An investment in an IPO has the potential to deliver attractive returns, but sometimes investors lose a lot of money. Prior to investing, it is important to understand how the process of trading these securities differs from ordinary stock trading, along with the additional risks and rules associated with IPO investments.

How to Trade and Invest in IPO Stocks – Quick Guide

- Check the upcoming IPOs. Our guide includes key facts about upcoming debuts on Nasdaq’s IPO calendar and other major stock exchanges.

- Decide how to take a position on an IPO: With us, you can trade or invest in the shares once the company has completed the IPO.

- Build your IPO trading plan and strategy. Make sure you know about trade planning and risk management, including when you plan to take profits and cut losses.

- Copy lead traders. Copy the moves of top performing traders in real-time with NAGA Autocopy.

What is an IPO?

There are thousands of companies that trade on the New York Stock Exchange (NYSE), Nasdaq, or Tadawul. These companies range from the leviathan Apple or Saudi Aramco to the smaller, more inconsequential companies, with market capitalizations of less than the price of a car.

Every one of those companies had to start somewhere. They each sprang to trading life with initial public offerings (IPOs), turning from private companies to public ones, attracting investors, and raising capital.

An initial public offering (IPO) is when a private company becomes public by selling its shares on a stock exchange.

Private companies work with investment banks to bring their shares to the public, which requires tremendous amounts of due diligence, marketing, and regulatory requirements.

Purchasing shares in an IPO is difficult as the first offering is usually reserved for large investors, such as hedge funds and banks.

Common investors can purchase shares of a newly IPO-ed company quickly after the IPO.

When an IPO has happened, you can go long or short on share prices through CFD trading or buy shares with ownership Remember, if you’re trading, you can profit from upward or downward share price movements.

How Does an IPO Work?

Going public is a challenging, time-consuming process that’s difficult for most companies to navigate alone. A private company planning an IPO needs not only to prepare itself for an exponential increase in public scrutiny but also so must file a ton of paperwork and financial disclosures to meet the requirements of the Securities and Exchange Commission (SEC), which oversees public companies.

That’s why a private company that plans to go public hires an underwriter, usually an investment bank, to consult on the IPO and help it set an initial price for the offering. Underwriters help management prepare for an IPO, creating key documents for investors and scheduling meetings with potential investors, called roadshows.

The underwriter puts together a syndicate of investment banking firms to ensure widespread distribution of the new IPO shares. Each investment banking firm in the syndicate will be responsible for distributing a portion of the shares.

Once the company and its advisors have set an initial price for the IPO, the underwriter issues shares to investors, and the company’s stock begins trading on a public stock exchange, like the New York Stock Exchange (NYSE) or the Nasdaq.

Why Do an IPO?

An IPO may be the first time the public can buy shares in a company, but it’s important to understand that one of the purposes of an initial public offering is to let early investors in the company cash out their investments.

Think of an IPO as the end of one stage in a company’s life cycle and the beginning of another—many of the original investors want to sell their stakes in a new venture or a start-up. Alternatively, investors in more established private companies that are going public also may want the opportunity to sell some or all their shares.

There are other reasons for a company to pursue an IPO, such as raising capital or boosting a company’s public profile:

- Companies can raise additional capital by selling shares to the public. The proceeds may be used to expand the business, fund research and development, or pay off debt.

- Other avenues for raising capital, via venture capitalists, private investors, or bank loans, may be too expensive.

- Going public in an IPO can provide companies with a huge amount of publicity.

- Companies may want the standing and gravitas that often come with being a public company, which may also help them secure better terms from lenders.

While going public might make it easier or cheaper for a company to raise capital, it complicates plenty of other matters. There are disclosure requirements, such as filing quarterly and annual financial reports. They must answer to shareholders, and there are reporting requirements for things like stock trading by senior executives or other moves, like selling assets or considering acquisitions.

Pros of IPOs

A successful IPO can raise massive amounts of capital, as becoming listed on a stock exchange can help to increase the exposure and public image of a company. In turn, the firm’s sales and profit can increase. IPOs are also beneficial to traders because it’s easier to buy publicly traded shares than those that only trade privately.

Cons of IPOs

Public companies are subjected to the rules and regulations of a governing body. One of the rules is that it is required to publicly disclose financials, such as accounting information, tax, and profits. IPOs also carry significant costs and could require the company to raise additional funding if its shares perform poorly.

