As the world of cryptocurrencies continues its rollercoaster ride, prudent investors may want to concentrate on some of the best blockchain stocks.

The thriving world of digital finance can be entered more predictably and smoothly with the help of traditional finance. It is a sensible plan to research high potential blockchain stocks by utilising this technology's powerful capabilities rather than riding the erratic wave of the cryptocurrency market.

Since many of these businesses are not pure plays, there is a backup plan in the form of an established core business. Today, many publicly traded organizations are incorporating blockchain into their business processes and offering clients blockchain-centric services.

How to trade and invest in Blockchain Stocks and ETFs

- Research your blockchain stocks – from established public companies have dabbled in blockchain businesses while smaller, to smaller, more focused firms that have put blockchain at the core of their operations, there are multiple options available;

- Define your strategy – trading lets you speculate on the price movement; dealing lets you take direct ownership of the shares of stocks or funds;

- Take your position – create an account with us to start trading and investing in blockchain stocks, ETFs and thematic portfolios focused on blockchain.

- Copy lead traders – alternatively, copy the moves of top performing traders in real-time with NAGA Autocopy.

For more info about how to trade and invest in blockchain stocks, including some of the best blockchain stocks and ETFs for 2026 read our guide below.

What is Blockchain?

Blockchain is a shared and immutable ledger that records transactions and tracks digital and non-digital assets using a computer network. An asset could be tangible (a car, house, cash, land, etc.) or intangibles (intellectual property patents, copyrights, and branding). A blockchain network allows anyone to track and trade virtually any asset, which reduces the risk of losing track of funds, and cuts costs.

At the core of the blockchain are the information blocks, which are basically a string of information. Every data block is kept in a time-stamped open ledger that all participants can access. This makes blockchain technology particularly useful in industries such as banking, where security is important.

What are Blockchain Shares?

Blockchain stocks are a more traditional, conservative way to tap into the rapidly growing blockchain technology, without betting it all on cryptos. Blockchain technology may prove to be a critical tool for conducting transactions and securely exchanging information, according to some of the biggest corporations in the world. And by trading or purchasing the stocks of those businesses, investors can expose themselves to a cutting-edge segment of the technological industry without really purchasing bitcoin, altcoins or NFTs.

Large, established public companies have dabbled in blockchain businesses while smaller, more focused firms have put blockchain and crypto at the core of their operations. In either case, there has yet to be a killer app that has made the case for blockchain as a core part of the future of business and technology.

It’s important to note that not all blockchain stocks are cryptocurrency stocks. Though some stocks in the blockchain space are companies that run crypto exchanges or even mine Bitcoin, others are large financial institutions or established technology firms that are developing blockchain products.

If you’re interested in buying and trading stocks only in crypto companies, you can check out this rundown of cryptocurrency stocks.

Best Blockchain Shares in March 2026

Whether you’re eyeing blockchain stocks with explosive upside or scouting for the best blockchain stocks to buy and trade, the market is ripe with options extending far beyond mere crypto trading.

A list of the top-performing stocks won’t indicate which will do well in the future, but many top stocks deliver solid returns year after year. Nvidia and AMD have boomed in 2025 driven by the Artificial Intelligence megatrend, while Amazon for instance, seem to have delivered attractive gains for what seems like forever, so following the best stocks may give you a clue as to which contenders can perform well in the years to come.

Here is a list of the top blockchain stocks for 2026 that you should consider if you want exposure to this exciting technology in your investment portfolio.

RIOT Blockchain (RIOT)

Riot Blockchain (NASDAQ: RIOT) continues to stand out as a leader in Bitcoin mining, offering investors a direct play on blockchain infrastructure. As of June 30, 2025, Riot has deployed a total hash rate of 35.4 EH/s, up significantly compared to the end of 2024. The company mined 2,956 BTC in the first half of the year, demonstrating strong operational growth. Riot’s self-mining segment is expanding rapidly, powered by its vertically integrated infrastructure and efficiency improvements, with fleet energy efficiency improving notably.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

On the financial side, Riot reported $153.0 million in revenue in Q2 2025, driven primarily by its Bitcoin-mining business. The company’s all-in cost to mine one BTC in that quarter was $48,992, reflecting the impact of lower power costs and its strategic power strategy. Riot also holds a significant Bitcoin treasury — over 19,000 BTC as of Q3 2025 — which provides optionality and long-term upside.

