The European stock markets continue to offer compelling opportunities for diversification and growth in 2026. After outperforming US equities in 2025, European stocks benefit from attractive valuations, strong fiscal stimuli, and evolving macroeconomic conditions that set the stage for further gains this year.

Using NAGA’s platform and apps, investors can easily buy the best European stocks for their portfolio or trade top European stocks through CFDs.

How to start investing in the best European stocks?

To trade and buy the best European stocks in 2026, investors should consider the following steps:

- Research and select: Begin with detailed research on undervalued stocks, sector trends, and growth leaders.

- Choose a broker: Use EU regulated brokerages like NAGA, which provide access to key European exchanges such as Frankfurt, Milano, Paris, Madrid, Amsterdam, Copenhagen, Bucharest and more.

- Diversify portfolio: Build a well-rounded portfolio across countries and sectors to mitigate risk and capture broad European market potential.

- Monitor currency impact: Monitor EUR/USD fluctuations and hedge currency risk if necessary.

- Stay informed: Follow macroeconomic data, trade developments, and regulatory changes that could impact European stock market performance.

With the NAGA social trading platform, investors can connect, copy the moves of top-performing traders, collaborate, and inspire fellow traders.

Why invest in European stocks?

European stock markets have been attracting attention in 2025. For example, New Zealand’s Super Fund – considered the world’s best-performing sovereign wealth fund— has recently increased its investments in European shares while reducing its allocation to the US. This is a sign that some global asset managers are losing confidence in the longer-term outlook for US shares.

Defence spending is increasing rapidly across the continent, as governments respond to ongoing security concerns. That’s supporting growth in aerospace, defence, and industrial sectors.

Energy security is another key focus. Following the 2022 energy crisis, the EU’s investing heavily in renewable energy, LNG infrastructure and power grid upgrades, aiming to reduce reliance on Russian gas and accelerate the green transition.

In fact, Europe now spends 10 times more money investing in clean energy than it does fossil fuels. This could benefit utilities and clean energy companies with strong infrastructure pipelines.

Investing in European stocks in 2026 offers several strategic advantages:

- Diversification: Exposure to Europe's diverse economies and sectors helps reduce portfolio risk and provides access to global growth drivers.

- Monetary policy support: Continued ECB monetary easing and fiscal stimulus measures contribute to supportive conditions for corporate earnings.

- Value opportunities: Many stocks remain undervalued due to macroeconomic uncertainties, creating chances for capital appreciation.

- Innovation and stability: Europe’s pharmaceutical and tech sectors are innovating, while utilities and consumer staples offer defensive characteristics.

- Rising dividends: European companies have restored and increased dividends after pandemic-related cuts, creating attractive income streams for yield-oriented investors.

- Currency dynamics: Although a stronger euro poses challenges, investors aware of currency risks can strategically position portfolios to benefit.

These factors combine for a balanced investment environment suitable for both growth and value-oriented strategies in 2026.

Best European stocks and stock markets in 2025

The best European stocks in 2025 by performance include stocks from both national markets with outstanding gains and high dividend-paying companies with solid fundamentals.

According to Q4 data for 2025 year-to-date performance, top-performing European markets include the Czech Republic (+53.4%), Poland (+48.4%), Hungary (+46%), Romania (+30%), and Spain. This rally is driven by macroeconomic factors such as ECB's accommodative monetary policy, strengthening economic fundamentals, and sector-specific growth, especially in banking, with notable performers including UniCredit and Deutsche Bank.

Regarding individual eurozone dividend stocks with strong recent performance, notable companies include:

- Royal BAM Group (Dutch engineering and construction)

- Heijmans (Dutch engineering)

- Trigano Group (French recreational vehicles)

- Melexis, Elecnor, Prosegur Compañia de Seguridad, Fielmann Group, Neste, and United Internet have also shown significant earnings and dividend yields in 2025.

Additionally, value stocks such as Novo Nordisk, BP, and Sanofi are cited among the best performing in European markets. Many emerging or mid-cap firms with strong fundamentals also show promising growth, including those with good debt-to-equity ratios and revenue growth.