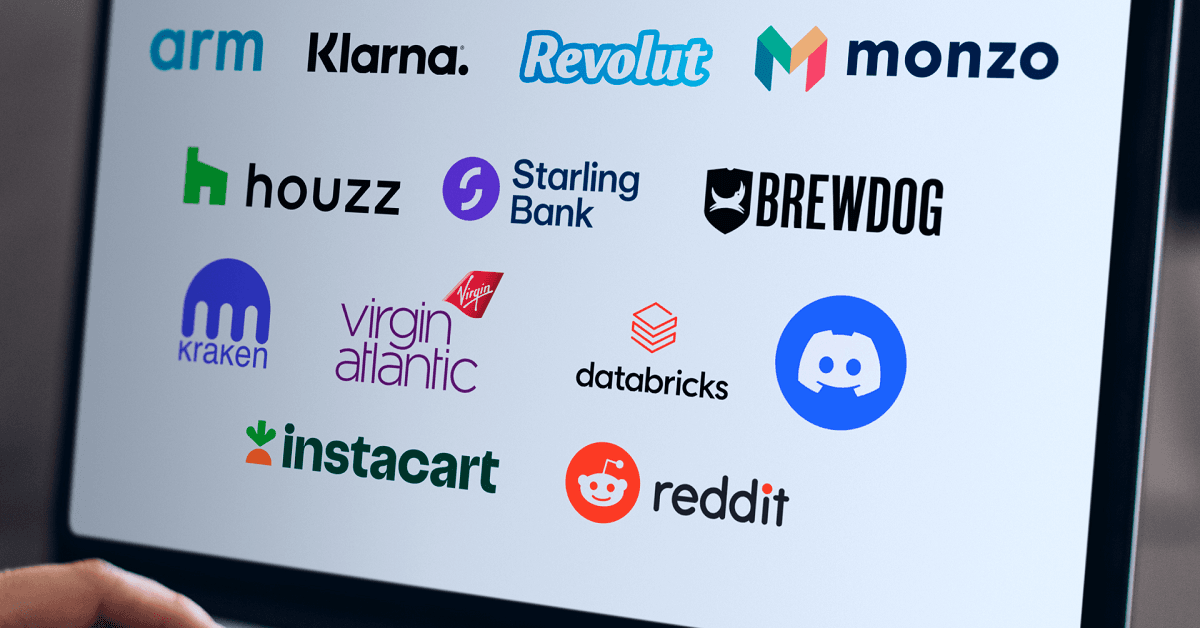

Upcoming IPOs 2026

It’s been a lackluster year for IPOs, as economic uncertainty has led many companies to take a ‘wait and see’ approach. However, more activity could be on the cards as 2023 progresses. Discover the US, Europe, UK, and Asia IPO contenders to watch.

1. Stripe IPO (estimated market cap: $106 billion)

2. Shein IPO (estimated market cap: $66 billion)

3. Databricks IPO (estimated market cap: $42 billion)

4. Canva IPO (estimated market cap: $42 billion)

5. Cohesity IPO (estimated market cap: $17 billion)

6. Deel (estimated market cap: $12.6 billion)

7. Plaid (estimated market value: $6.1 billion)

8. Revolut (estimated market cap: €75 billion)

9. SumUp (estimated market cap: £11.1 billion)

10. Visma (estimated market cap: £16.2 billion)

11. Monzo (estimated market cap: £6 billion)

12. PayPay (estimated market cap: $20 billion)

Upcoming US IPOs

The American IPO space, particularly its tech stocks, shows no sign of slowing down in 2026. Are these the best upcoming US IPOs?

Stripe IPO (estimated market cap: $106 billion)

Stripe, a major payment processing company based in San Francisco, is one of the most anticipated IPOs for 2026, with a valuation that could reach or exceed $106 billion at the time of listing.

Stripe IPO timing remains uncertain, with management weighing market conditions and strategic factors, including tax efficiency. As a dominant player in global online payments processing, Stripe's entry into the public markets is closely watched, expected to provide significant liquidity for current investors and employees while unlocking broader retail access for public investors.

Stripe's potential listing would likely be on the NYSE or NASDAQ.