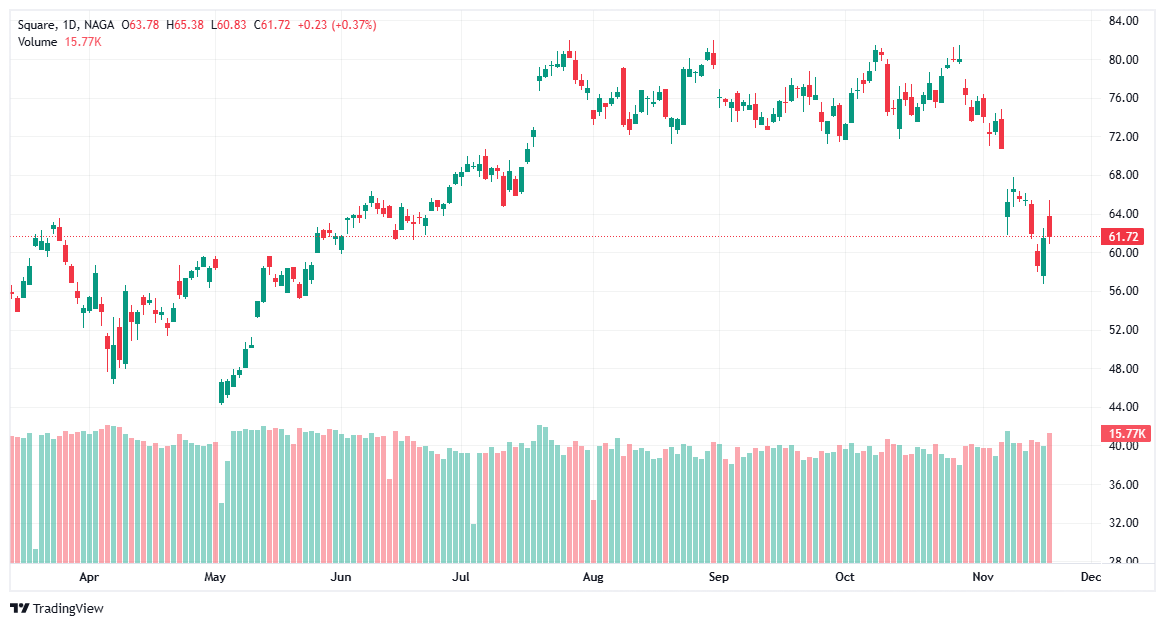

Block (SQ)

Block (NYSE: SQ) — formerly Square — remains a fintech powerhouse, blending payments, peer-to-peer banking, and crypto integration within its Cash App and seller ecosystem. As of Q1 2025, Block reported total net revenues of $5.77 billion, with $2.30 billion generated from Bitcoin-related sales. The company has also repurchased $2.5 billion worth of its Class A shares in the first half of 2025, signaling strong capital return discipline.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

On its balance sheet, Block held approximately 8,584 BTC (fair value ~$708.5 million) as of March 31, 2025. The company’s bitcoin investment is marked to fair value each quarter, resulting in sizable gains and losses depending on BTC’s price — for example, a $93 million loss was recorded in Q1 2025. With its strong ecosystem, commitment to Bitcoin, and solid financial footing, Block is a compelling blockchain share, although volatility from its crypto exposure should be viewed as part of its long-term play.

MicroStrategy Incorporated (MSTR)

MicroStrategy has evolved into a Bitcoin treasury company, storing one of the largest publicly disclosed Bitcoin treasuries among corporates. As of April 28, 2025, the company reported holding 553,555 BTC, acquired at a total cost of about $37.9 billion, which translates to a “BTC yield” (paper gain) of 13.7% YTD. To fund its accumulation, MSTR executed a record $21 billion at-the-market (ATM) equity offering in Q1 2025.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

Despite its massive Bitcoin holdings, the core software business remains under pressure. In Q1 2025, total revenue was $122.4 million, but MicroStrategy reported a net loss of $18.5 million, largely due to fair-value adjustments on its Bitcoin holdings. The company has rebranded as Strategy, signaling that its primary identity now revolves around its Bitcoin accumulation strategy.

