As many tech companies have sensed the excitement and are making moves to be part of the next big thing, the opportunity for investors is considerable. The key is to choose the stocks that are set to benefit the most from the rush to the metaverse. However, most likely only a few are going to be integral to the metaverse, reaping the big rewards.

There is quite a bit you should know before you start investing. If you want to invest in metaverse stocks right away, here is a quick guide that can help.

Getting Started with Metaverse Stocks - Quick Guide

- Research your metaverse stocks – You can get exposure to stocks of entities that are involved in the creation and make-up of the metaverse.

- Define your strategy – Trading lets you speculate on the price movement; dealing lets you take direct ownership of the metaverse stocks.

- Take your position – create an account with us to start trading or investing in metaverse stocks.

- Copy lead traders – Alternatively, copy the moves of top performing traders in real time with NAGA Autocopy.

Trade Metaverse Stocks Invest in Metaverse Stocks Start Copy Trading

What is a Metaverse?

The metaverse is a virtual space that's collectively owned and shaped by the community. This virtual space allows people to meet, socialize and attend virtual events such as concerts, work, and games. Oftentimes, Web3, blockchain, and NFTs are correlated with the metaverse. This technological combo is seen as a huge revolution for digital products and experiences.

The first time many investors heard of the concept was in October 2021 when Facebook announced it was changing its name to Meta Platforms, with a focus on bringing the metaverse to life.

Two months later, Bloomberg projected that the metaverse could be a nearly $800 billion market opportunity. At the start of Q2 2022, Citi released a report that projects the addressable market for the metaverse will reach between $8 trillion and $13 trillion by 2030.

In other words, the metaverse is on track to dwarf other high-profile technology trends including electric vehicles (EVs) and cryptocurrency.

What are Metaverse stocks?

Metaverse stocks are considered companies listed on the stock market that are focused on the development of the metaverse. A metaverse investment could involve stocks of public companies developing infrastructure for the metaverse, as well as those creating virtual worlds and pioneering content, commerce, and social experiences.

While most still confuse the metaverse with online gaming, brands and internet users are starting to get involved in this space, including many big-name brands, such as Nike. For instance, Nikeland exists in the metaverse to establish the brand’s digital presence in the space while also promoting its digital assets. But they’re not the only ones who rushed to the metaverse. Other big consumer brands have already established a metaverse presence.

Metaverse stocks are categorized into several groups:

Hardware – Companies that sell and support consumer and enterprise hardware used to access, interact with or develop the metaverse. Compute – Companies that enable and supply computing power to support physics calculation, data reconciliation, and artificial intelligence, among others. Virtual platforms – Companies developing and operating immersive three-dimensional simulations and worlds for consumers to interact with.

Networking – Companies that provide, manage and transmit data. Interchange standards – Companies that provide real-time connections, high bandwidth, and decentralized data transmission. Payments – Companies that provide digital payment processes, and fiat on-ramps to cryptocurrencies. Content, assets, and identity services – Companies that design, create, sell, store and manage digital assets such as NFTs and crypto.

Investors may be interested in metaverse stocks to get in early on that metaverse-fueled growth and do so at a discounted price compared to what most of these stocks traded for last fall or even at the start of the year.

Since most metaverses are closely related to the blockchain and their economies use digital assets, investors looking to gain exposure to new technologies may also be interested in NFTs, and metaverse crypto coins.

Top metaverse stocks to watch

Here are eight metaverse stocks that are potentially positioned to be big winners in this next wave of technology, according to analysts:

META Platforms (META)

Meta Platforms (META), formerly known as Facebook, is a company that pioneered virtual reality (VR) and social networking apps. The company also launched the Oculus VR headset as hardware to help users get the full immersive metaverse experience. The company owns a reality lab division that is responsible for the metaverse and virtual reality experiences. While the primary source of income comes from selling advertising space on their social platforms, the VR/AR business segment of Meta Platforms generated $1.6 billion in revenue for the first half of 2025.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

The company continues investing heavily in its metaverse vision but faces operating losses in Reality Labs. Meta Platforms' stock price performance shows that it has done exceptionally well since going public in 2012, though the company now balances significant spending on AI and infrastructure alongside metaverse ambitions.