Databricks IPO (estimated market cap: $62 billion)

Databricks, a key player in Artificial Intelligence and data technology, is widely considered a strong contender for an initial public offering (IPO) within the next year. Based in San Francisco, the company ranks among the top 10 most valuable private tech firms globally.

In December 2024, Databricks secured a significant $10 billion funding round, the largest of 2024, which valued the company at around $62 billion.

Market experts believe the IPO will attract significant interest, comparing Databricks with companies like Snowflake, Crowdstrike, and large tech players such as Alphabet, Amazon, or Microsoft, making it a key growth opportunity in AI-driven enterprise software.

Cohesity IPO (estimated market cap: $17 billion)

Cohesity, a data security firm headquartered in California and backed by investors including Nvidia, is preparing for a 2026 IPO with an expected valuation of around $17 billion. The company is aiming to capitalize on a growing market by leveraging AI technology for threat detection.

Cohesity delayed its IPO to strengthen its market position and to merge with Veritas’ data protection unit, a deal completed in December 2024.

The company is comparing its valuation to Rubrik (RBRK), which went public in April 2024 and is valued at over $17 billion. A Cohesity IPO at or above Rubrik's valuation would more than double the company's value since the Veritas merger.

Deel IPO (estimated market cap: $12.6 billion)

Deel is a San Francisco-based human resources and payroll software company planning an IPO as soon as 2026. It has achieved a substantial annual revenue run rate of $800 million, marking a 70% year-over-year growth, and recently raised $300 million in a secondary share sale, boosting its valuation to $12.6 billion.

Deel intends to list publicly in the U.S., aiming to capitalize on its rapid growth fueled by the rise in remote work since the pandemic. Investors are attracted to Deel’s industry-leading position, robust financials, and the potential for continued expansion in global HR services.

Experts note that Deel IPO could reinvigorate the public market, which had slowed due to rising interest rates, and the addition of experienced board members further strengthens investor confidence.

Plaid IPO (estimated market cap: $6.1 billion)

Plaid is a San Francisco-based fintech company specializing in connecting consumer bank accounts to financial applications and expanding into lending, identity verification, credit reporting, and anti-fraud services. While Plaid IPO had been anticipated for 2025, it has been confirmed it will not go public this year but continues to track the milestone with plans to go public eventually, potentially in 2026.

The company recently raised $575 million at a $6.1 billion valuation, a significant reduction from its previous $13.4 billion valuation in 2021, reflecting broader market contraction. Plaid has reported strong revenue growth of over 25% in 2024, a return to positive operating margins, and a meaningful increase in enterprise customers, including Citi and Robinhood.

From a stock investing perspective, Plaid's delay in IPO allows the company to strengthen its financials and product suite while maintaining optimism for future market conditions. This cautious approach appeals to investors who value sustainable growth and market timing over rushed public offerings.

Some of the Best US Stocks for Maret 2026

Upcoming EU&UK IPOs

Which of these could be the best European IPOs to follow?

Revolut IPO (estimated market cap: $75 billion)

Revolut, the London-based fintech company, is widely expected to pursue an IPO in 2026, with recent valuation estimates reaching as high as $75 billion, reflecting its rapid growth and expansion in financial services. The company has shown strong financial performance, with anticipated pre-tax profits to surpass its £1.1 billion pre-tax profit mark from 2024.

Revolut is planning a listing likely on the Nasdaq Stock Market in the U.S., though a dual listing including London’s stock exchange is also under consideration as part of strategic positioning. The firm has expanded its offerings to include commercial real estate lending, private lending, and plans to introduce AI-driven financial guidance and an in-app mortgage product.

Investors view Revolut’s IPO prospects positively due to its diversified services, robust revenue growth, and leadership focus on timing the public market for optimal return. However, the company has yet to file an IPO formally and is reportedly waiting for favorable market conditions before proceeding.

SumUp IPO (estimated market cap: £11.1 billion)

SumUp, a UK-based fintech known for its card reader solutions tailored to small businesses and merchants, is preparing for a potential IPO in 2026. The company is reportedly targeting a valuation between $10 billion and $15 billion (£11 billion), which would mark a major milestone and position SumUp as a significant player in the global payments industry.