Other top blockchain stocks

Nvidia (NVDA)

This is the largest manufacturer of graphics processing units (GPUs), which are one of the most important hardware components for cryptocurrency mining. Plain and simple, the blockchain wouldn’t work without these GPU cards. Although sales of Nvidia's crypto-targeted CMP chips have cooled off as cryptocurrency prices have declined, sales are expected to rebound if the crypto market recovers. And, even if it doesn't, the rest of Nvidia's business is an absolute powerhouse market leader.

Honeywell International Inc. (HON)

Honeywell International Inc. operates in four segments which cover the productivity, building technologies, materials, and aerospace markets. Honeywell also became one of the first companies in the world in 2019 to bring the reliability of blockchain technologies to the aerospace segment, as it used the secure ledger platform to introduce an online marketplace which significantly reduced transaction times in a highly sensitive market that needed secure part authentication.

Coinbase (COIN)

Coinbase is the largest cryptocurrency exchange in the world, offering more than 100 cryptocurrencies. There are approximately 73 million users verified in over 100 countries and more than $1 billion of cryptocurrency trading volume through the company's platform.

Marathon Digital Holdings, Inc. (MARA)

Marathon Digital Holdings emerged in the market in the aftermath of the boom in cryptocurrencies and it is also a publicly-traded company. MARA runs cryptocurrency mining facilities capable of consuming megawatts of electrical power and it reported $38 million in revenue during the first half of this year.

VMware, Inc. (VMW)

VMware offers its enterprise customers the VMware Blockchain platform which is primarily focused on providing the companies with a secure platform for their daily transactions and other record-keeping needs.

IBM (IBM)

IBM Blockchain, on the blockchain side, has already offered transformative solutions to clients like Kroger, True Tickets, and others. If blockchain-based solutions gain more popularity, the company could see significant growth.

HIVE Blockchain Technologies (HIVE)

HIVE Blockchain works to build a bridge between the blockchain space and traditional capital markets. HIVE Blockchain is also involved in mining cryptocurrencies such as Ethereum and Bitcoin, using 100% green energy.

Argo Blockchain plc (ARBKF)

Argo Blockchain is a United Kingdom-based cryptocurrency mining company. Argo is a mining-as-a-software (MaaS) service provider that makes it easy for clients to mine Bitcoin Gold, Ethereum, and other alternative coins (altcoins) through the cloud.

CME Group (CME)

This is the largest options and futures exchange. It offers futures on Bitcoin and Ethereum. It also is the only exchange that creates a market for cryptocurrency futures contracts, although rival exchange CBOE is planning to reenter the space in the future.

Mastercard (MA)

Mastercard announced a partnership with R3 blockchain technology company to develop a cross-border payment system. This could give the company a significant competitive advantage by eliminating major barriers to international money transfers.

DocuSign (DOCU)

DocuSign is the market leader in eSignature technology. They have used blockchain technology since 2015 to allow customers to record their agreements using the Ethereum blockchain.

Amazon (AMZN)

Amazon Managed Blockchain is a feature of the AWS (Amazon Web Services) platform that allows customers to manage and create their own blockchain networks. Amazon has the potential to incorporate blockchain technology in its huge e-commerce business.

PayPal Holdings Inc. (PYPL)

Digital payments specialist PayPal is fully embracing cryptocurrency and blockchain technology. Not only can users buy and sell crypto in their PayPal accounts, but PayPal is also reportedly exploring the launch of its own stablecoin that would be backed by the U.S. dollar.

Advanced Micro Devices Inc. (AMD)

Semiconductor company Advanced Micro Devices is developing a central processing unit and graphics processing unit technology aimed at making blockchain transactions faster and more secure. The company is also working on developing blockchain compute solutions with a wide variety of use cases.

How to find blockchain stocks

The stocks mentioned above represent just a small piece of the universe of companies trying to use blockchain technology. If you’re considering investing in blockchain stocks, you can dig deeper in a couple of ways.