European stock market overview for 2026

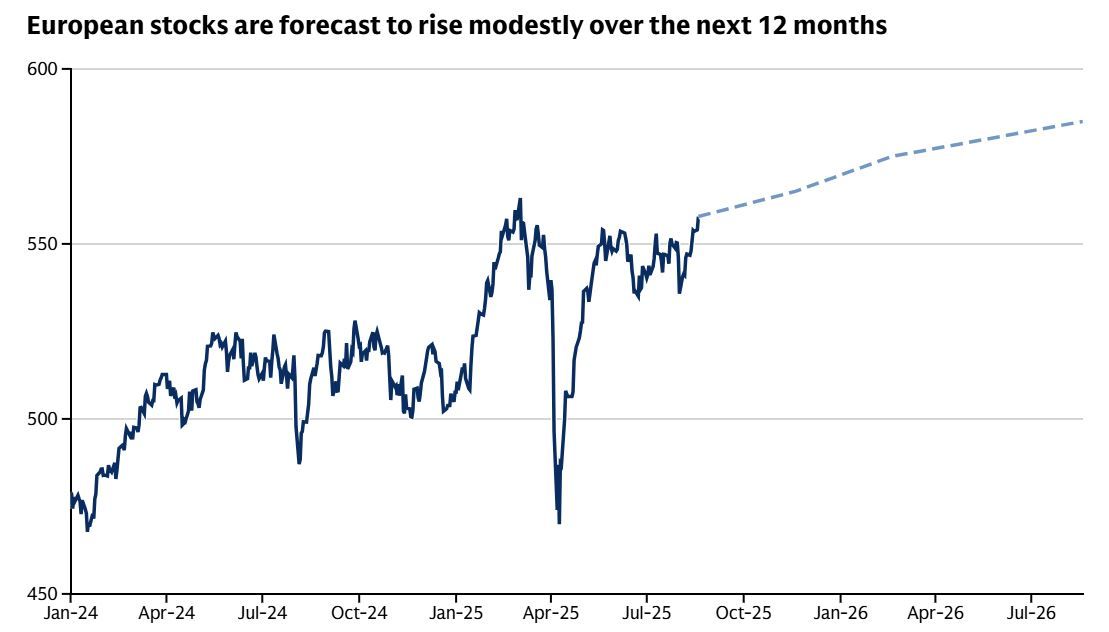

European stocks are forecasted to rise during 2026 amid improving economic growth and strong shareholders’ cash returns. However, according to Goldman Sachs, the potential gains are limited by a drag on corporate earnings from a stronger euro rate against the US Dollar. The euro's expected appreciation against the U.S. dollar (projected to reach around 1.25) may create export challenges for large multinational firms relying on transatlantic trade.

Despite trade tensions and tariff uncertainties, European stock indices like the STOXX 600 are forecast to reach new highs by mid-2026. According to the investment bank, the benchmark index's total return will be 8% in 2026, including dividends.

Sector leaders include pharmaceuticals, utilities, and renewable energy, with growth stocks also attracting significant investor attention due to strong insider ownership and promising innovation pipelines.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

Are European stocks undervalued?

European stocks have become more expensive since early 2025, with the forward price/earnings (P/E) ratio rising to 14.4, placing valuations in the 70th percentile of their historical range. While this suggests European equities are highly valued in absolute terms, they still trade at a discount compared to U.S. stocks when adjusting for sector and growth differences. Additionally, relative to bonds and other asset classes, European equities do not appear overly stretched.

Earnings forecasts for 2025 and 2026 have been revised down, with consensus expecting a slight decline in 2025 EPS and only modest growth in 2026. A key factor weighing on earnings is the anticipated 7% rise in the euro against the U.S. dollar, which will reduce the value of export revenues from European companies. As a result, domestic-focused stocks with resilient earnings may offer better opportunities, while overall selectivity is critical in navigating the moderately valued European market in 2026.

Should you buy European stocks in 2026?

After several years of outflows, European equity funds are seeing renewed inflows from both domestic and international investors in 2025. This shift stems from portfolio diversification away from U.S. assets, driven by a weakening dollar and concerns over the high concentration and expensive valuations of U.S. tech stocks. Even with this rising demand, European investors still hold relatively light exposure to their own markets, with many preferring U.S. equities.

The U.S. and European markets have diverged notably, with value stocks leading in Europe while growth stocks dominate in the U.S. Europe’s market concentration is lessening, and small companies are outperforming, unlike in the U.S. Key drivers include a falling dollar, slowing U.S. growth, and shifting trade dynamics with China, which now acts more as a competitor than a growth engine for Europe.

Analysts suggest focusing on cyclical stocks such as banks, technology, and retailers, while being cautious on autos and commodities. Small companies may also benefit from a stronger euro and an active M&A environment, but overall growth remains subdued amid fiscal and sovereign risks outside Germany. Selectivity and diversification remain essential when investing in European stocks in 2026.

Top European stocks to watch in 2026

Investors targeting the best European stocks for 2026 should consider firms with strong growth catalysts and resilient fundamentals.

Renewable Energy

With Europe committed to ambitious climate targets and green transition policies, renewable energy companies are positioned for significant growth.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

- Siemens Energy AG is a major player in renewable power generation, while its subsidiary Siemens Gamesa is a market leader in both onshore and offshore wind.

- Iberdrola leads investment in wind and solar generation, benefiting from expanding EU subsidies and rising demand for clean power.