SumUp is considering listings on either the London Stock Exchange or the New York Stock Exchange, with both options offering strategic advantages in terms of investor base and valuation potential. The IPO proceeds are expected to fuel further expansion, technological innovation, and acquisitions as the company capitalizes on the growing demand for cashless payments and digital financial services.

Founded in 2012, SumUp has expanded its footprint to over 30 countries and benefits from strong revenue growth fueled by diverse payment processing and business tools. The planned SumUp IPO also aligns with a broader wave of high-profile fintech listings, offering investors exposure to a fintech leader in the evolving digital economy.

Visma IPO (estimated market cap: £16.2 billion)

Visma, a Norway-based software company specializing in accounting, payroll, and HR software solutions for small and medium-sized enterprises across Europe, is planning a high-profile IPO in London in 2026. Backed largely by UK private equity firm Hg, which owns about 70% of the business, Visma aims to achieve a valuation of approximately €19 billion ($20 billion).

The company generated €2.8 billion in revenue and €185 million in pre-tax profits in 2024, supported by significant cash flow and a strategy based on more than 350 acquisitions. Hg and co-investors plan to retain a substantial stake post-IPO, emphasizing long-term investment confidence.

Visma IPO is expected to be one of the biggest tech listings in Europe, and a potential catalyst for the struggling London Stock Exchange, which has seen fewer large listings recently. Investors see Visma as a robust player with steady growth, bolstered by strong fundamentals and diversification in the software market.

Monzo IPO (estimated market cap: £6.0 billion)

Monzo, the London-based digital bank famous for its coral cards, is preparing for a highly anticipated IPO expected in early 2026. The IPO is projected to value Monzo at over £6 billion, potentially reaching around £7 billion, which significantly exceeds its last valuation of £4.5 billion from a secondary sale in 2023.

Monzo has more than 11 million customers, including 600,000 business accounts, and reported its first annual profit in 2024 with £15.4 million profit on £880 million in revenue, marking a dramatic turnaround from a 2023 loss. The company is working with Morgan Stanley for investor meetings, aiming to choose London as the likely listing venue, although some support exists for a U.S. listing.

Investors are attracted by Monzo’s rapid revenue growth, expanded product offerings such as premium accounts and business banking, and a solid path to profitability. Monzo IPO is anticipated to be one of the UK's biggest fintech listings in years, signaling confidence in Monzo’s position within the competitive digital banking landscape.

Some of the Best EU&UK Stocks for Maret 2026

Upcoming Asia IPOs

Which pre-IPO Asia companies should you follow?

Shein IPO (estimated market cap: $66 billion)

Shein, the Chinese fast-fashion giant headquartered in Singapore, is targeting an IPO potentially in 2026, with plans shifting recently towards a listing in Hong Kong after failed attempts in New York and London. Initially, Shein had valued itself at around $90 billion during fundraising but faces pressure to cut its IPO valuation to about $60 billion to $70 billion due to regulatory hurdles, declining profitability, and political tensions impacting its largest markets, especially the US.

The company saw profits drop nearly 40% to about $1 billion in 2024 despite a 19% increase in sales to $38 billion, reflecting challenges from new tariffs and import rules. Shein is working with multiple investment banks and has secured approval from the UK's Financial Conduct Authority but still awaits consent from Chinese regulators for any London float.

Investors are cautious given Shein's regulatory scrutiny and the need to prove sustainable profitability, but the company's strong sales growth and large global customer base keep it attractive. The final Shein IPO structure and valuation remain subject to market conditions and regulatory approval.

How to trade and invest in Chinese stocks

Canva IPO (estimated market cap: $42 billion)

Canva, the Australian design software company famous for its user-friendly online graphic design platform, is widely expected to go public with an IPO in 2026. The company recently crossed $3.3 billion in annual recurring revenue (ARR) and is valued at around $42 billion based on recent employee share tender offers, with some estimates projecting a valuation as high as $50 billion.

Canva boasts 240 million monthly active users and 27 million paid seats, supported by AI-driven tools generating 800 million monthly interactions, making it a strong SaaS IPO candidate. Analysts note the valuation multiples Canva could command in the public market range from conservative averages around 12.7x ARR (like Adobe) to premium multiples approaching or exceeding Figma's, which could push valuations beyond $70 billion.