Roblox (RBLX)

Roblox (RBLX) stands as a prominent player in the metaverse domain — not just a gaming platform, but a social creation ecosystem where millions connect, build, and engage. As of Q3 2025, Roblox reported revenue of approximately $1.92 billion, up significantly year‑over‑year, and bookings of around $1.92 billion, representing strong growth in in‑game spending and platform adoption. Daily active users surged to over 150 million, and engagement hours climbed towards 40 billion hours during the quarter.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

Despite the robust user metrics, Roblox still operates at a net loss — the company continues to invest heavily in infrastructure, creator incentives and global expansion to monetise its social‑metaverse vision. For investors and traders eyeing metaverse stocks on platforms like NAGA, Roblox presents a high‑growth opportunity: its scale, brand recognition, and network effects give it leverage in the race to define digital social spaces. At the same time, the risk profile remains elevated, as profitability, competition and user‑monetisation are key variables yet to fully materialise.

Nvidia (NVDA)

Nvidia (NVDA) is one of the most influential semiconductor companies powering the metaverse. Its advanced GPUs and AI-accelerated chips are essential for real-time rendering, 3D simulation, and large-scale virtual environments. Nvidia’s Omniverse platform — a scalable, real-time 3D development ecosystem — has become a major pillar for companies building immersive digital worlds, digital twins, and collaborative virtual workplaces. The company’s hardware also supports major metaverse-related infrastructure projects, including Meta Platforms’ supercomputing initiatives, making Nvidia indispensable to the next generation of interactive virtual experiences.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

In fiscal 2025, Nvidia reported revenue of roughly $130.5 billion, driven largely by explosive demand in AI and high-performance computing. The stock has surged dramatically over the past several years, cementing Nvidia’s position as a core beneficiary of the AI mega-trend in 2025. While the metaverse narrative has evolved, Nvidia continues to provide the foundational technology behind its growth — from 3D content creation to cloud simulation. This makes NVDA one of the most strategically important metaverse-linked stocks to watch for long-term investors.

Microsoft (MSFT)

Microsoft (MSFT) remains one of the world’s most influential technology companies and a major contender in shaping the metaverse ecosystem. The company continues to expand Microsoft Mesh — its collaborative mixed-reality platform — enabling immersive meetings, shared 3D workspaces, and avatar-based interaction across Microsoft Teams and enterprise environments. Mesh now includes customizable immersive spaces designed for training, remote collaboration, and corporate events, positioning Microsoft as a leader in enterprise-focused metaverse infrastructure. Beyond collaboration tools, Microsoft is integrating metaverse capabilities into Azure, supporting developers and companies building large-scale virtual environments and digital twins.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

Although the planned acquisition of Activision Blizzard was ultimately abandoned in 2023, Microsoft continues to strengthen its presence in immersive gaming and cloud-based experiences through Xbox, Game Pass, and Azure Gaming services. Financially, Microsoft remains one of the most resilient mega-cap stocks: as of late 2025, shares have delivered strong long-term returns, supported by consistent revenue growth across cloud computing, AI integration, and enterprise software. MSFT is also one of the few major tech players that pays a steady dividend, making it a compelling choice for metaverse investors seeking both innovation exposure and defensive stability.