Vestas and Orsted are other renewable energy stocks offering significant growth potential as Europe’s renewable capacity expands toward its ambitious climate targets

Defence

The European defence stocks gained significant attention in 2025 due to rising geopolitical tensions and increased military spending in the region, and this trend is expected to continue. These companies are involved in defence manufacturing, aerospace, and cybersecurity sectors.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

- Rheinmetall AG is a key player in European defence, focusing on military vehicles, weapons, and munitions.

- BAE Systems PLC is the largest defence firm in the UK, offering broad exposure across maritime, aerospace, and electronic warfare.

Other top European defence stocks include Airbus SA and Leonardo S.p.A.

Healthcare and pharmaceuticals

Demand for innovative therapies and aging populations make healthcare stocks defensive yet growth-oriented choices.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

- Novo Nordisk continues to innovate in diabetes and obesity treatments, with blockbuster drugs fueling robust revenue growth.

- AstraZeneca leverages vaccine revenues and a strong R&D pipeline addressing chronic diseases.

Other European healthcare stocks stand out due to their innovation-driven growth are Sanofi and Novartis.

Technology and Industrials

Tech adoption in manufacturing, semiconductor markets, and AI adoption boosts leading players.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

- ASML dominates semiconductor lithography, a critical supply chain supplier in a global chip shortage environment.

- Siemens provides automation and digitization tools essential for Industry 4.0 transitions.

Some of the best technology stocks recommended by experts in Europe also include names like SAP SE and Infineon Technologies.

Luxury Goods and Consumer Discretionary

Reopening of economies and rising disposable incomes, especially from Asia, support luxury brands.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

- LVMH remains the world’s largest luxury conglomerate with strong exposure to emerging consumer markets.

- Hermès benefits from exclusivity and brand loyalty sustaining pricing power.

Other top European stocks closely tied to global wealth trends, consumer confidence, and brand prestige include Richemont SA and Christian Dior.

Financials

Rates normalization and balance sheet improvements underpin selective opportunities in European banks.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

- Deutsche Bank shows signs of operational turnaround with improving profitability and dividend recovery.

- Banco Santander offers a mix of retail banking and growing digital services with attractive valuation metrics.

BNP Paribas S.A. and HSBC Holdings plc are other top European financial stocks offering a mix of cyclical and defensive qualities.

These sectors and stocks combine structural growth themes with defensive resilience, providing an attractive foundation for European portfolios in 2026. With NAGA investors can access hundreds of top European stocks listed on the major stock exchanges such as Frankfurt, Paris, Milano, Madrid, Amsterdam, Vienna, Bucharest, and more.

Explore the European stock markets

Most undervalued European stocks in 2026

Finding undervalued European stocks involves a combination of systematic screening, fundamental analysis, and awareness of current market conditions. Below are the steps for identifying these opportunities and some examples of undervalued European stocks currently trading at significant discounts to their estimated fair value.

- Start with reputable screeners: Use platforms like Morningstar, Yahoo Finance, Simply Wall St or Tip Ranks to filter for European stocks trading at significant discounts to fair value.

- Analyze fundamentals: Review key ratios (P/E, P/B, PEG, dividend yield) and compare to sector averages.

- Check for quality: Look for wide moat ratings and low ESG risk.

- Review recent analyst reports: See if there are recent upgrades or downgrades and read commentary for context.

- Diversify: Spread investments across sectors and countries to manage risk.

These European undervalued stocks, identified through discounted cash flow analyses and market price comparison, offer attractive entry points with upside potential:

Table with the most undervalued European stocks in Q4 2025

Stock Name Exchange Current Price Estimated Fair Value Discount to Fair Value Sandoz Group SWX CHF 48.42 CHF 95.00 49% Micro Systematioz OM SEK 62.00 SEK 122.78 49.5% Lingotes Especiales BME EUR 5.60 EUR 11.14 49.7% DSV CPSE DKK 1333.00 DKK 2654.85 49.8% Allegro.eu WSE PLN 33.55 PLN 66.46 49.5%

These European stocks stand out for being nearly 50% undervalued on average, representing lucrative possibilities for patient long-term investors who seek value underpinned by solid fundamentals.

ETFs – Funds buying the best European stocks

Investing in European ETFs offers a convenient way to gain diversified exposure to the best European stocks. ETFs typically track major indexes or sectors, providing broad market access with lower risk. They attract investors seeking a balanced approach to Europe's diverse economy, including technology, finance, and defence industries.

Here are some of the best European ETFs to consider based on their performance and outlook:

- Amundi Prime Europe UCITS ETF: Tracks a broad index of large and mid-cap European companies with low fees and wide exposure across developed European markets.

- MSCI Europe UCITS ETF: Covers leading companies from 15 European developed countries, offering a well-diversified equity exposure throughout the continent.