Canva’s IPO is viewed as potentially one of the largest tech listings in 2026, driven by its scale, profitability, and innovative AI-enabled growth in design software globally. The company continues to expand its enterprise user base and global reach, making it highly attractive from an investor and market perspective.

PayPay IPO (estimated market cap: $20 billion)

PayPay, Japan's leading QR payment platform co-owned by SoftBank Group, Yahoo Japan, and Mitsui Fudosan, is preparing for a U.S. IPO potentially as early as December 2025 or early-2026. The IPO is expected to value PayPay at over $20 billion (approximately 3 trillion yen), making it one of the largest Japanese tech IPOs in recent years.

PayPay dominates Japan's QR code payment market with around two-thirds market share and boasts 70 million users as of 2025. The company has diversified its services into financial offerings such as virtual credit cards and postpaid payments and holds a 40% stake in Binance Japan. Strong financial metrics include $7.8 billion in Q3 2025 revenue with a 12.9% net margin, outperforming some global payment companies, supported by Japan's fast-growing cashless payments market.

The PayPay IPO aims to provide liquidity for SoftBank Group and access to global capital for PayPay’s expansion while enhancing its brand visibility internationally.

Key IPO Terms

Like everything in the world of investing and financial markets, initial public offerings have their own special jargon. You’ll want to understand these key IPO terms:

- Common stock. Units of ownership in a public company typically entitle holders to vote on company matters and receive company dividends. When going public, a company offers shares of common stock for sale.

- Issue price. The price at which shares of common stock will be sold to investors before an IPO company begins trading on public exchanges. Commonly referred to as the offering price.

- Lot size. The smallest number of shares you can bid for in an IPO. If you want to bid for more shares, you must bid in multiples of the lot size.

- Preliminary prospectus. A document created by the IPO company that discloses information about its business, strategy, historical financial statements, recent financial results, and management. It has red lettering down the left side of the front cover and is sometimes called the “red herring.”

- Price band. The price range in which investors can bid for IPO shares, set by the company and the underwriter. It’s different for each category of investor. For example, qualified institutional buyers might have a different price band than retail investors like you.

- Underwriter. The investment bank manages the offering for the issuing company. The underwriter determines the issue price, publicizes the IPO, and assigns shares to investors.

How to Evaluate Buying an IPO Stock

If you've decided on buying IPO stock, be sure to consider the strengths of the business itself. Ask yourself a few key questions:

- If this business does not grow at a high enough rate to justify its price, what is the reason? What are the probabilities of those failures occurring?

- What are the competitive moats that protect the business? Are there patents, trademarks, key executives, or some other unique factor protecting it?

- What is stopping some other firm from coming in and destroying the attractive economics?

Also, consider your personal level of comfort with the business and how it is run:

- Would you be comfortable owning this business if the stock market were to close for the next five, 10, or 25 years? In other words, is this business model and the company's financial foundation sustainable? Or is obsolescence because of technological advancement or lack of sufficient capital a possibility?

- If the stock falls by 50% due to short-term problems in the business, will you be able to continue holding your shares without any emotional response?

Do your due diligence on the company and its prospects before plunking capital down. It may be difficult to do, as the company hasn't made a good deal of financial information public to that point, but it's crucial to your success.

Metrics for judging a successful IPO process

The following metrics are used for judging the performance of an IPO:

- Market Capitalization: The IPO is successful if the company’s market capitalization is equal to or greater than the market capitalization of industry competitors within 30 days of the initial public offering. Otherwise, the performance of the IPO is in question.

Market Capitalization = Stock Price x Total Number of Company’s Outstanding Shares

- Market Pricing: The IPO is successful if the difference between the offering price and the market capitalization of the issuing company 30 days after the IPO is less than 20%. Otherwise, the performance of the IPO is in question.

How to buy or trade IPO stock

- Research the market. Some currently private businesses have potential to become rivals within the technology, energy, finance, e-commerce, and healthcare industries.

- Buy pre-IPO stock through a participating broker. Several trading platforms allow you to invest in the company before its future IPO is carried out.

- If this is not an option, you can trade on the company once it is public. This is often through financial derivatives, such as CFDs with the option to trade with leverage.

- Pick a strategy. Choose whether you want to go long (buy) or go short (sell). Please note that some trading restrictions may apply on initial trading.