Stock indices ETFs There are a couple of stock indices that are curated to provide a sampling of the economy around blockchain. The Nasdaq Blockchain Economy Index is one example. Looking at the companies listed there, and digging into their businesses, can help turn up blockchain stocks that might appeal to you. Exchange-traded funds allow you to buy a selection of stocks or other investments directly from a public exchange. This can be helpful if you want exposure to several companies without having to assemble an investment portfolio yourself.

What are Blockchain stock funds (ETFs)

An ETF (Exchange-Traded Fund) is an investment product that is based upon an underlying asset. A blockchain ETF owns stocks in companies that have business operations in blockchain technology or profit from it in some way. Most investors are still precautious when investing in blockchain shares, especially due to the blockchain association with cryptocurrencies and their highly volatile values.

Bear in mind that blockchain technology is different from cryptocurrency, and a blockchain ETF is different from a cryptocurrency ETF, including the first Bitcoin ETF launched in 2021. For instance, blockchain ETFs invest only in stocks of regulated public companies. Many of these are popular blue-chip tech companies with no direct cryptocurrency involvement.

ETFs can also be traded on the regular stock exchanges, just like any other stock or commodity. The stock prices of these companies are affected not only by blockchain technology but also by hype and other factors related to blockchain.

Best Blockchain ETFs for 2026

Blockchain ETFs are one of the ways to get exposure to cryptocurrency and blockchain technology without investing in cryptocurrencies. These funds track stocks of companies that invest in blockchain technology and are also available in the traditional markets.

The blockchain ETF marketplace is still a niche area, and only a handful of funds are focused on the blockchain space. Remember that there is no public company that is only focusing on blockchain, and most of these ETFs have stocks that overlap with other funds. We’ll mention some of the most popular blockchain ETFs to illustrate what kind of assets these funds can hold.

Global X Blockchain ETF (BKCH)

The Global X Blockchain ETF offers broad exposure to companies operating across the blockchain ecosystem. Launched in mid-2021, the fund includes more than 25 firms involved in mining, blockchain infrastructure, and related services. It charges a reasonable annual expense ratio of 0.50%.

With over $100 million in assets under management, its top holdings include companies such as Riot Platforms, IREN, Applied Digital, Cipher Mining, and Coinbase. This ETF is a solid option for investors who believe in blockchain’s long-term potential but prefer diversified exposure instead of picking individual stocks.Bitwise Crypto Industry Innovators ETF (BITQ)

The Bitwise Crypto Industry Innovators ETF provides targeted exposure to companies deeply involved in the crypto and blockchain ecosystem. It tracks an index of 30 firms that generate at least 75% of their revenue from crypto-related activities or hold a significant portion of their assets in digital currencies. About 85% of the fund is allocated to these core innovators, while the remaining portion includes large-cap companies with meaningful crypto exposure.

BITQ’s top holdings typically include names like MicroStrategy, Coinbase, and other crypto-focused businesses, offering investors a concentrated way to participate in the growth of the digital asset industry.Invesco Elwood Global blockchain UCITS ETF

The Invesco Elwood Global Blockchain UCITS ETF provides investors with targeted exposure to global companies that are adopting, integrating, or developing blockchain technology. It tracks the Elwood Blockchain Global Equity Index (BLOCK), which selects firms based on their use of blockchain in operations or their potential to benefit from the technology's growth. The fund offers a diversified entry point into the blockchain ecosystem, including both established tech leaders and emerging innovators.

Top holdings in the ETF include companies from sectors such as financial technology, software, and hardware that support blockchain infrastructure and applications. By allocating investments across multiple companies worldwide, the fund aims to balance growth potential with risk, allowing investors to participate in the expanding digital asset and blockchain economy without focusing on a single stock.Amplify Transformational Data Sharing ETF (BLOK)

The Amplify Transformational Data Sharing ETF (BLOK), launched in January 2018, was one of the first ETFs focused exclusively on blockchain technology. Actively managed, the fund invests in companies that are using or developing blockchain solutions, including firms in cryptocurrency exchanges, mining operations, and developers of innovative blockchain applications. BLOK provides investors with a way to gain diversified exposure to the blockchain sector through a single investment vehicle.