Snap (SNAP)

Snap Inc. (SNAP), the parent company of Snapchat, remains a major innovator in augmented reality — a foundational layer of the metaverse. While Meta focuses heavily on VR, Snap has doubled down on AR experiences that blend digital content with the physical world. Snapchat’s 3D Bitmoji avatars, advanced lenses, and immersive filters continue to attract a large Gen Z and Gen Alpha user base, positioning Snap as a leader in social AR interaction. The company’s AR development ecosystem, Lens Studio, now hosts millions of community-built AR experiences, making Snap a hub for creators contributing to metaverse-ready digital environments.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

Snap is also advancing its hardware ambitions with the next generation of Spectacles, lightweight AR glasses designed for creators and real-world digital overlays. These glasses support real-time AR effects, gesture-based interaction, and environmental mapping — capabilities that place Snap ahead of many competitors in wearable AR innovation. Despite ongoing monetization challenges and increased competition, Snap’s focus on practical AR adoption rather than fully immersive VR worlds makes it a strategically unique metaverse play. For investors watching metaverse-driven social platforms, SNAP offers exposure to AR hardware, creator ecosystems, and next-generation digital interaction.

Apple (AAPL)

Apple (AAPL) has spent years positioning itself as a major force in the future of spatial computing — Apple’s preferred term for the metaverse. While the company first introduced ARKit in 2017, enabling developers to build advanced augmented-reality experiences on iPhone and iPad, its biggest leap came with the launch of Apple Vision Pro in 2024. This mixed-reality headset blends digital content seamlessly with the physical world, offering ultra-high-resolution displays, hand- and eye-tracking, spatial apps, and immersive environments. Vision Pro represents Apple’s first dedicated step toward a spatial computing ecosystem, where productivity, entertainment, and social interaction coexist in a 3D space.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

Apple’s strategic advantage comes from its massive global ecosystem—over 2 billion active devices—and its tight integration of hardware, software, and services. The company is already expanding VisionOS, opening the door for immersive apps, 3D content creation, and next-generation communication tools. While Vision Pro remains a premium device with early-adopter pricing, Apple is reportedly developing more affordable models to widen mainstream adoption. With its brand strength, developer community, and history of redefining consumer technology, Apple is well-positioned to become one of the most influential players in the emerging metaverse landscape.

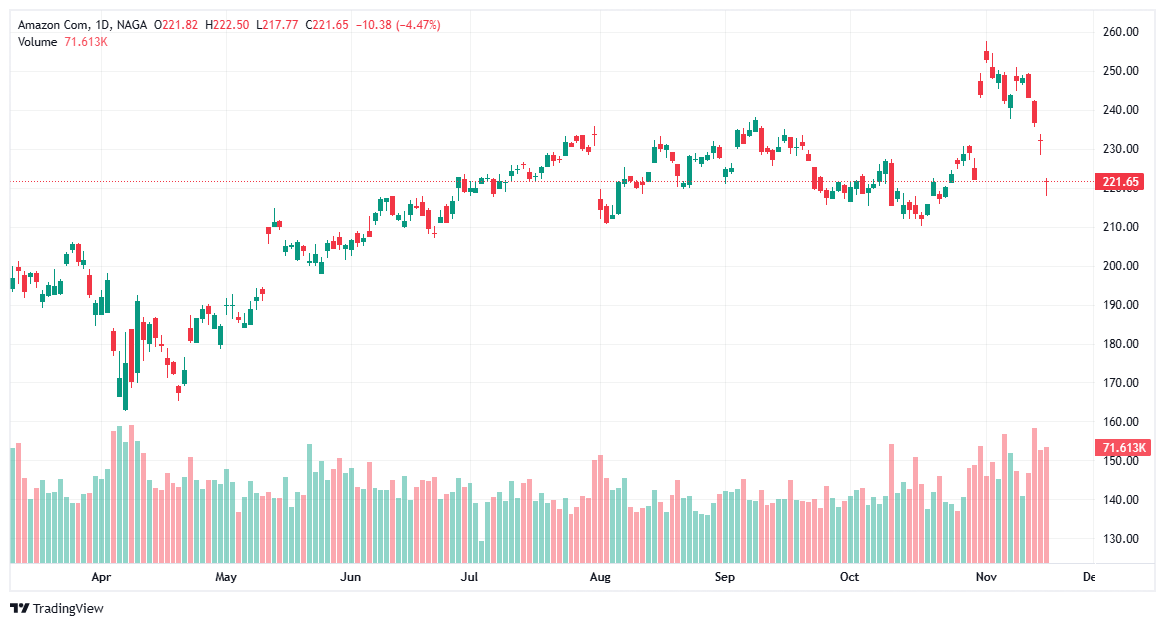

Amazon (AMZN)