- Keep up to date with news and analysis. This can include daily reports and predictions from professional market analysts and external news providers.

To trade CFDs on the price movements of an upcoming IPO after it has passed the process, it's a simple process to register for a live account with us and get started now.

Investing in the primary market lets you take a position on the company’s stock pre-IPO; investing in the secondary market will give you ownership of the shares once the company has completed its IPO.

With us, you can invest in the company’s shares with an Invest account on the secondary market. You can also trade on the company’s share price on the secondary market with derivatives like CFDs.

Buying shares

You can create an Invest account to invest in shares once they’re listed on the stock exchange.

When you’re investing, you’ll pay the full value of the position up front which will give you direct ownership of the company’s stock. This’ll make you a shareholder, and you’ll be eligible to receive any dividends that the company pays and get shareholder voting rights if the company grants them.

Trading derivatives

You can create a Trading account to speculate on a share’s price movements with derivatives like contracts for difference. Before the IPO, you can use these derivatives to trade our grey market, and after the IPO you can use them to speculate on a stock’s price rising (by going long) and falling (by going short.

You might choose derivatives because they enable you to open a position with leverage, which requires a small deposit (margin) rather than committing the full value of the shares upfront. This can magnify profits and losses, as both will be calculated from the full exposure of the trade, not just the margin you put up a deposit.

Should You Trade or Invest in the Upcoming IPOs?

As with any type of investing, putting your money into an IPO carries risks—and there are more risks with IPOs than buying shares of established public companies. That’s because there are less data available for private companies, so investors are making decisions with more unknown variables.

Despite all the stories you’ve read about people making bundles of money on IPOs, there are many more that go the other way. In fact, more than 60% of IPOs between 1975 and 2011 saw negative absolute returns after five years.

Just because a company goes public, doesn’t necessarily mean it’s a good long-term investment.

Conversely, a company might be a worthwhile investment but not at an inflated IPO price. You could buy the best business in the world, but if you overpay for it by 10 times, it’s going to be hard to get your capital back out of it.

Buying IPOs, for most buyers, isn’t investing—it’s pure stock speculation, as many of the shares allocated in the IPO are flipped on the first day. If you really like the stock and plan to hold it as a long-term investment, it is recommended to wait a few weeks or months until the frenzy has disappeared, and the price has come down.

The Benefits of Buying IPO Stock

The Downsides of IPO Investing

Buying IPO stock can be appealing. A block of common stock bought during an initial public offering has the potential to deliver huge capital gains decades down the line. Even just the annual dividend income of an extraordinarily successful company can exceed the original investment amount, given a few decades' time. Your investment provides capital to the economy, enabling companies that provide real goods and services to grow and expand. Learning how to buy IPO stock can lead to extremely attractive results when conditions are right. The biggest downside for IPO investors is dealing with volatile price fluctuations. It can be hard to stay invested when the value of your shares plummets. Many stockholders don't stay calm when prices tumble. Rather than valuing the business and buying accordingly, they look to the market to inform them. However, in doing so, they fail to understand the difference between intrinsic value and price. Instead, consider whether look-through earnings and dividend growth are growing and poised to stay that way.

The Bottom Line

The late and legendary Benjamin Graham, who was Warren Buffett's investing mentor, decried IPOs as being for neither the faint of heart nor the inexperienced. They're for seasoned investors; the kind who invest for the long haul, aren't swayed by fawning news stories and care more about a stock's fundamentals than its public image.

For the common stock investor, purchasing directly into an IPO is a complicated process, but soon after an IPO, a company's shares are released for the public to buy and sell. If you believe in a company after your research, it may be beneficial to get in on a growing company when the shares are new.

Free resources

Before you start trading and investing in the upcoming IPOs 2026, you should consider using the educational resources we offer like NAGA Academy or a demo trading account. NAGA Academy has lots of free trading and investing courses for you to choose from, and they all tackle a different financial concept or process – like the basics of analyses – to help you to become a better trader or make more-informed investment decisions.

Our demo account is a suitable place for you to learn more about leveraged trading, and you’ll be able to get an intimate understanding of how CFDs work – as well as what it’s like to trade with leverage – before risking real capital. For this reason, a demo account with us is a great tool for investors who are looking to make a transition to leveraged trading.