The ETF’s top holdings typically include major tech and financial companies such as Nvidia, Coinbase, and Silvergate Capital, reflecting a blend of hardware, software, and financial infrastructure providers. By focusing on companies with direct involvement in blockchain, BLOK offers a strategic approach for investors seeking to participate in the growth of the global blockchain economy while spreading risk across multiple firms.

How to Invest in Blockchain Shares and Funds

Blockchain technology is not limited to cryptocurrencies, and it has many other applications, such as international payments, decentralized finance, auditing, and regulatory compliance. Here are some of the most popular ways to invest in blockchain shares and blockchain ETFs.

Please note that some of the blockchain shares and funds are high-risk investments and may not suit every investor.

Buy and Hold

The most common strategy for investors is the buy-and-hold strategy, which implies that the Blockchain shares, and ETFs are held for longer periods. Those who apply this strategy believe that the long-term gains from investing will outweigh the volatility of the asset.

The buy-and-hold strategy is simple. Simply pick a stock, ETF, or mutual fund and buy it. Then, hold it for many years. You could also keep it for many decades. Investors rely on fundamental analysis when choosing their assets for the buy-and-hold strategy. Ideally, you would look for blockchain stocks that are low in price relative to the company's fundamental value. This strategy is regarded as passive investing, and it is particularly useful for markets in which the “time in the market” is more important than “timing the market”.

With NAGA.com you can buy shares in over +3,000 stocks and ETFs listed on 10 global major exchanges with zero commission (Terms apply) through an Invest Account.

Trading through CFDs

Trading blockchain stocks CFDs (contracts for difference) allows investors to gain exposure to price movements without owning the underlying assets. CFDs can be described as contracts between two parties (i.e., the provider and you). They require the provider to pay the difference in exit and entry prices. Because its price is determined from the price of an underlying asset, it is considered a financial derivative instrument. CFDs have made trading accessible to all investors, due to the low entry cost and straightforward mechanism.

With NAGA, you can trade CFDs on a wide range of leading cryptocurrencies or invest in 30 cryptocurrencies with tight spreads, as well as a wide range of stocks, commodities, mutual funds, and global currency pairs. within a single Trading Account.

Getting started with NAGA.com

Here is how to invest in blockchain shares with a trusted, highly regulated broker like NAGA.com:

- Choose the right account type. Begin by assessing your risk tolerance and investment horizon. If you want to buy and hold blockchain stocks for the long term, open an investing account. If you prefer to speculate on short-term price movements with leverage, a CFD trading account is the better option.

- Create your account. Register on NAGA and complete the KYC verification process to confirm your identity.

- Fund your account. Deposit fiat currencies such as U.S. dollars or Euros to be ready to buy blockchain stocks.

- Select your blockchain stocks. Carefully research the companies involved in blockchain technology that are available on NAGA. While some ETFs in this sector might not be offered, you can still gain exposure by selecting individual blockchain-focused companies.

- Place your order. Follow NAGA’s platform steps to submit and complete your buy order. You can start with one stock or diversify across multiple blockchain companies to suit your strategy.

Final words

Blockchain technology is a promising area of innovation that can be applied to many sectors. Investors around the globe are intrigued by its potential after witnessing its tremendous growth over the last decade. Of course, the rise of cryptocurrencies such as Bitcoin and Ethereum has fueled interest in the technology behind the blockchain.

Anyone looking to invest in blockchain technology should research cryptocurrencies and other blockchain and crypto-related companies. However, investing in a Blockchain ETF can be a worth checking strategy since it is giving larger diversification than investing individually in blockchain-related businesses, as they cover a wider range of companies.

Free Resources

Before you invest in blockchain stocks and blockchain ETFs, you should consider using the educational resources we offer like NAGA Academy or a demo trading account. NAGA Academy has lots of free cryptocurrency and blockchain courses for you to choose from, and they all tackle a different financial concept or process – like the basics of analyses – to help you to become a better trader or make more-informed investment decisions.

Our demo account is a suitable place for you to get an intimate understanding of how trading and investing work – as well as what it’s like to trade with leverage – before risking real capital. For this reason, a demo account with us is a great tool for investors who are looking to make a transition to leveraged securities.