- STOXX Europe 600 UCITS ETF: Tracks the 600 largest European firms, providing broad market coverage and sector diversification across Europe.

- Xtrackers MSCI Europe UCITS ETF: Offers a cost-efficient way to invest in large and mid-cap stocks across multiple European countries with strong liquidity.

- SPDR MSCI Europe UCITS ETF: A popular choice for investors seeking comprehensive representation of European equities with reliable performance and transparency.

These ETFs typically have expense ratios ranging between 0.05% and 0.25%, and are especially attractive for investors who want diversified, cost-effective exposure to Europe's stock market via a single product on platforms like NAGA. They cover various investment styles, including broad market, dividend-focused, and sector-specific themes, making them versatile choices for 2026 portfolios.

Indices tracking the best European stocks

Indices like the STOXX Europe 600 and EURO STOXX 50 provide investors with broad and diversified exposure to the best European stocks, making them essential tools for efficient portfolio building.

The STOXX Europe 600 index covers 600 large, mid, and small-cap companies across 17 European countries. Investors benefit from its broad diversification across sectors and countries, which reduces risks associated with any single market or industry. The index represents approximately 60% of the Eurozone's total market capitalization, with deep liquidity and transparency in price formation.

The EURO STOXX 50 focuses on the 50 largest and most liquid blue-chip companies in the Eurozone, offering investors concentrated exposure to top-tier multinational corporations known for stable earnings and dividends. This index is a popular benchmark in Europe for its balanced sector representation and its role as an underlying for a variety of financial products, including ETFs and derivatives.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

How to invest in European stocks with NAGA – Step-by-Step guide

Here is a step-by-step guide on how to invest in European stock market with NAGA, a trademark of The NAGA Group AG, a German based FinTech company publicly listed on the Frankfurt Stock Exchange:

Step 1: Open and fund your NAGA Account

Start by creating an account on NAGA’s platform. Complete the registration process by submitting the required documents for verification. Once approved, fund your account using your preferred payment method to enable trading and investing in European stocks, ETFs, or CFDs.

Step 2: Choose your strategy

Decide whether you want to buy stocks with full ownership, trade European stocks via CFDs, or invest in ETFs focused on the top European stocks. Stocks with ownership give you shareholder rights, while CFDs offer more flexibility and leverage. ETFs provide diversified exposure to the best European sectors or indexes.

Step 3: Use NAGA Autocopy for smart investing

If you prefer a hands-off approach or want to learn from experts, use NAGA Autocopy to replicate the trades of top-performing European stock investors. This feature automatically copies the positions of traders you choose, enabling you to benefit from their strategies and insights without active management.

Step 4: Monitor your portfolio and manage positions

Regularly check your investments via the NAGA dashboard. Analyze market trends and individual stock or ETF performance. Use stop-loss or take-profit orders to limit risk or lock in gains on your stock or CFD positions. Staying informed is crucial for timely decision-making to protect or grow your investments.

Step 5: Exit your positions strategically

Plan your exit based on your investment goals. For CFD trades, you can close positions instantly on NAGA’s platform. For owned stocks or ETFs, sell your shares directly through NAGA’s trading interface when you want to realize profits or cut losses. Consider market conditions, tax implications, and your portfolio rebalancing needs to exit optimally.

This stepwise method leverages NAGA’s versatile platform and apps—whether you want ownership, leveraged trading, ETF diversification, or copy trading—to invest wisely in European stocks.

Conclusion

European stocks offer diversification into a mature yet dynamic economic region with a broad range of sectors showing resilience and growth potential. Despite near-term headwinds such as currency fluctuations and global trade uncertainties, stocks across industries like renewable energy, defence, healthcare, technology, and financials demonstrate strong fundamentals and potential. With multiple undervalued stocks available and supportive monetary and fiscal policies in place, Europe remains a strategic choice for both growth and value investors seeking to balance risk and income.

Ready to invest in the best European stocks for 2026? Use NAGA’s intuitive platform to buy shares with ownership, trade CFDs, or invest in ETFs tracking Europe’s leading companies. Benefit from NAGA Autocopy to replicate top traders’ strategies and stay connected to market movements.

Explore the European stock market now with NAGA and build your diversified portfolio to capture growth across Europe’s evolving economy and sectors.

Free resources

Before you start investing in European stocks, you should consider using the educational resources we offer like NAGA Academy or a demo trading account. NAGA Academy has lots of free trading courses for you to choose from, and they all tackle a different financial concept or process – like the basics of analyses – to help you to become a better trader or make more-informed investment decisions.

Our demo account is a suitable place for you to learn more about leveraged trading, and you’ll be able to get an intimate understanding of how CFDs work – as well as what it’s like to trade with leverage – before risking real capital. For this reason, a demo account with us is a great tool for investors who are looking to make a transition to leveraged trading.