stable” income play.

Trade AF shares CFD I Invest in AF Stock

Note: While investing in penny stocks, investors must remember one has to be diligent in their research and invest their entire corpus in a diversified manner to hedge against potential risks that come with higher return prospects of penny stocks.

Some of the Best Stocks for فبراير 2026

Advantages of Investing in Penny Stocks

Due to their low volume, penny stocks tend to be more volatile than established equities. This means high opportunities for both gains and losses, and investors should be careful to understand both the risks and benefits.

Potential for High Returns

Most penny stocks have tiny market capitalizations, meaning it takes a small amount of money to move their share price substantially. Therefore, positive news, such as signing on a major customer or forming a new strategic alliance, can lead to sizeable returns before the mainstream investing world discovers the stock. Conversely, negative news can lead to significant losses.

Leverage

Penny stocks attract investors with a small amount of trading capital as their lower share prices allow them to buy thousands of shares. For example, if an investor has $500 to invest, they can purchase 2,000 shares of a penny stock trading at 25 cents. If that stock doubles over a month, the investor makes a quick 100% return on their investment. However, with the same starting capital, the investor could afford only a small number of shares in most USA 500 stocks, making it almost impossible to achieve those gains over the same period.

Risks of Investing in Penny Stocks

However, some factors exacerbate the risk associated with investing in or trading penny stocks. These securities are usually riskier than more established companies.

Low Liquidity

Penny stocks often trade on thin volume, meaning it can be difficult for investors to enter and exit their positions. Moreover, these stocks typically have a wider spread between the bid and ask, which increases trading costs. For example, if a penny stock has a bid price of $1.00 and an ask price of $1.50, a trader wanting to buy at market gets caught paying a 50 cent per share premium. Therefore, investors should use limit orders to minimize trading costs when buying and selling penny stocks.

Extreme Valuations

Penny stocks that start moving rapidly higher in price show up on stock screeners and may even get media attention. This often attracts more speculators who push prices up even higher, leading to unstainable valuations. For instance, during the dotcom bubble in the late 1990s, many penny technology stocks doubled and tripled in price despite not generating any earnings. However, when the market turned bearish a few years later, many Nasdaq-listed penny stocks with unsustainable valuations fell substantially or were delisted.

How to Invest in Penny Stocks

There are two routes to investing in penny stocks: speculating on their prices using CFDs or buying the assets in the hope they increase in value.

Trading penny stocks using CFDs

A CFD is a contract in which you agree to exchange the difference in the price of an asset from when you first open your position to when you close it. You are speculating on the price of the market rather than taking ownership of the stocks. If you open a long position and the stock or ETF does increase in value, you’ll make a profit, but if it falls in price, you’ll make a loss – the opposite is true for a short position.

Buying penny stocks and ETFs

This means that you take ownership of a portion of the company or fund outright, with the intention of holding it with a brokerage and profiting if it increases in value.

Exchange-traded funds (ETFs) like iShares Microcap ETF allow you to invest in a basket of selected penny stocks at once as opposed to any single company. ETFs are traded much like ordinary stocks.

Get Started with NAGA.com

- Choose which type of account you want to use. Your first concern should be your risk appetite and time horizon. If you want to buy and hold penny stocks, open an investing account. If you want to speculate on price movements (including falling prices) with tight spreads and leverage, open a CFD trading account.

- Create an account. Regardless of your chosen account, you need to register and complete the KYC process to verify your identity.

- Fund your account with fiat money. Before buying and trading any penny stock, you need to fund your exchange account with U.S. dollars, Euros, or other currencies.

- Select your stocks. When selecting penny stocks, consider the number of shares available, share liquidity, and the risk of dilution if there are too many shares outstanding. Alternatively, investors can buy shares in micro-cap ETFs.

- Place a buy order for your chosen stock. Follow the steps required by the trading platform to submit and complete a buy order.

When trading stocks, the CFDs (contracts for difference) are stored in your account and are more liquid than the underlying asset. However, you should be aware that CFD trading is fast-moving and requires close monitoring. As a result, traders should be aware of the significant risks when trading CFDs. There are liquidity risks and margins you need to maintain; if you cannot cover reductions in values, your provider may close your position, and you'll have to meet the loss no matter what subsequently happens to the underlying asset.

With NAGA, you can trade a wide range of CFDs on stocks and invest in +3.000 stocks and ETFs with ownership.

Final words

While penny stocks are volatile, there are some cautions that an investor can take to reduce their downside risk. One is to conduct proper due diligence: Since penny stocks tend to trade in venues with lower entry requirements, investors should take extra care to read the company's statements and ensure that the company is financially sound.

It is also important to rely on reputable stockbrokers. While there are scams to watch out for, most of them are promoted by dubious emails and cold calls. A reputable broker should be able to provide high-quality written research to back up any investment claims.

Finally, as with any speculative investment, never put in more money than you can afford to lose.

Free resources

Before you start investing and trading in penny stocks, you should consider using the educational resources we offer like NAGA Academy or a demo trading account. NAGA Academy has lots of free trading courses for you to choose from, and they all tackle a different financial concept or process – like the basics of analyses – to help you become a better trader or make more informed investment decisions.

Our demo account is a suitable place for you to learn more about leveraged trading, and you’ll be able to get an intimate understanding of how CFDs work – as well as what it’s like to trade with leverage – before risking real capital. For this reason, a demo account with us is a great tool for stock investors who are looking to make a transition to leveraged trading.