Amazon (AMZN) remains one of the most influential companies shaping the future of digital commerce, and its role naturally extends into metaverse-related technologies. The company already incorporates advanced AR tools in its shopping experience—allowing users to visualize furniture, décor, and household items directly in their homes. As immersive shopping becomes more common, Amazon is expected to expand these capabilities further through VR showrooms, interactive 3D product previews, and more personalized virtual retail experiences. The company’s massive data ecosystem, AI expertise, and dominance in online retail create a strong foundation for metaverse-driven commerce.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

Beyond consumer applications, Amazon Web Services (AWS) plays a central role in building the infrastructure required for the metaverse. AWS is the world’s largest cloud computing provider, powering a significant share of global digital platforms, gaming environments, and enterprise applications. As virtual worlds, spatial apps, and immersive online interactions require vast computing resources, Amazon stands to benefit from increased demand for cloud storage, rendering, networking, and developer tools. Combined with its advertising network and e-commerce scale, Amazon is positioned to be a major enabler—and beneficiary—of the next generation of AR, VR, and metaverse experiences.

Top Metaverse Stocks Investment Comparison 2025

Company Ticker Key Metaverse Focus Market Cap (approx.) Notable Attributes Meta Platforms META VR/AR hardware and virtual social environments $1.8 trillion Leader in VR with Quest, owns large virtual social spaces Roblox RBLX Virtual worlds, user-generated content and gaming $95.7 billion Popular virtual experience platform with active user base Nvidia NVDA GPU and AI chips for rendering and simulation $600+ billion Provides critical hardware enabling metaverse computing Microsoft MSFT Cloud infrastructure, collaborative 3D environments $2.5 trillion Powers enterprise-scale metaverse with Azure and Mesh Snap SNAP AR lenses, social augmented reality apps $40+ billion Leader in mobile AR experiences through Snapchat platform Apple AAPL AR hardware and mixed reality software $3+ trillion Creator of Vision Pro headset; strong AR ecosystem Amazon AMZN Cloud services, e-commerce virtual experiences $1.3+ trillion Provides AWS cloud backbone for metaverse infrastructure

Alternatively, investors can buy shares in metaverse-oriented exchange-traded funds (ETFs). Prospective shareholders should first understand and agree with how a fund selects investments for its portfolio. These ETFs invest in prominent metaverse-related companies with the hope of matching or outperforming benchmark indices.

Metaverse ETFs are a popular option for investors who want to gain portfolio exposure to the metaverse without having to research and choose individual stocks themselves.

You can find an ETF to suit any metaverse investment strategy you desire by using NAGA Web Trader.

How to invest in metaverse stocks

There are two routes to investing in metaverse stocks: speculating on their prices using CFDs or buying the assets in the hope they increase in value.

Trading metaverse stocks using CFDs

A CFD is a contract in which you agree to exchange the difference in the price of a cryptocurrency from when you first open your position to when you close it. You are speculating on the price of the market rather than taking ownership of the metaverse stocks. If you open a long position and the cryptocurrency or stock or ETF does increase in value, you’ll make a profit, but if it falls in price, you’ll make a loss – the opposite is true for a short position.

Before you can start, you would need to open a CFD trading account.

Buying metaverse stocks

This means that you take ownership of a portion of the company outright, with the intention of holding it with a brokerage and profiting if it increases in value.

Before you can start, you would need to open an investing account with a broker like NAGA.com.

Each investor should research the available ways to invest in the metaverse before deciding what’s the best option for their situation. Decide whether you want to buy stock or trade stocks. Remember that the metaverse and its assets are volatile assets, as it’s the case with crypto, and you shouldn’t invest more than you are willing to lose.

Some of the most popular metaverse investments are ETFs and stocks because these investments do not require investors to get involved in the metaverse space. Another advantage when investing in metaverse stocks is that you can also use U.S. Dollars instead of cryptocurrency.

Getting started with NAGA.com

Here is how to invest in metaverse stocks with an international, highly regulated broker like NAGA.com:

- Choose which type of account you want to use. Your first concern should be your risk appetite and time horizon. If you want to buy and hold metaverse stocks, open an investing account. If you want to speculate on price movements (including falling prices) with tight spreads and leverage, open a CFD trading account.

- Create an account. Regardless of your chosen account, you need to register and complete the KYC process to verify your identity.

- Fund your account with fiat money. Before buying and trading any metaverse stock, you need to fund your exchange account with U.S. dollars, Euros, or other currencies.

- Select your metaverse stocks. It’s time to decide on your first metaverse stock investment. We strongly recommend that you thoroughly research the public companies that are somehow invested in the metaverse. Alternatively, investors can buy shares in metaverse ETFs.

- Place a buy order for your chosen Metaverse stock. Follow the steps required by the trading platform to submit and complete a buy order for one or more metaverse stocks.

When trading metaverse stocks, the CFDs (contracts for difference) are stored in your account and are far more liquid. However, you should be aware that CFD trading is fast-moving and requires close monitoring. As a result, traders should be aware of the significant risks when trading CFDs. There are liquidity risks and margins you need to maintain; if you cannot cover reductions in values, your provider may close your position, and you'll have to meet the loss no matter what subsequently happens to the underlying asset.

With NAGA, you can trade CFDs on a wide range of stocks and invest in +3.000 stocks with ownership.

Pros and Cons

Before developing your investment plan, keep in mind that the metaverse is an emerging technology, and nobody can say if internet users will adopt this in the future. With that said, here are the pros and cons of investing in metaverse stocks.

Pros of investing in Metaverse stocks

Metaverse stocks can be bought with fiat money, and no blockchain or cryptocurrency transaction is needed. Investors can make money from their metaverse stock investments and receive dividends based on the company's profits over time. Metaverse stocks belong to public companies that have a long history on the market. This can give you a predictable return on your investment. These well-established companies are listed on the major stock exchanges, and they provide access to financial and data analysis reports. Metaverse stocks are less volatile (than crypto or other related digital assets) as the companies offering them have various income sources and don’t rely entirely on this emerging technology. Metaverse stocks can help investors diversify their investment portfolio across different industries and countries. Investors can also choose to invest in metaverse ETFs, which provide exposure to a basket of stocks with interest in the metaverse.

Cons of investing in metaverse stocks

The metaverse is an emergent technology, and any investment can result in a loss. The metaverse stocks' share prices can be extremely sensitive to industry news and developments. If the company has financial difficulties, the stock price may drop. If the company isn’t profitable, investors will not receive any dividends.

Metaverse Stocks Summary

The metaverse is a trending word and has already started attracting many companies that want to link their names to this emerging technology. But only time will tell if all these companies will succeed and deliver tangible returns to shareholders.

Today, investors have more opportunities than ever, as major tech giants and innovative startups continue to develop AR, VR, AI, and 3D simulation technologies that form the foundation of the metaverse. While market volatility and shifting consumer demand have caused notable fluctuations in share prices in recent years, long-term adoption trends remain supportive. Investors should closely monitor company fundamentals, product ecosystems, and real-world applications to determine which metaverse-related stocks have the strongest potential to benefit from ongoing digital transformation.

Free resources

Before you start investing and trading in metaverse stocks, you should consider using the educational resources we offer, like NAGA Academy or a demo trading account. NAGA Academy has lots of trading and investing courses for you to choose from, and they all tackle a different financial concept or process – like the basics of analyses – to help you to become a better trader or make more informed investment decisions.

Our demo account is a suitable place for you to learn more about leveraged trading, and you’ll be able to get an intimate understanding of how CFDs work – as well as what it’s like to trade with leverage – before risking real capital. For this reason, a demo account with us is a great tool for stock investors who are looking to make a transition to leveraged trading.